If you’re watching a market that is experiencing a great deal of momentum, you may want to know how to do a momentum scalp trade with Nadex Binaries

How does the trade work? When the bar’s volume exceeds expectations, and the high/low of that bar is broken by 3 ticks by the very next bar, you execute the trade. Your profit target is the bar size, less three ticks. You can set your stop loss at the low of the setup bar if you’re long on the trade or set it at the high of the setup bar if you’re short.

This type of trade is usually a very quick trade and doesn't require a stop loss. It’s just in and out. Rinse and repeat. Over and over again. You can do multiple entries and collect a profit many times. You can take profit on the bar after you enter. When the trend reverses, and the volume has once again exceeded expectations, you can put on more trades. Be sure you’re checking the deviation level and the volume. You want to be mindful of the whole deviation level. Watch for when it has moved +1 or -1.

It is great when performing this strategy on binaries, because it can be done day or night, even early morning. This is a fantastic trade if you only have a little bit of time before or after work because you can usually put on just a couple of trades and “clean up.” Sometimes, especially when using Momentum Scalping on binaries, it’s a good idea to use OTM strikes, which have a lower risk. You have a greater profit potential than ATM or ITM strikes, which move slower. You are only looking to make $15-20 per contract, but remember, you can trade as many contracts as your account size will allow.

On August 21, 2014, this trade was explained during The Diagnostic Trading Hour on TFNN. This type of trade is known as a Momentum Scalp. It can be done on any instrument, but on the radio show, it was demonstrated using a Gold binary. As you know, the market can sometimes move so fast that you don’t have a chance to get in on the trade. However, if you were already in on this Gold Binary trade, you probably had a big smile on your face! In the image below, you will see that it moved more than fifteen points in one second!

To view image click HERE.

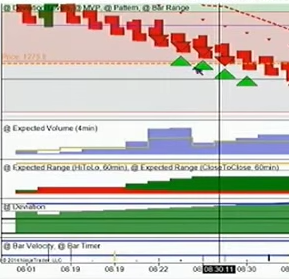

This gold trade took place on a unique day because the market had already blasted through deviation levels before the day started. When the market moves that much, you have to mentally say that level two deviation is the new level one deviation. When utilizing the Deviation portion of the chart, you would normally back off when it showed trading hitting about 80%, but because of the different deviation level, and having already blasted through a deviation level, you would back off when it showed 180-190%. To better understand what that means, please see the image below.

To view image click HERE.

![]()

The arrow shows deviation hitting 180% on the Deviation portion of the chart.

The Momentum Scalp trade was further demonstrated in this way: Because the market was going down, when volume exceeded expectation, the trade was sold three ticks below the low of that bar where volume exceeded expectation. Profit was taken on the next bar. This happened four times at $70 a pop! That’s $280. That’s if you just did one contract. If you did ten contracts, that would be $2800. In the image below, you will see red triangles placed on each of the bars where volume exceeded expectation so a trade was entered. You’ll see green triangles where the trade was exited. Trading stopped when Deviation hit about 180% as was mentioned above. To view image click HERE

The market continues to go down and hits the next deviation level and then starts going back up. At this point, you can put on more trades if you want. There were three more possible trades going up, so you would buy and then sell, the same way as before, always watching volume and deviation.

A little bit later, volume picks up and trades are again possible. Five of the seven bought trades were profitable and all of the sell trades won. Grand total for the day? Eighteen wins and two losses. If stops weren't tightened, and they could have been, there were twenty-eight ticks lost, which equaled $72. After commissions, if you use $4 as the round turn cost, there was a net profit of $908! That was on single contracts. Could you have done anything to have a better net profit? You could have tightened your stops to limit our losses. You don’t have to trade all day nor do you need to take every trade. Momentum Scalps on Nadex Binaries can be traded by part time traders with very little time to trade.

Momentum Scalping is a fast moving tool to have in your trading arsenal. If you would like to learn more about how to trade this strategy and others, go to www.apexinvesting.com. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. The forum content is updated daily and includes over 7000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, Forex, stock and options, and gain an edge for successful trading overall.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.