There’s a news report coming out. Do you straddle it or strangle it? It can seem very confusing trying to learn the terminology. During The Diagnostic Trading Hour on August 13, 2014, the terms were clearly defined and an example was presented of a straddle placed according to news reports. A couple of tips were given to help you easily remember the difference between a straddle and a strangle. A straddle is done on spreads whereas strangles are placed on binaries. To view this episode of The Diagnostic Trading Hour in its entirety, click on this Link:

To further clarify, a strangle is two contracts placed on the same instrument expiring at the same time. The lower one is the sell and the upper one is the buy. The two places as if you were wrapping your hands around it to strangle all the profits you can out of it! You can take profit when the strike price is hit.

A straddle is also two contracts placed on the same instrument expiring at the same time, but it’s as if you are straddling a fence; you’re right on top of it. When choosing a straddle on a spread, you have to make sure that the floor of the contract you are buying matches the ceiling of the contract you are selling. In this way, you can make money when the news comes out, whether the price goes up or down far enough. If it moves far enough in both direction, you could make double profits! The image below shows the contracts that could be selected with matching floor and ceiling prices.

To view image clickHERE

The example on the diagnostic Trading Hour involved the news that came from Great Britain about their employment change. This news was scheduled to come out at 4:30 A.M. ET. The news trading plan suggested the following:

To view image clickHERE:

This image is from the free binary Forex news trading plan posted in the free members area of ApexInvesting.com’s website.

Trades could be placed (entered) as early as 11:00 P.M. ET the night before the news report. The maximum risk to look for was $40 with an expiration of 7:00 A.M. ET. You want to make sure that the expiration happens after the news. It is fine to give yourself a little wriggle room of a couple of dollars risk when finding the spreads that will work for you. Let’s look at an image of the trade a trader placed based off this news plan.

To view image clickHERE

To keep this trade simple, let’s look at what happens if only one contract was bought and one was sold, instead of ten, like the trader did. The contract that was bought was the 1.6800-1.7100. The contract that was sold was the 1.6500-1.6800. The floor and the ceiling levels match at 1.6800. The expiration time was 7:00 A.M. He bought at 1.6824 and sold at 1.6781. To find the risk on the buy contract, you would subtract the floor from the entry price:

1.6824 -1.6800 = 24. To find the risk on the sell contract, subtract the entry price from the ceiling: 1.6800 - 1.6781 = 19. So, the total risk on this straddle would be $24+ $19= $43. That is close enough to the maximum risk that was suggested in the news trading plan.

How do you know where to set your take profit? It is best to go for at least a 1:1 ratio for take profit and sometimes, this can seem hard to figure out. To make it simple, let’s say that our risk is $40: $20 on each side of our straddle. If the trade goes down and doesn't come back up, the buy side loses. If it goes up and doesn't come down, the sell side loses. This trade went down and didn't come back up, so the buy side lost $20. In order to make back what was risked, there needs to be a $40 profit. If one side has already lost $20, you have to add that to the amount you want to make, i.e. $40 + $20 = $60.

For the example trade on the Diagnostic Trading Hour, there was actually a risk of $43. The buy side lost $24, so in order to make up that loss, and still make $40, you would add 40+24=64 and set your take profit at 64 ticks below the entry price. Entry price: 1.6781- 64= 1.6717. Then you would achieve your goal of making $40 on the trade.

Just to see the difference, let’s examine what would happen if the trade would have gone the other way. Let’s say that the market flew up. Then, the sell side would have lost $19 and in order to still make $40 on the trade, the $19 would need to be added to $40. So, 40 + 19 = 59 and you would set your take profit at 59 ticks above your entry price. Entry price:

1.6804 + 59 = 1.6883.

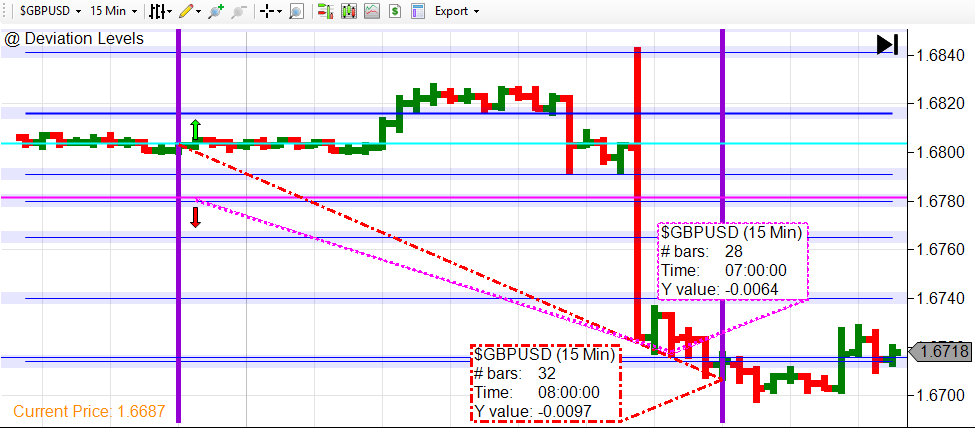

Another thing to take into consideration is the deviation levels. These are available every day at Apex Investing Institute. The website can be found below. Be mindful of the deviation levels and take profit a few ticks above or below, depending on the direction of your trade. Most of the time, the market will just bounce against a deviation level, so it is best to take your profits and get out.

As you know, the market moved down. The trader got in at 1.6781, and exited according to his plan of reaching a 1:1 ratio at 1.6717 for a $64 profit. That would cover his loss on the bought spread. In the image below, that is shown with the magenta colored line. To see what might have happened if the trade could have been entered at 11:00 P.M. at market price of 1.6804 and held until expiration at 7:00 A.M., the trade would have had a profit of $97. That move is shown by the red dashed line.

To view image clickHERE

Placing a straddle on the news isn't very difficult and setting the take profit should be easier to understand. If you would like to learn more on how to place straddles on news events, go towww.apexinvesting.com, a service provided by Darrell Martin. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. The forum content is updated daily and includes over 7000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, Forex, stock and options, and gain an edge for successful trading overall.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.