Amdocs DOX should command a significantly higher valuation than its current $44/share based on its steady and growing cash flows. Unlike many software companies, DOX has consistent profits with modest but steady growth. DOX specializes in customer care, billing, and order management for telecommunications companies. While the industry as a whole is growing slowly, DOX has opportunities to grow its own profits significantly faster and exceed the market’s low expectations. Strong growth opportunities combined with a cheap valuation make DOX one of our Most Attractive Stocks.

Competitive Position

The telecom industry is going through a round of consolidation. AT&T T, the largest wireless carrier is acquiring Leap Wireless, the fifth largest carrier in the U.S., while numbers three and four, T-Mobile TMUS and Sprint S, are mulling a potential merger. Verizon VZ, number two, has made several smaller acquisitions to beef up its digital media services.

All this consolidation means the telecom landscape is changing rapidly. However, all this consolidation looks like it could be beneficial for DOX, which has long thrived on serving the largest customers in the industry. In 2013, DOX’s 10 largest customers accounted for 70% of its revenue, and AT&T alone accounted for 28% ($940 million). The more DOX’s customers grow by consolidating other players, the more business there is for DOX.

This consolidation could be a negative if there were any signs that the big players are growing unhappy with DOX’s services and considering a change, but that doesn’t seem to be the case. AT&T recently selected DOX to provide billing management for its connected car initiative, and Vodafone VOD expanded its existing business with DOX at the end of January.

Any industry shakeup carries a degree of risk, and DOX’s highly concentrated customer base means that the loss of one customer could have a significant impact. However, based on DOX’s solid relationship with its largest customers and the continued expansion of its business with them, industry consolidation should end up being a positive.

Track Record of Profitability

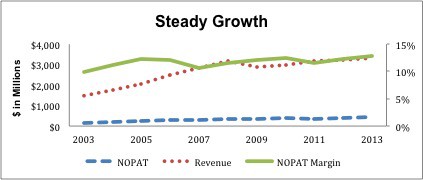

We usually associate software companies with high growth and low profitability (see my recent articles on CALD, N, and CRM). DOX does not fit that profile. Instead, DOX has grown after-tax profit (NOPAT) by 11% compounded annually for the past decade. During this period it has maintained a double digit NOPAT margin and return on invested capital (ROIC). Figure 1 shows just how consistent DOX has been.

Figure 1: NOPAT, NOPAT Margin and Revenue Growth Over the Last Decade

Rapid growth is nice, but I’d rather have a company that can sustain long-term growth without sacrificing margins, and that’s what DOX has been able to do. Its revenue growth, especially over the past five years, is nothing to write home about, but it has been able to cut costs, grow NOPAT and keep its margins high. In 2013, DOX increased revenue by 3% but actually managed to cut its Selling, General, and Administrative expense by 1.5%. Even in the slow growth environment of the past few years, DOX has achieved decent profit growth through increased efficiency.

GAAP net income actually slightly understates DOX’s profitability in 2013, as it includes roughly $20 million (5% of NOPAT) in various non-operating expenses. One of the most significant non-operating expenses we found was a $4 million foreign currency exchange loss, which is a common expense this year due to devaluation of the Venezuelan Bolívar. Removing these non-operating expenses shows that DOX actually earned a NOPAT of $430 million in 2013, rather than the $410 million in reported GAAP net income.

Stock is on Sale

I’m not sure whether it’s fear over industry consolidation, disappointment over slower revenue growth, or a misunderstanding of the stability of DOX’s business, but the market does not currently value DOX at a level commensurate with its profitability. At its current price of ~$44/share, DOX has a price to economic book value ratio (PEBV) of only 1.0. This ratio implies that the market expects DOX to never grow NOPAT beyond its 2013 level. Such an expectation seems clearly too pessimistic.

As a good comparison, one of DOX’s closest competitors, CSG Systems CSGS commands a PEBV of 1.3. At the very least, then, DOX should have nearly 30% upside from its current valuation. However, CSGS also has less scale, inferior margins and ROIC, and lower long term NOPAT growth. Therefore, DOX should command an even higher valuation than CSGS.

Using our discounted cash flow model, we can value DOX based on a number of hypothetical growth scenarios.

-

If DOX can grow NOPAT by 6% compounded annually for 15 years, the stock has a present value of ~$66/share. -

If DOX can grow NOPAT by 11% compounded annually for 10 years (equaling its past growth), the stock has a present value of ~$79/share. -

If DOX can grow NOPAT by 11% compounded annually for 15 years, the stock has a present value of ~$97/share.

That last scenario might seem overly optimistic, but $97/share actually wouldn’t be that rich a valuation when compared to the market as a whole. At $97/share, DOX would have a PEBV of 2.3, which is still below the S&P 500’s PEBV of 2.7.

I don’t think DOX will go to $97/share right away, but my DCF scenarios show how cheap DOX is and that it could more than double in price and still be cheap when compared to the market. Given its track record, 6% NOPAT growth seems too modest for DOX, but even then the stock has 50% upside to its current value if it can maintain that growth for 15 years.

In addition to industry consolidation, DOX has another potential catalysts for growth. DOX has been acquiring several small companies using the $1.2 billion in excess cash it had on hand at the end of 2013. DOX is using these acquisitions to expand into new product segments and gain a better foothold in high growth regions like Latin America.

DOX has opportunity for growth, and if it manages even decent execution on these opportunities, it can justify a much higher share price.

No ETFs or mutual funds allocate significantly to DOX and earn an Attractive-or-better rating. For investors who absolutely want their exposure through a fund, Oak Associates Funds: Pin Oak Equity Fund (POGSX) allocates 4.9% to DOX and earns our Neutral rating. However, the best strategy would be to buy the stock directly and avoid paying unnecessary management fees given that there are no funds that allocate to DOX and enough other good stocks that are worth trusting with your money.

Sam McBride contributed to this report

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.