Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Ventas Inc. VTR is in the Danger Zone. Over 50% of VTR’s business is providing senior housing communities, so it has benefited from a rapidly growing demand for elder care. For several years now, the supply of senior living facilities has grown to keep up with current and expected demand. Nevertheless, some supply/demand imbalance has persisted, enabling VTR to enjoy unusually high margins.But those days are over. First, supply is catching up to demand. In 2011 alone, competitors Brookdale Senior Living (BKD) and Health Care REIT (HCN) both increased their number of units owned by over 16,000, while Elmcroft Senior Living added over 14,000 units.

And many other firms, public and private, are jumping into the same businesses as VTR and driving down margins and returns on invested capital (ROIC).

VTR is cannot maintain the high margins that helped it to succeed in the early parts of the decade. VTR’sNOPAT (Net Operating Profit After Tax) margin declined from a peak of 72% in 2003 down to a low of 8% in 2011 before rebounding slightly last year.

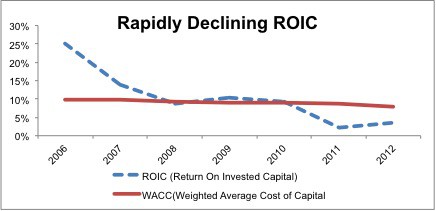

These declining margins have hurt VTR’s economic earnings even as it has still managed to grow GAAP net income. As Figure 1 shows, VTR’s return on invested capital (ROIC) has been declining for several years now. For the last two years, ROIC has been less than WACC (Weighted Average Cost of Capital), causing VTR to have negative economic earnings.

Figure 1: Competitive Advantage Is Gone

These misleading earnings—accounting earnings that are positive and increasing while economic earnings are negative and declining—help VTR to earn its Very Dangerous rating. The accounting rules that govern GAAP net income were not designed for equity investors. They were designed for debt investors. Current accounting rules give companies a vast number of ways to manipulate earnings.

Our measure of economic earnings reverses these distortions and shows the true amount companies are earning for investors.

VTR’s negative economic earnings are not a death sentence, but they are a sign of a company struggling to adapt its business model to a newly competitive environment. Unfortunately for investors, VTR is priced like a company about to see massive profit growth and expanding margins and ROICs.

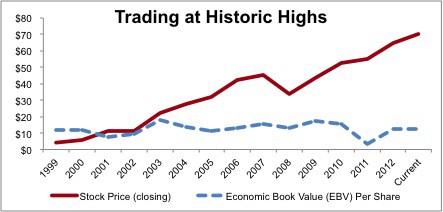

Figure 2 shows the stock price of VTR against its economic book value (EBV) per share since 1999. EBV is a measure of the value of a company’s value assuming zero growth in profitability. For much of the early part of the decade, VTR’s price stayed at or near its EBV per share. In recent years, however, the stock price has risen far above EBV per share.

Figure 2: Trading at Nearly 6x Economic Book Value

Simply put, the valuation of VTR is writing checks that the business cannot cash. To justify the current price of ~$81.80/share, VTR must grow NOPAT by 20% compounded annually for the next 16 years. Expecting that kind of growth from a company with declining margins and economic earnings is simply too risky.

Sometimes the market focuses too much on one trend while ignoring other key factors, like valuation. In this case, excitement over a rapidly growing aging population has caused many investors to overlook the evolution in the elder care marketplace and assume VTR can continue its winning ways as if that evolution never took place. Investors need to be looking at the balance sheet rather than the census.

I also recommend avoiding the following ETFs because of their large allocation to VTR and Neutral or worse rating.

- iShares FTSE NAREIT Residential Index Fund REZ – 10% allocation to VTR – Dangerous Rating.

- iShares Cohen & Steers Realty Major ICF – 7% allocation to VTR – Very Dangerous Rating

- PowerShares Active U.S. Real Estate Fund PSR – 6% allocation to VTR – Dangerous Rating

Sam McBride contributed to this article

Disclosure: David Trainer and Sam McBride receive no compensation for writing about any specific stock, sector, or theme.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.