The persistent climb of the stock market over the last six months has confounded both individual investors and professional money managers. The relentless onslaught of bullish optimism has pushed the major averages to hit new all-time highs nearly every day. For those of us that enjoy buying on a pullback, we have been out of luck for quite some time. Remember 1,565 on the S&P 500? We we are already 5% above that level and it is becoming rapidly apparent that the sky is the limit for stocks in 2013.

So what should you do when your portfolio is mostly cash and that nagging feeling of performance anxiety starts to creep into the back of your mind?

The easiest thing to do is give in and capitulate by throwing your capital into the most aggressive investments you can find to try and make-up for lost time. You will get instant relief and gratification by putting money to work and feeling like you are part of the crowd. However, that relief can quickly turn into gut wrenching agony if you get caught up in a swift correction that wipes out 5-10% of your portfolio in a matter of weeks. Remember that you don’t want to be the last investor that throws in the towel, only to see your hard earned rapidly money evaporate. Instead you need to have a game plan in place to make investment decisions with as little emotion as possible.

Plan Your Trade, Trade Your Plan

If you have cash on the sidelines that you want to put to work, I would recommend that you bide your time by creating a watch list and planning your next moves with precision. In my experience, trades are far more successful when you are able to put money to work on your terms rather than out of a feeling of desperation. You can start by selecting 10-20 stocks or ETFs that you are considering adding to your portfolio and monitoring them on a regular basis. You should be looking at their charts and preparing your entry points based on historical points of support, resistance, or trend lines. This will allow you to clearly filter out all of the daily noise and have a plan for when the trend of the market changes. You can even set limit orders for these trades to execute automatically when your targets are hit.

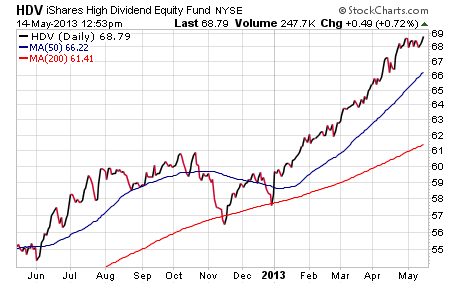

A few of the ETFs that are on my watch list right now include:

iShares High Dividend ETF HDV

iShares International Select Dividend IDV

PowerShares S&P 500 Low Volatility Index SPLV

iShares Emerging Market Minimum Volatility Index EEMV

First Trust Multi-Asset Diversified Income Fund MDIV

I am evaluating each of these positions on their own technical and fundamental merits. Not all of them will make it into my portfolio at the same time or in the same allocation, but they are designed to give me exposure to specific areas of the market that I believe will outperform. In addition, I will be constantly updating my watch list to include new positions based on changes in the market and areas of value that I can exploit.

Despite all of the bulls calling for Dow 20,000 or S&P 1,900, I am more inclined to believe that we are due for at least a modest correction which will setup an excellent buying opportunity. Be patient. Be prepared. Be smart.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.