Happy New Year!

Happy New Year!

And what a way to start it off with our Futures flying up another 1.5% – on top of Monday's 2% gains you might have missed as we celebrate the non-event of the Fiscal Cliff that we kept telling you not to worry about last year (see any post). On Monday morning's Alert, and in our Chat Room, I reminded our Members, as the market tanked, not to be too bearish, saying:

Keep in mind that we need to spend 2 days below our levels to be officially bearish so let's hope we do get some good news today and take back those 50 dmas so we can treat them as a blip and throw the spike out in our forward calculations.

As you can see from Dave Fry's SPY chart, that was pretty good advice as we quickly reversed that bad open and flew higher. We looked over our virtual portfolios at 11:52 and decided, fortunately, to maintain our very bullish stances based on the news available to us and, of course, our general attitude that the whole cliff thing was overdone.

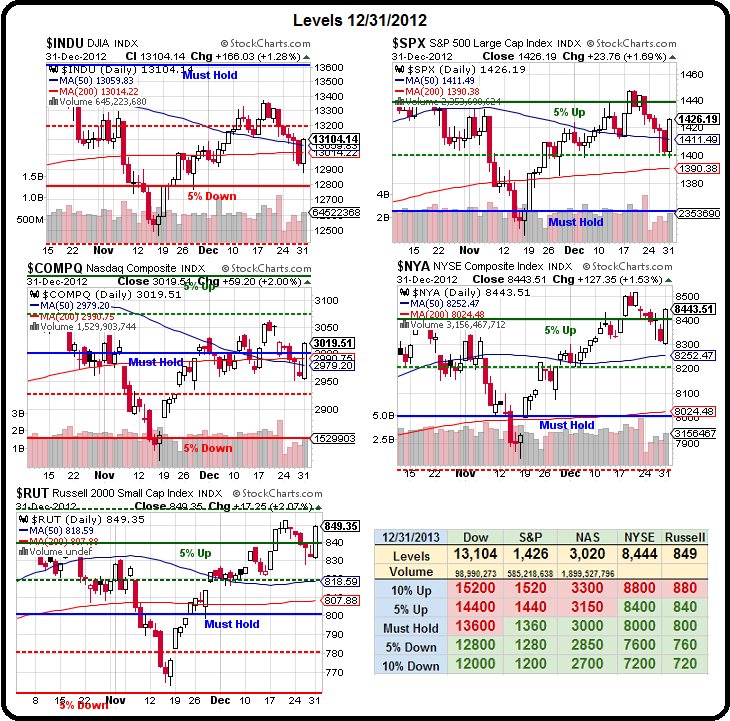

We added long plays on GDX and CIM but maintained general hedges (medium-term) on TZA and USO – just in case talks broke down or the cliff deal turned out to be a "sell on the news" event – which still remains to be seen after this morning's excitement. As you can see from our Big Chart (welcome back StJ!), we still have a long way to go before re-establishing a bullish position – as opposed to confirming a double top in the high end of our channel.

We added long plays on GDX and CIM but maintained general hedges (medium-term) on TZA and USO – just in case talks broke down or the cliff deal turned out to be a "sell on the news" event – which still remains to be seen after this morning's excitement. As you can see from our Big Chart (welcome back StJ!), we still have a long way to go before re-establishing a bullish position – as opposed to confirming a double top in the high end of our channel.

This morning, in Member Chat, we already had 4 pages of extensive commentary on the cliff deal and Europe, 2012 in review and 2013 looking forward, so I'm not going to get into that again here and I've made commentary over the last two weeks on why we are bullish about 2013 – especially in the housing sector.

Pimco's Mahamed El-Erian made the point well this weekend on why investors HAVE to have confidence in equities for 2013 – the Fed. El-Erian said: "If you have an institution that has a printing press in the basement, you respect it." That's a nice, simple, investing premise…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.