Check out my latest Danger Zone interview with Chuck Jaffe of MarketWatch.com.

iShares S&P MidCap 400 Growth Index Fund (NYSE:IJK) is in the Danger Zone this week because its holdings are much worse than the other mid-cap growth “index” ETFs.

Do Not Trust ETF Labels – Even “Index” Labels

Many ETFs are labeled “index” ETFs. Naturally, many investors assume that having “index” in the ETF’s name means all the holdings are the same or the provider cannot influence the nature of the holdings, but that is not true.

For example, of the three “index” ETFs in the mid-cap growth style, two get a Neutral rating while one gets a Dangerous rating. How is that possible if they are supposed to hold the same stocks? The answer is that they do not hold the same stocks.

There is no overlap in the top 5 holdings among these three ETFs. Their portfolios are not close to being the same. And there is a meaningful difference in the quality of holdings.

iShares S&P MidCap 400 Growth Index Fund (NYSE:IJK) gets 2-stars or a Dangerous rating because it has dangerous-rated holdings. iShares Morningstar Mid Growth Index Fund (NYSE:JKH) and iShares Russell Midcap Growth Index (NYSE:IWP) get 3-stars and have neutral-rated holdings.

The “index” label, for mid-cap growth ETFs, is misleading as it does not mean that these ETFs have the same portfolio of holdings.

The point is that investors cannot trust the “index” label to mean that all the ETFs or mutual funds with that label hold a standard portfolio of stocks.

The Danger Within

Buying an ETF without analyzing its holdings is like buying a stock without analyzing its business and finances. As Barron’s says, investors should know the Danger Within. Put another way, research on ETF holdings is necessary due diligence because an ETF’s performance is only as good as its holdings’ performance.

PERFORMANCE OF ETF’s HOLDINGs = PERFORMANCE OF ETF

Note that no ETFs with a dangerous portfolio management rating earn an overall rating better than two stars. These scores are consistent with my belief that the quality of an ETF is more about its holdings than its costs. If the ETF’s holdings are dangerous, then the overall rating cannot be better than dangerous because one cannot expect the performance of the ETF to be any better than the performance of its holdings.

Find the ETFs with the worst overall ratings on my ETF screener. More analysis of the Best Sector ETFs is here.

How To Avoid ETFs with the Worst Holdings

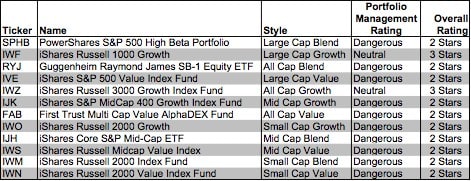

Assessing an ETF’s holdings is important because an ETF’s performance is determined more by its holdings than its costs. Figure 1 shows the ETFs within each style with the worst holdings or portfolio management ratings. The styles are listed in descending order by overall rating as detailed in my 4Q Style Rankings report.

Figure 1: Style ETFs With Worst Holdings

Sources: New Constructs, LLC and company filings

My overall ratings on ETFs are based primarily on my stock ratings of their holdings. My firm covers over 3000 stocks and is known for the due diligence done on each stock we cover.

iShares’ ETFs appear more often than any other provider in Figure 2, which means they offer the most ETFs with the worst holdings. iShares Core S&P Mid-Cap ETF (NYSE:IJH) has the worst holdings of all mid cap blend ETFs. iShares Russell 1000 Growth (NYSE:IWF), iShares S&P 500 Value Index Fund (NYSE:IVE), iShares Russell 3000 Growth Index Fund (NYSE:IWZ), iShares S&P MidCap 400 Growth Index Fund (NYSE:IJK), iShares Russell 2000 Growth (NYSE:IWO), iShares Russell Midcap Value Index (NYSE:IWS), iShares Russell 2000 Index Fund (NYSE:IWM), iShares Russell 2000 Value Index Fund IWN have the worst holdings of all ETFs in their styles.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.