- EUR/USD reaches 11-day high amid trade deal concerns.

- EUR/USD approaches 100-day SMA, key resistance level.

EUR/USD advanced for the third day in a row on Monday and struck an 11-day high as the dollar came under further pressure amid reports that Chinese officials are pessimistic about a trade deal with the United States. According to media reports, China doubts a ‘phase one’ deal could be signed given US President Trump's reluctance to roll back some tariffs, which China thought the US had agreed to.

Trade deal concerns translated into lower US yields, falling stocks, a weaker greenback, and higher demand for safe-havens in financial markets.

On the data front, October’s US housing starts will be released on Tuesday, while investors should be closely following the release of the Federal Reserve's latest meeting minutes on Wednesday and the European Central Bank minutes on Thursday. ECB President Christine Lagarde is due to speak in Frankfurt later in the week. However, investors’ sentiment would likely remain driven by US-China trade negotiations headlines.

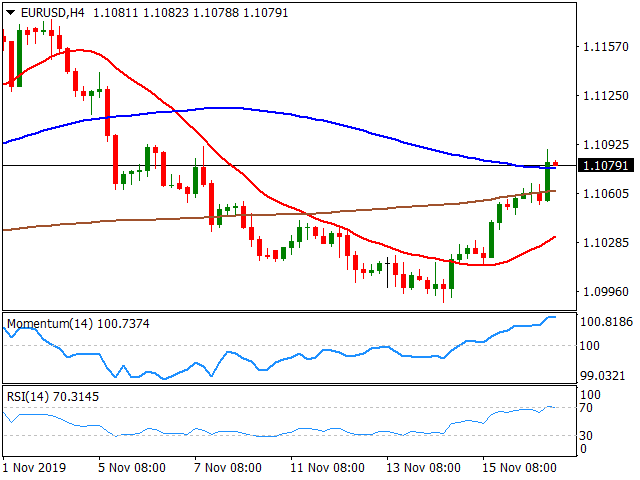

EUR/USD Short-Term Technical Outlook

From a technical point of view, the EUR/USD perspective has turned bullish according to technical indicators in the 4-hour chart, with the pair trading close to its 11-day peak of 1.1089 hit during the New York session. However, the RSI has reached overbought levels, favoring a phase of consolidation before another upward leg. Even though the technical picture has also improved in the daily chart, EUR/USD remains capped by the 100-day SMA currently at 1.1094, which is the key resistance level to overcome. Above this level, the pair could gather bullish momentum with the next target at the 1.1175/1.1180 area, where October’s monthly high converges with the 200-day SMA.On the flip side, key short-term support is seen at the 1.1030 area as a breakdown could lead to renewed weakness toward 1.1000, en-route to 2019 lows.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.