Preparing For A Possible Default

According to the Congressional Budget Office, as reported by Jason Lange of Reuters ("Wall Street Gets Ready To Trade Defaulted U.S. Debt") if Congress doesn't vote to raise the US government's debt ceiling, the United States could start defaulting on its obligations (including principal and interest payments on Treasury securities) as soon as October 22nd. Lange also reported that a securities industry trade group had begun preparation for trading defaulted US debt, suggesting that industry participants believe there is some prospect of a default occurring.

No Panic Now

So far, judging by the costs of hedging the iShares Barclays 20+ Year Treasury Bond ETF (NYSE: TLT), options market participants don't appear to find the prospect of a default likely. But if one were to happen, it's difficult to predict how hard Treasury securities (and ETFs comprised of them) would get hit. For investors who would like to insure against an unlikely but potentially disastrous scenario, here are two ways of doing so.

1) Hedging With Optimal Puts

Higher cost, but uncapped upside.

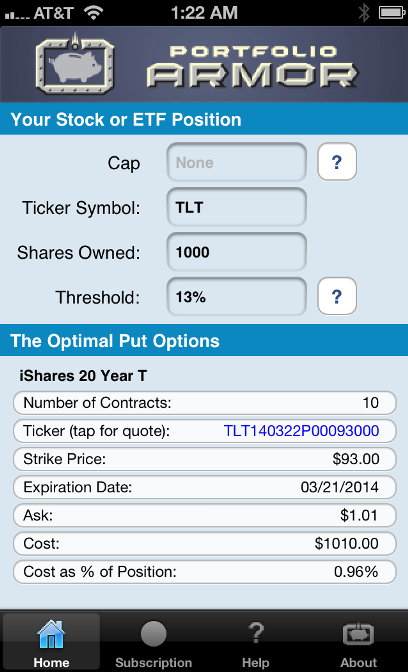

These were the optimal puts*, as of Friday's close, to hedge 1000 shares of TLT against a greater-than-13% drop at anytime over the next six months.

As you can see at the bottom of the screen capture below, the cost of this protection, as a percentage of position value, was 0.96%.

2) Hedging With An Optimal Collar

Pays you to hedge, 7% upside cap.

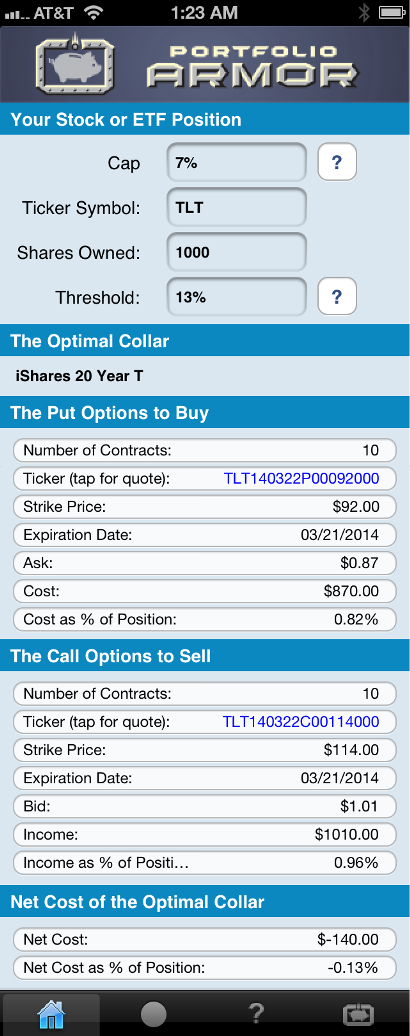

This was the optimal collar**, as of Friday's close to hedge 1000 shares of TLT against a greater-than-13% drop over the next six months, for an investor willing to cap his upside potential at 7% over the same time frame.

As you can see at the bottom of the screen capture above, the net cost of this collar was negative, meaning an investor would have gotten paid to hedge in this case.

If you want to pay even less to hedge, you can use a larger decline threshold, or a lower cap.

Possibly More Protection Than Promised

In some cases, hedges such as the ones above can provide more protection than promised. For a recent example of that, see this post about hedging shares of the SPDR Gold Trust ETF GLD.

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.