Don’t put all your eggs in one basket. This timeless advice, passed down for generations, is especially true when it comes to investing. Whether you’re just starting out or enjoying retirement, having the right mix of investments, also known as asset allocation, can help you weather the market’s ups and downs and pursue your goals.

But what is the right asset allocation? The answer depends on your age and other factors, including:

- Time horizon. When do you plan to use the money in your portfolio?

- Goals. What are you investing for (first home, children’s education, retirement)?

- Investment objective. Are you looking for more growth or income?

- Risk tolerance. Will market fluctuations keep you up at night?

- Current and future income sources. Are you working or retired?

What Type of Investor Are You?

Based on all these factors, you can decide if you’re an aggressive, moderate, or conservative investor. Your investment identity will influence how you allocate your portfolio among stocks, bonds, and other investments.

| Aggressive Investor | Moderate Investor | Conservative Investor | |

|---|---|---|---|

| Income Source | Modest or high salary | Modest or high salary | Modest salary or fixed income |

| Risk Tolerance | High | Moderate | Low |

| Investment Objective | Aggressive growth | Moderate growth | High income and some growth |

| Time Horizon | 10+ years | 5-10 years | 0-5 years |

| Sample Asset Allocation | 75% stocks, 25% bonds | 50% stocks, 50% bonds | 25% stocks, 75% bonds |

These examples are for illustrative purposes only. Not a recommendation of any specific asset allocation. Asset allocation samples are based on income, risk tolerance, investment objective, and time horizon. Generally, younger investors may be comfortable taking more risk and older investors may prefer less. Past performance does not guarantee future results.

Staples of Asset Allocation

Many investors split their portfolio between stocks and bonds because it’s a straightforward way to weigh growth and risk versus income and safety. Over the long term, stocks have historically provided growth to a portfolio. However, in exchange for this potential growth, you assume more risk. The value of stocks typically move up and down based on the market and other factors.

Having bonds in your portfolio may help reduce the risk because stocks and bonds generally move in opposite directions. It doesn’t happen all the time, but when stock prices fall, bond prices usually rise. Also, bonds typically don’t fluctuate as much as stocks. That’s because they’re designed to provide regular income; price appreciation is a secondary consideration.

Not comfortable deciding how to allocate your portfolio? You may want to consider exchange traded funds, also known as ETFs. An ETF is a marketable security that tracks an index, a commodity, bonds or a basket of assets like an index fund and trades like a common stock. Keep in mind all investments involve risk, including loss of principal.

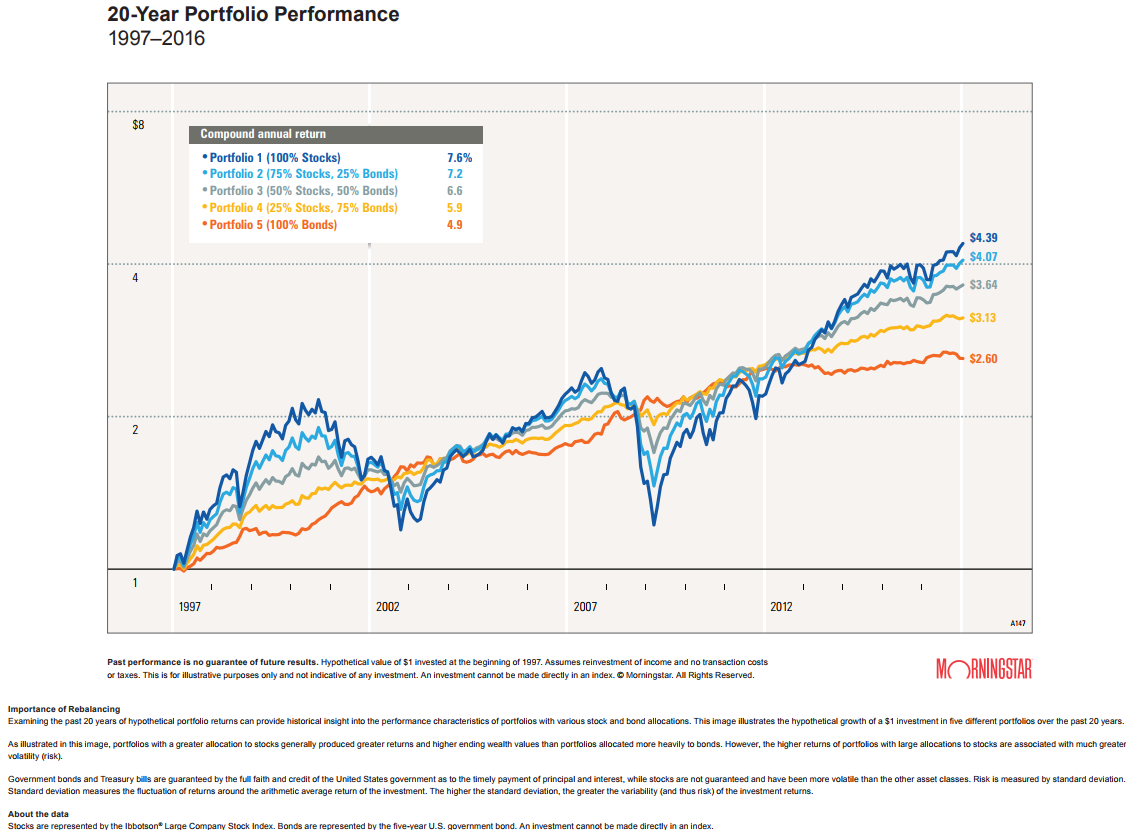

20-YEAR PORTFOLIO PERFORMANCE.

This graphic shows the hypothetical growth of five different portfolios with different asset allocations among stocks on bonds over 20 years. Data source: Stocks are represented by the Ibbotson® Large Company Stock Index. An investment cannot be made directly in an index. The data assumes reinvestment of income and does not account for taxes or transaction costs. Image source: Morningstar. For illustrative purposes only. Past performance does not guarantee future results.

Don’t Set It and Forget It

Allocating your portfolio among different investments is not a one-and-done activity. Asset allocation is all about finding the blend of investments that works for the current stage of your financial journey. For example, younger and middle-aged investors may have a higher allocation in stocks because they’re focused on saving for their first home or their children’s education. Retirees tend to have more in bonds because they want the income to help meet daily expenses.

After a major life event occurs, such as the birth of a child or career change, it’s important to review your asset allocation to make sure it aligns with new goals and investment objectives. If it doesn’t, you may want to reallocate your portfolio (shift assets around) to help you stay on track.

The financial markets are another reason to keep an eye on your asset allocation. Market fluctuations can cause your portfolio to become more aggressive or conservative than you intended. For example, perhaps it’s shifted from 60 percent stocks and 40 percent bonds to 65 percent and 35 percent, respectively. This shift is fine if you’re comfortable with the new weighting and it meets your needs. Otherwise, you may want to rebalance your portfolio so it reflects your target allocation.

Time Well Spent

With so many things competing for your attention, it’s easy to put off reviewing your investments. Don’t put it off any longer. Log in to your TD Ameritrade account, and check out the tools and resources available to help you review your portfolio.

An effective asset allocation strategy can be one of the keys to your financial well-being now and in the future.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.