The small-cap growth style ranks eighth out of the twelve fund styles as detailed in my style rankings for ETFs and mutual funds. It gets my Dangerous rating, which is based on aggregation of ratings of 11 ETFs and 493 mutual funds in the small-cap growth style as of October 19, 2012. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

Figure 1 ranks from best to worst the eight small-cap growth ETFs that meet our liquidity standards and Figure 2 shows the five best and worst-rated small-cap growth mutual funds. Not all small-cap growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 27 to 1282), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the small-cap growth style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any small-cap growth ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Get my ratings on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings

* Best ETFs exclude ETFs with NAV less than 100 million.

Sources: New Constructs, LLC and company filings

Rydex S&P Smallcap 600 Pure Growth RZG, Vanguard S&P Small-Cap 600 Growth ETF (vVIOG), and First Trust Small Cap Growth AlphaDEX Fund FYC are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

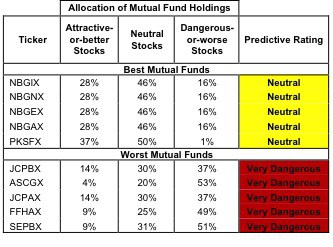

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAVs less than 100 million.

Sources: New Constructs, LLC and company filings

Virtus Equity Trust: Virtus Small-Cap Sustainable Growth Fund PXSGX is excluded from Figure 2 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Rydex S&P Smallcap 600 Pure Growth RZG is my top-rated small-cap growth ETF and Neuberger Berman Equity Funds: Neuberger Berman Genesis Fund NBGIX is my top-rated small-cap growth mutual fund. Both earn my Neutral rating.

iShares Morningstar Small Growth Index Fund JKK is my worst-rated small-cap growth ETF and Security Equity Fund: Small Cap Growth Series SEPBX is my worst-rated small-cap growth mutual fund. JKK earns my Dangerous rating, while SEPBX receives my Very dangerous rating.

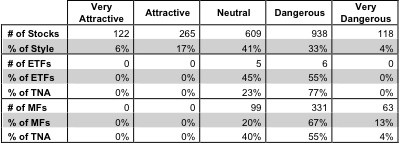

Figure 3 shows that 387 out of the 2052 stocks (over 23% of the total net assets) held by small-cap growth ETFs and mutual funds get an Attractive-or-better rating. However, no small-cap growth ETFs or small-cap growth mutual funds get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and growth ETFs hold poor quality stocks.

Figure 3: Small-cap growth Style Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering small-cap growth ETFs and mutual funds, as no mutual funds in the small-cap growth style allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Focus on individual stocks instead.

Copart Inc. CPRT is one of my favorite stocks held by small-cap growth funds. It receives my Very Attractive rating. Copart is an online auto auction website. It has generated positive economic earnings each of the past fourteen years, which translates into value for shareholders. It also trades at a price-to-economic book value (P/EBV) of 1.18. As a reference point, rival CarMax Inc. (KMX) trades at a P/EBV of 1.57. In exchange for the 25% discount in valuation, CPRT has a ROIC of 19% compared to KMX’s ROIC of 14%. This discrepancy in profitability may be due to advertising expenses. CPRT only allocates $6.5 million to advertising compared to the $100.3 million that Carmax spent. Sometimes there are opportunities for investors to pick up stock in lesser-known companies at a bargain price. This appears to be the case with CPRT.

Nuance Communications, Inc. NUAN is one of my least favorite stocks held by small-cap growth funds. NUAN offers low profitability at a high cost resulting in a Very Dangerous rating. NUAN has never generated positive free cash flows, which makes it all the more unbelievable that the market values the stock at 20.5x its economic book value. To justify this valuation, the company would have to grow their after-tax operating earnings (NOPAT) at 20%, compounded-annually, for thirteen years. While the company may grow revenues and earnings in the future, it will only create value for shareholders if it exceeds the expectations already in the stock price. I suggest investors invest in stocks with lower expectations and better historical profits.

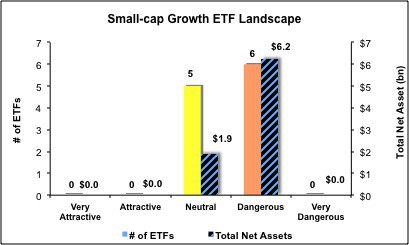

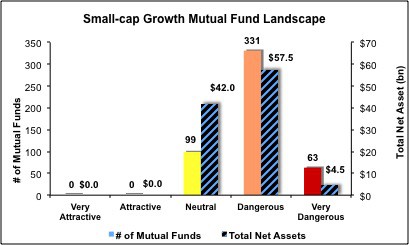

Figures 4 and 5 show the rating landscape of all small-cap growth ETFs and mutual funds.

Our style rankings for ETFs and mutual funds report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with reports on all 11 ETFs and 493 mutual funds in the small-cap growth style.

Disclosure: I receive no compensation to write about any specific stock, sector, style or theme.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.