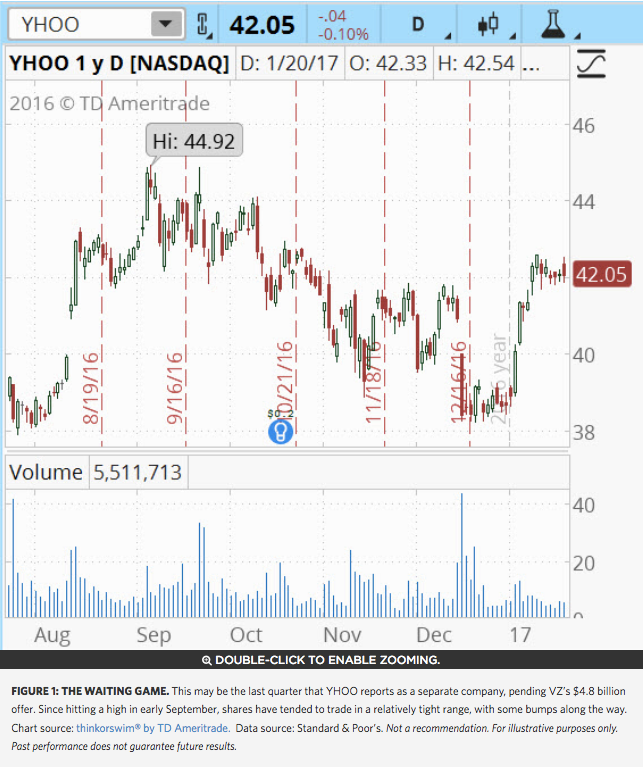

Earnings season kicks into high gear this week with a number of big names reporting. Among the Monday releases, YYahoo! Inc. YHOO will report what may be its last quarterly earnings numbers, as its pending acquisition by Verizon Communications Inc. VZ, announced in July 2016, moves toward completion.

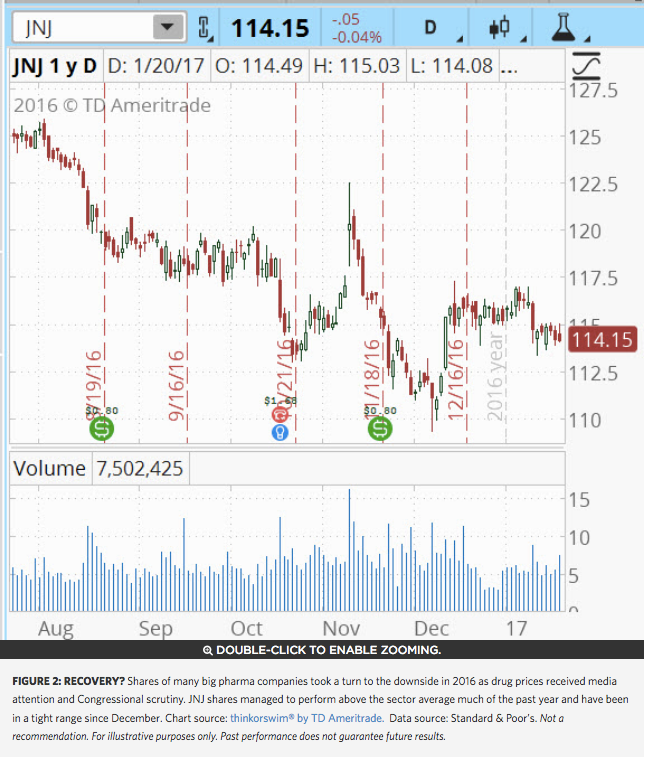

On Tuesday before the opening bell, pharmaceutical giant Johnson & Johnson JNJ and Chinese e-commerce heavyweight Alibaba Group Holding Ltd BABA offer up a fresh look at their earnings and revenue figures.

Yahoo Swan Song?

In the previous quarter, some analysts said at the time that they were more interested in what the next chapter of YHOO might look like than they were in the earnings numbers. This time around, in what could be the last quarter that sees YHOO operating as an independent company, the earnings story may not necessarily be the top story either.

Last July, VZ offered $4.8 billion to acquire YHOO’s core business. A couple months later, in September, YHOO announced a data breach that may have compromised at least 500 million user accounts. It remains unclear whether the security breach will impact the terms of the deal, which was initially scheduled to close in the first quarter of 2017.

Because of the timing, YHOO has said it will not hold a conference call after the earnings results are announced.

For the quarter, the consensus estimate from analysts reporting to Thomson Reuters Corp TRI is $0.21 per share, up from $0.13 a share a year ago. Revenue is projected to rise slightly to $1.38 billion from $1.3 billion last year.

The options market has priced in an expected share price move of 4.2% in either direction around the earnings release, according to the Market Maker Move™ indicator on the thinkorswim® platform from TD Ameritrade.

Call activity has been seen at the weekly 43 strike while put activity has concentrated at the 40.50 strike. The implied volatility lies at the 29th percentile. (Please remember past performance is no guarantee of future results.)

Note: Call options represent the right, but not the obligation, to buy the underlying security at a predetermined price over a set period of time. Put options represent the right, but not the obligation, to sell the underlying security at a predetermined price over a set period of time.

JNJ’s Drug Business

JNJ’s baby-care, oral-care and skin-care consumer products are likely crowding the medicine cabinets of many households across the U.S., but since 2014, it is its pharma products that ring up the most revenues. JNJ has a handful of drugs that are either nearing maturity or recently off-patent, but with others having been newly-released, some analysts are watching those numbers carefully.

New product launches of oncology drugs Imbruvica and Darzalex might help grow top-line sales, as might its immunology drugs Stelara and Simponi, as well as blood thinner Xarelto. But as some analysts point out, biosimilar versions of some of these drugs from competitors may have an impact.

These recent launches may help offset declining sales of Olysio, the hepatitis C virus (HCV) treatment, and antipsychotic drug Invega, both of which face growing competition from other name drugs and generic brands.

Analysts reporting to Thomson Reuters are forecasting earnings of $1.56 share, about an 8% increase over the year-ago profit. Revenue is expected to strengthen to $18.3 billion from $17.8 billion a year ago.

The options market has priced in an expected share price move of about 1.7% in either direction around the earnings release, according to the Market Maker Move™ indicator on the thinkorswim® platform.

Call activity has been seen at the weekly 115 strike, with puts active at the monthly 115 and 110 strikes. The implied volatility sits in the lower half at the 23rd percentile. (Please remember past performance is no guarantee of future results.)

BABA’s Record Revenues?

The China-based e-commerce giant—considered by many to be a proxy for consumption in China—is expected by some analysts to deliver record revenues, boosted by better site traffic and purchases, strong growth in its cloud business, and better trends in digital media like the online video-streaming business, Youku Tudou, which was acquired by Alibaba last year.

A handful of analysts have said in recent notes that, based on their proprietary data, they believe BABA’s online marketing revenue for China retail business may grow at a rate exceeding 40%. Much of that, they say, looks to be generated from better sales of apparel, household products, and baby, children and maternity items.

Others, meanwhile, say they’re expecting businesses like cloud computing and digital media to rise by triple-digit percentage points. Overall, some analysts are forecasting total earnings growth rates in the 30% to 40% range. Some note, too, that the December quarter has typically been a big one, partly because of the Nov. 11 Singles’ Day shopping event BABA created in 2009. Last year’s extravaganza rang up a record 120.7 billion yuan ($17.55 billion) worth of merchandise that BABA claimed was 32% higher than the year-ago period.

As for the conference call, some analysts say they expect to hear more about BABA’s foray into bricks-and-mortar stores as an avenue for greater distribution. Earlier this month, BABA announced that it was working on a deal to become the controlling shareholder of China’s Intime Retail Group, which operates 29 department stores and 17 shopping malls.

Other analysts say they are listening for greater insight into BABA’s cloud-computing business, which it said had a 130% year-over-year jump in revenue in the quarter that ended in September. Other businesses that BABA could comment on include its digital and entertainment division, which produces romantic comedies along with other programs, and its logistic operations, Cainiao Network.

And then there are the expectations for BABA’s partnership with the International Olympic Committee. Last week, BABA announced that it had inked a long-term deal to become the official cloud services and e-commerce platform services, as well as founding partner of the Olympic Channel.

For the quarter, analysts reporting to Thomson Reuters forecast per-share earnings of 7.75 yuan, or $1.13, roughly 21% higher than the year-ago period. Revenue is anticipated to hit 50.3 billion yuan, or $7.32 billion, a near 46% run higher.

The options market has priced in an expected share price move of just over 4.2% in either direction around the earnings release, according to the Market Maker Move™ indicator on the thinkorswim® platform.

Call activity has been seen at the weekly 95 and 100 strikes while put have been active at the monthly 95 strike. The implied volatility lies at 30th percentile. (Please remember past performance is no guarantee of future results.)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.