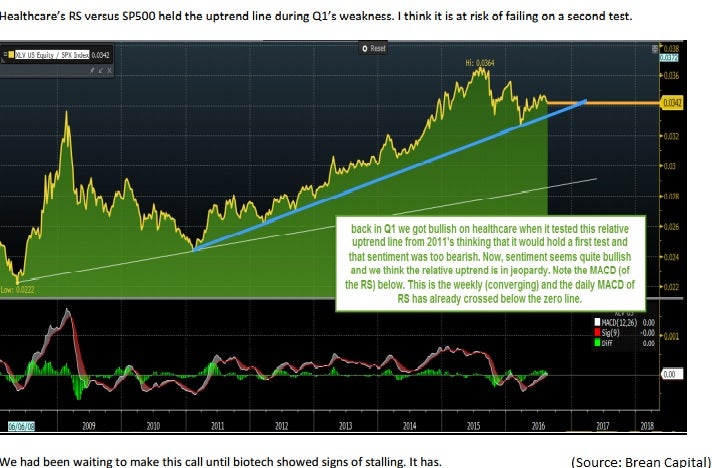

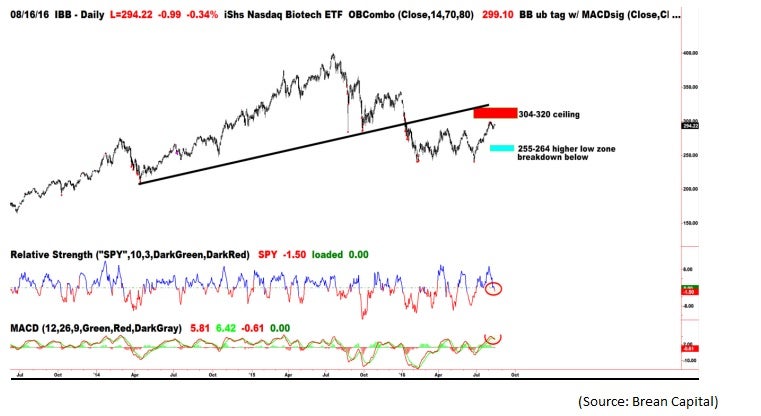

Frank Longman of Brean Capital cautioned investors over the weekend who are positive on healthcare stocks. The analyst suggested investors reduce their healthcare weighting to underweight based on technical indicators.

Longman cited deteriorating relative strength, price momentum and momentum of breadth.

"Those rollovers combined with the technical breakdown in one of the strongest large cap healthcare stocks (Bristol-Myers Squibb Co BMY) and a general dearth of long side trade setups left us feeling like risk was to the downside and interested in reducing proactively at current levels with the intention of revisiting after a pullback to support," Longman wrote.

Longman also noted that based on general sentiment, it seems like an "inopportune" time to recommend going underweight the sector, but "these things happen when you choose systems over inputs."

Here are some of the charts included in Longman's research note which he used to justify his underweight thesis.

Do you have ideas for articles/interviews you'd like to see more of on Benzinga? Please email feedback@benzinga.com with your best article ideas. One person will be randomly selected to win a $20 Amazon gift card!© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.