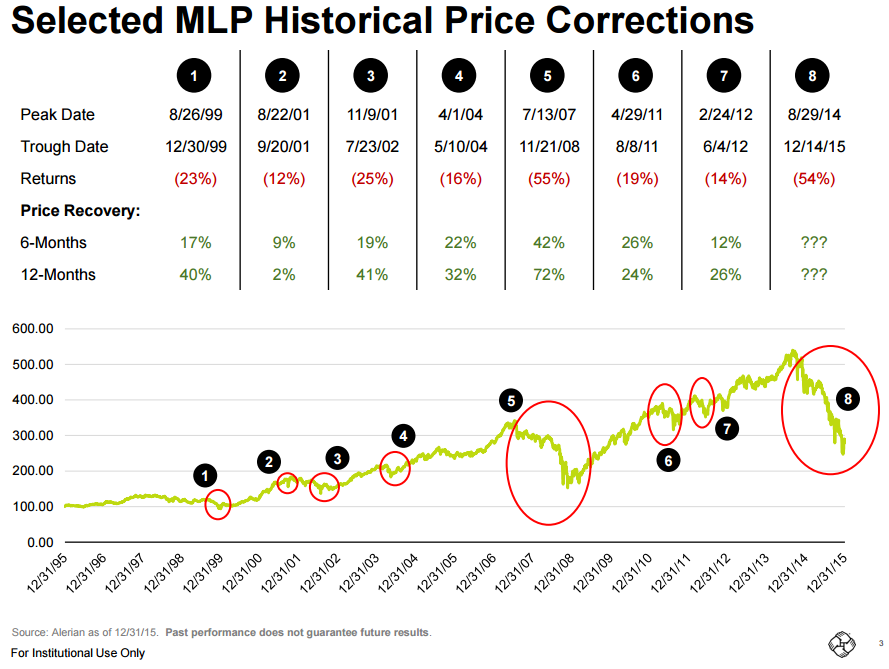

After hours on Wednesday Oppenheimer held a conference call to discuss MLPs. The firm laid out 8 periods of corrections going back to 1995. The most the group lost came in 2007/2008, declining ~55 percent. With the new revelations that a manager inside Berkshire Hathaway (NYSE: BRK-A) may be responsible for the holding company's bet on Kinder Morgan KMI, many have been left pondering if the bottom is has been seen in oil.

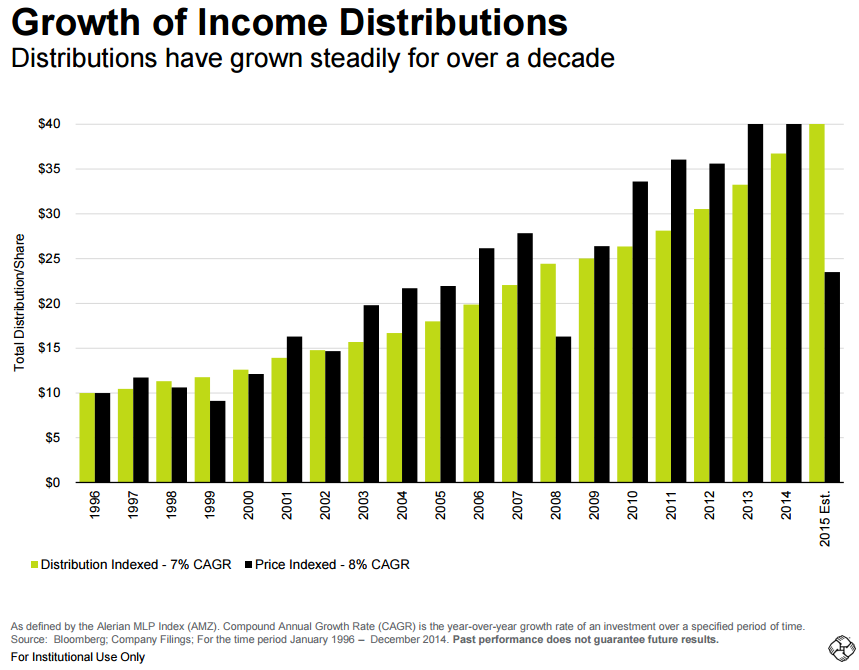

Although the declines are intense for those who have to experience them, there is hope for those holding MLPs. Growth of income distributions has remained relatively stable over the past 20 years.

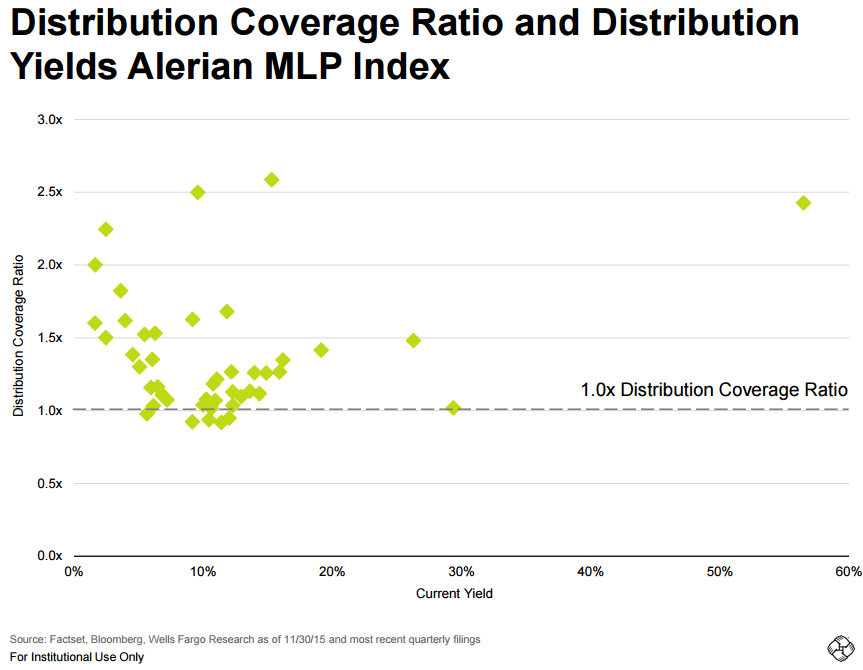

Oppenheimer notes the reasonablly steady growth in income distributions coupled with the clear grouping on the Scatterplot of Coverage Ratio/Yields distribution of the Index below may be the bullish metric the market is missing.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.