SolarCity Corp SCTY is plunging 30% in pre-market trading after the company posted its Q4 earnings yesterday after market close. The company posted revenues of $115.48 million, compared to estimates of $106 million and a loss of ($2.37) per share, compared to estimates of ($2.57). Despite this beat, the company reported only 272 megawatt installations this quarter, slightly less than the 280-300 megawatts predicted. The company credits this miss to 15 MW of projects that were not completed due to "terrain conditions" in the East Coast. Similarly, investors could not take their focus off weak guidance, as the company predicted a Q1:2016 loss of between ($2.55) and ($2.65) per share, compared to analysts' estimates for the next quarter of ($2.36) per share.

For Robert W. Baird analyst Ben Kallo, the weak guidance outweighed the earnings beat, as he reiterated his Neutral rating on the stock and slashed his price target to $47 from $60. He commented, "Financial results beat estimates across the board, management reiterated FY:16 installation guidance, and costs continue to decline. That said, SCTY missed on Q4 installs and issued weaker-than-expected Q1 installation guidance… which will make 2016 back-half loaded."

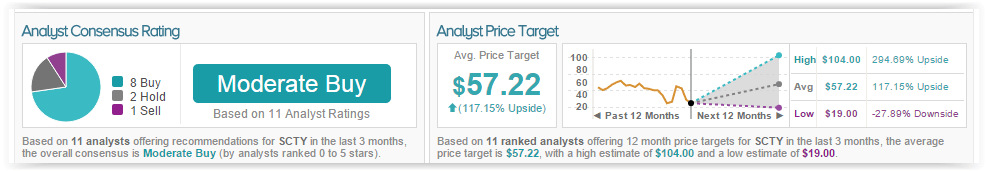

According to TipRanks' statistics, out of the 11 analysts who have rated the company in the past 3 months, 8 gave a Buy rating, 1 gave a Sell rating, while 2 remain on the sidelines. The average 12-month price target for the stock is $57.22, marking a 117% upside from where shares last closed.

Walt Disney Co DIS is down close to 3% in pre-market trading following the release of their Q1 earnings yesterday after market close. While the company posted revenues of $15.2 billion for the quarter, as well as earning of $1.63 per share, exceeding analysts' estimates of $14.73 billion and $1.45, respectively, operating income from cable networks marked a 5% loss. This is attributable to its ESPN subscriber losses as well as increased costs for NFL and college football games.

Following earnings, analyst Daniel Salmon of BMO Capital weighed in on the stock, maintaining his Market Perform rating and cutting his price target to $95 from $110. He states, "FY1Q16 EPS of $1.63 beat our $1.50 estimate and consensus of $1.45. Revenues were also generally ahead of estimates, but segment operating income performance was mixed, with a notable miss in Media Networks, and also a slight one in thenewly combined Consumer Licensing/Interactive segment. Parks were nicely ahead, while Studio was well-ahead driving the EPS beat. Disney repurchased $2.4B of shares in the quarter and continues to expect to buy back between $6-$8 B in F2016."

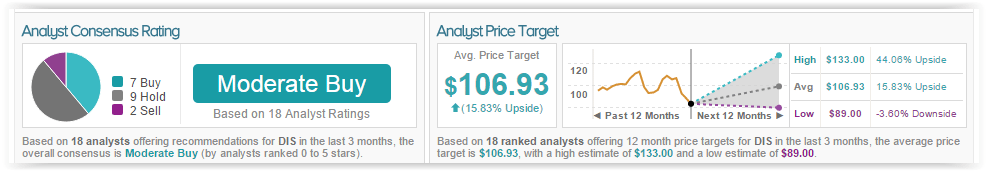

According to TipRanks' statistics, out of the 18 analysts who have rated the company in the past 3 months, 7 gave a Buy rating, 2 gave a Sell rating, while 9 remain on the sidelines. The average 12-month price target for the stock is $106.93, marking a 16% upside from where shares last closed.

Prospect Capital Corporation PSEC is up close to 10% in pre-market trading after the company posted their Q2:2016 earnings report yesterday after market close. Net investment income came in at $100.9 million, marking a $9.7 million increase from last quarter, and earnings of $0.28 per weighted average share, marking a $0.02 increase from last quarter.The company also declared monthly cash dividends of 8.3 cents per share to shareholders.

Cantor analyst David Chiaverini weighed in on shares following earnings. The analyst reiterated a Hold rating on the stock with a price target of $6.50. He states, "We view these results as mixed given NOI upside, an improvement in the level of nonperforming loans, and significant insider buying, offset by a 5% decline in book value. Our HOLD rating is based on the company's

below-average expected 2016 dividend coverage of 98% vs. BDC peers at 104%, and its higher-than-average CLO exposure, which represents 17% of the portfolio."

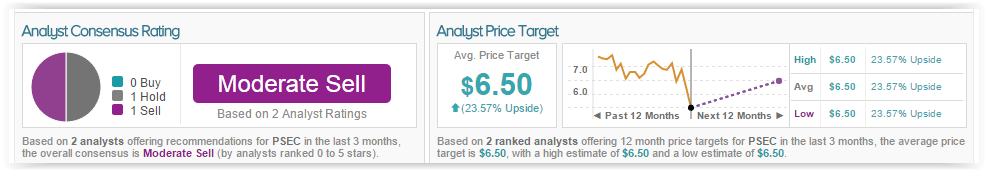

According to TipRanks' statistics, out of the 2 analysts who have rated the company in the past 3 months, 1 gave a Sell rating while the other remains on the sidelines. The average 12-month price target for the stock is $6.50, marking a 24% upside from where shares last closed.

Akamai Technologies, Inc. AKAM shares are soaring nearly 17% in pre-market trading, following solid fourth-quarter results and a new $1 billion share repurchase program. Fourth-quarter revenues were $579.2 million, versus consensus of $569 million, while guidance for 1Q16 was modestly higher than current consensus estimates.

After reviewing the results, FBR analyst David Dixon comment: "We see greater DIY (and repricing) risks in the CDN business as foundational datacenter and fiber assets are established for more players today than in 2011, providing low incremental cost opportunity. An intense sales focus has the performance and security solutions business ramping nicely, but we see secular challenges with the enterprise segment bifurcating. Specifically, we see more migration to cloud platforms, which is likely to confine AKAM to a reduced (partnership based) role for companies' CDN, Web security, and enterprise security needs."

The analyst remains bearish on the stock, reiterating an Underperform rating while lowering the price target to $42 (from $49).

According to TipRanks.com, which measures analysts' and bloggers' success rate based on how their calls perform, analyst David Dixon has a yearly average return of 9.3% and a 45.5% success rate. Dixon has a 35.2% average return when recommending AKAM, and is ranked #599 out of 3560 analysts.

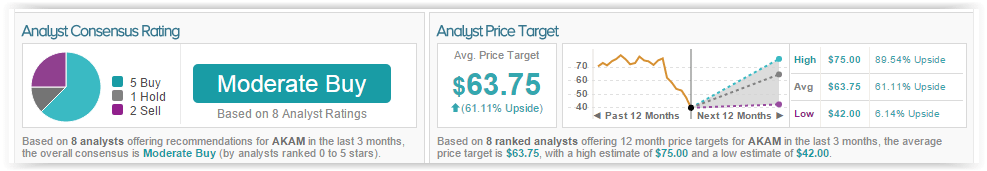

Out of the 16 analysts polled by TipRanks, 8 rate Akamai Technologies stock a Buy, 6 rate the stock a Hold and 2 recommend a Sell. With a return potential of 71%, the stock's consensus target price stands at $67.50.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.