Twitter Inc TWTR shares are having an awful Tuesday, down almost 8 percent on the back of a downgrade from analysts at Stifel. "The company will be challenged to reach its near- and long-term financial expectations given its current usage trajectory," the firm warned.

Stifel reveals a few major concerns about Twitter (and explains the problems in graph form):

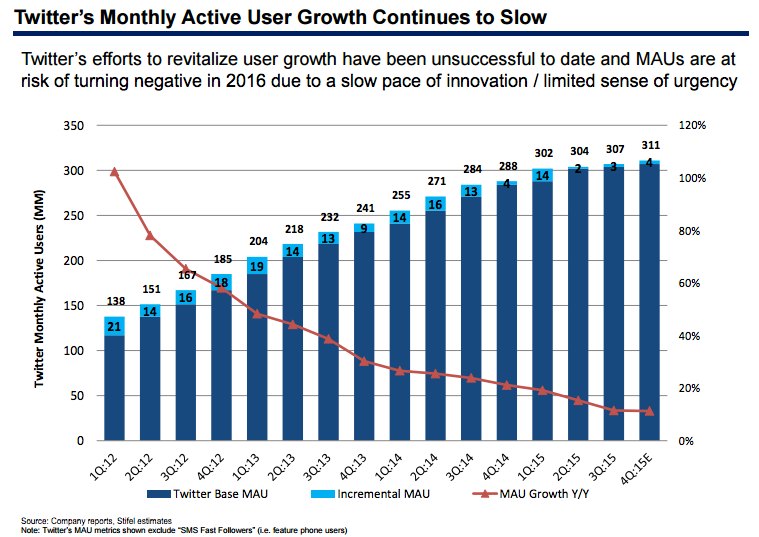

Twitter active user growth is slowing and at risk of going negative this year.

Facebook Inc FB is dominating Twitter in ad revenue per U.S. user.

Facebook users spend far more time on the site than Twitter's.

Twitter stock is expensive compared to peers.

Of note, Stifel analysts do mention that when adjusted for time spent, Twitter monetizes users at four to five times Facebook's average. In the fourth quarter of last year, Twitter ad revenue per MAU per 1,000 minutes was $16.05, while Facebook's figure was $3.74.

That normalization doesn't help investors, but it does show the potential Twitter has if management can figure out how to keep users on the platform longer. Stifel analysts infer that Twitter needs better product innovation and a greater sense of urgency, two things Wall Street has stressed in the past.

At the moment, investors aren't confident this will happen any time soon. The stock is less than a dollar off its all-time low of $15.48.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.