Apple Inc. AAPL shares are down 0.5 percent on Thursday morning, and while the market may be focused on a text message bug, there's another story brewing on Wall Street.

UBS analysts Steven Milunovich and Peter Christiansen just issued a massive note on Apple in China.

The country is the primary "driver" of growth at the tech giant, UBS said. So much so, in the firm's eyes, that it holds a 12-month Buy rating on Apple with a $150 price target.

Check out seven graphics UBS compiled in the Apple report:

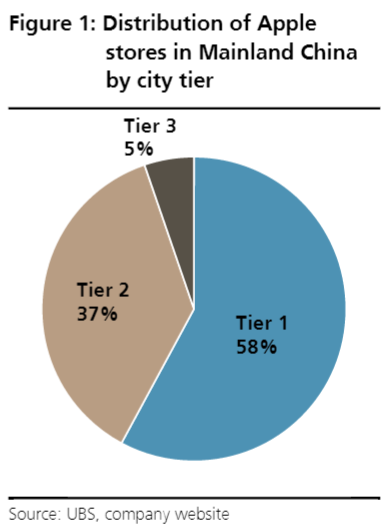

Tier 1 Cities Make Up The Majority Of Apple Store Distribution In China

iPhone Sales In China Are Becoming More Important To Apple

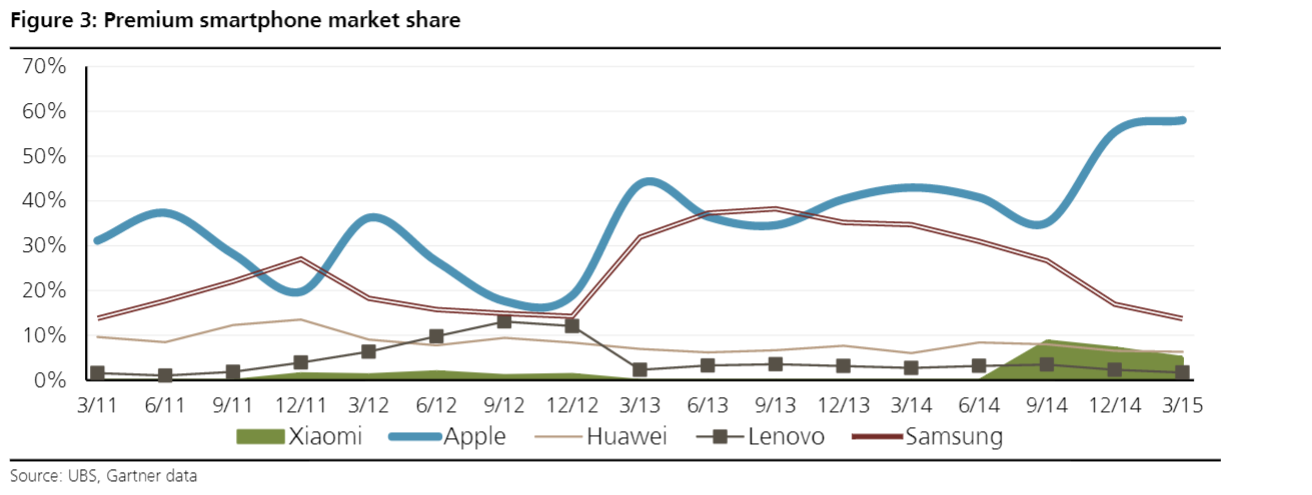

Premium Smartphone Share Is Growing At A Time When Competitors Are Shrinking Or Stagnant

Total Market Smartphone Share Is Also Growing

Market Share Is Expanding No Matter How One Looks At It

The iPhone Sells At Multiple Income Levels

The Apple Brand Is Trusted

And Users Are Committed

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.