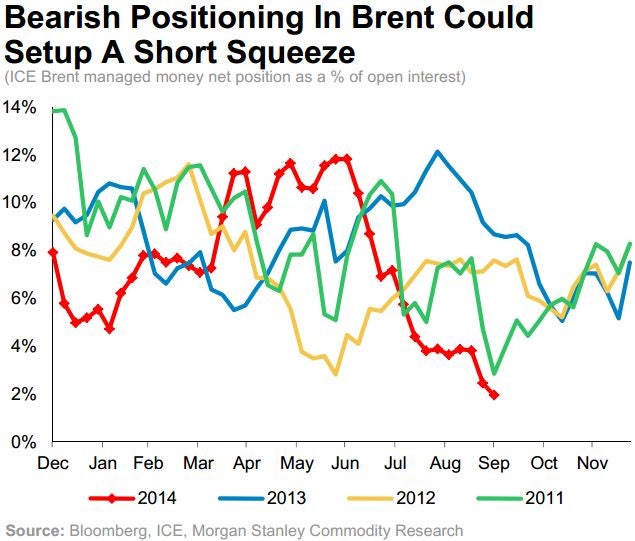

Oil’s selloff has confused pundits as they don’t know whether to be happy for the consumer who can now afford to drive down the street or to shun the levels and reiterate the pain on Big Oil’s margins. Either way, the sub $90 trading level in Brent crude has caused Morgan Stanley MS to come out with a report highlighting the potential correction from “extreme short positioning in Brent.”

The selloff doesn’t scare Morgan as the bank notes it is seeing “the latest round of weakness in oil is not a product of weak end demand or an economic slowdown in our view.” Hyper seasonality and supply growth have caused a realignment of trade flows though Brent prices should recover into the Year end and find levels of bullish support.

Despite the front month selloff, which can be mostly attributed to a stronger and stronger dollar, the structure for Brent remains strong further out and analsysts at Morgan Stanley are expecting a rebound from these currently depressed levels. The analysts note:

- Brent structure rising into expiry,

- At current prompt prices, floating storage no longer works, suggesting inventory overhangs may be moderating,

- West African and North Sea diffs are stable or rallying,

- Buyers are returning, manifesting in stronger Dubai structure,

- Runs are already rising.

So if you're short now, enjoy it while you can, the low oil prices won't be here for much longer

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.