Michael Kors KORS is expected to beat on earnings when they release the data on August 4. The company is expected to earn $0.81 on revenue of $852.45M. KORS forward P/E of 20.7x is below the 23.7x average for the peer group according to data from Capital IQ. Tangent to the P/E is the P/E/G which enables analysts to incorporate growth expectations. KORS PEG ratio stands at 0.89x and is lower than the peer group average of 1.65x.

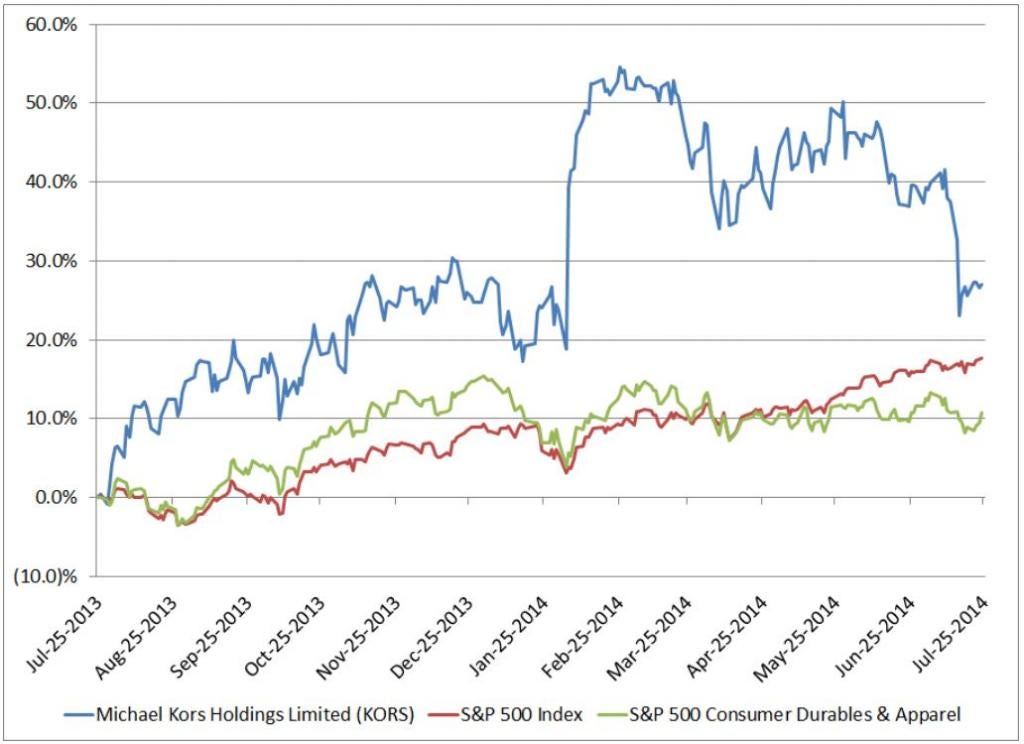

The clothing retailer's stock performance has outperformed the S&P 500 and continues to do so even after the most recent sell off. The retailer has seen its stock price rise 27.1 percent while the S&P 500 has returned 17.6 percent over the past year.

(Click To Enlarge)

Growth estimates for the April to June period are expected to grow 2.3 percent according to data released by the US Commerce Department on June 15. Morgan Stanley MS says in a note released on July 21:

“We think the brand remains resilient and see upside into Q1”.

In the same note, Morgan Stanley says that KORS is a “MS best idea” and the investment bank believes it deserves to trade at a premium to Coach COH.

As for KORS ability to take over the market share Coach has lost recently, Goldman Sachs GS says:

"KORS is the only handbag competitor with the brand awareness, strength, price positioning, and distribution to take on COH's lost share".

“We also point out that the KORS brand resonates globally with customers, particularly in the U.S., due to Michael Kors’ success as a leading runway fashion designer, with an over 30+ year career in the fashion industry”.

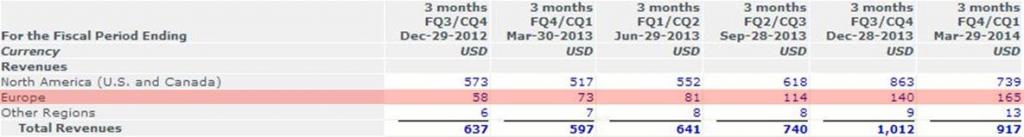

European expansion continues as KORS has added four new locations bringing the total count in Europe to 80 locations currently and is slated to add another 50 locations by the end of 2015. Each opening is met with great fanfare according to Janney. As for revenue in Europe, KORS has increased European revenues in each of the past six quarters.

(Click To Enlarge)

Gauging from the chart provided in the Goldman note, KORS leads everyone in Google GOOG search activity in the UK.

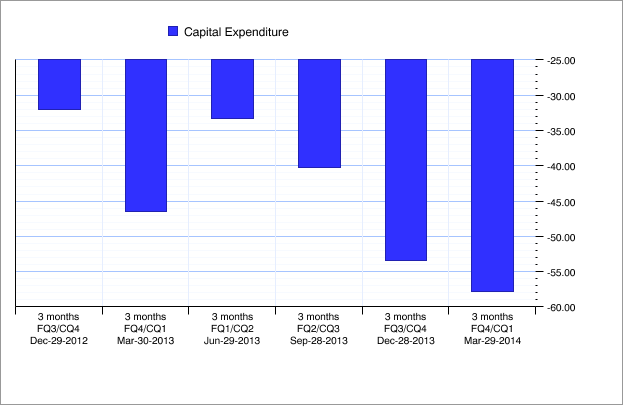

The trend since the Great Recession has been for corporations to cut CapEx in favor of deploying capital into share buybacks. The impact of this behavior was noted by Goldman Sachs GS in a note from late June 2014. Bucking that trend KORS increased its Capital Expenditures over the past six quarters.

(Click To Enlarge)

The expectations are high KORS on August 4th and rightfully so, the company has beat expectations for the past six reports.

(Click To Enlarge)

Nearing the final hour of trading on Thursday, KORS traded down 0.63 percent to $81.75

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.