We believe the panic liquidation by growth-oriented investors following Planet Payment, Inc.’s (PLPM) (“Planet” or “the company”) revenue miss and guidance reduction is fundamentally misguided and has resulted in the opportunity to buy a dollar for $0.50 – and into a defensible, high- growth and margin, increasingly cash-generative, and recurring revenue business. The company trades at 3 year lows on investor capitulation, yet by our assessment, it is the most valuable it has been throughout its history.

We have followed Planet Payment for 3 years now because we believe it to have a dominant competitive position as a differentiated international payment processor, and to be the leader in one of the fastest growing, most lucrative areas of the payment space, dynamic currency conversion (“DCC” or “multi-currency payment processing”).

Planet reported Q2’13 earnings on August 13, 2013, and on the surface the results appeared very concerning. Further, management reduced 2013 guidance and guided for 2014 revenue growth of 20%, a seemingly anemic target in light of the new, potentially game-changing markets the company is on the verge of entering this year.

However, an analysis of the company’s underlying operating metrics and a closer examination of the company’s explanations for the reduction reveal that Planet is setting up for a string of upside surprises. We believe the guidance revision was solely the result of delays in tech rollouts, which are likely to be resolved before year end. Such delays have no impact on Planet’s company’s earnings power.

We believe Planet equity has an intrinsic worth of $4-6 per share, indicating 75-160% upside from current levels.

Business Overview

We have followed Planet Payment (PLPM or “Planet”) for 3 years now because we believe it to have a dominant competitive position as a differentiated international payment processor and to be the leader in one of the fastest growing, most lucrative areas of the payment space, dynamic currency conversion (“DCC” or “multi-currency payment processing”). Planet was founded in 1999 by current CEO Philip Beck, a former international banking and corporate attorney. The company has built a proprietary, currency-neutral payment processing technology platform that serves as an outsourced, revenue-enhancing infrastructure that banks and processors subscribe to through 3-5 year contracts. Once an acquirer or merchant is up and running on its platform, Planet generates recurring revenue by processing its payment transactions.

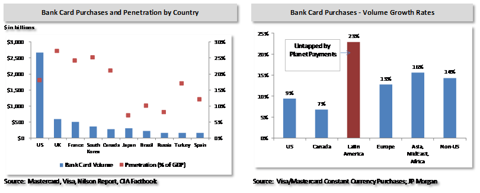

The company counts 5 of the top 17 global acquirers and payment networks Visa (V) and MasterCard (MA) as customers. Its client base includes more than 60 acquiring banks and processors across 22 countries and territories across the Asia Pacific region, North America, the Middle East, Africa, Europe, and, most recently, South America. As Planet’s global profile increases and the value of its solutions are realized in new geographic markets, the company experiences network effects, driving accelerating adoption of its services and increasing the value of its platform. This creates significant barriers to entry and results in earnings leverage for shareholders given the recurring revenue features of its customer contracts and largely fixed operating expense of its platform.

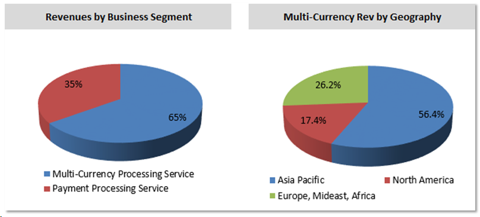

Planet manages its business in two operating segments: multi-currency processing, or DCC, services and payment processing services. The charts below contain Planet’s revenue breakdown by business segment and its multi-currency segment’s primary geographic end markets as of Q4’2012.

Its payment processing services (~35% of revenue) comprise authorization, capture, clearing and settlement services for its customers. This segment typically processes transactions for lower per-ticket purchases, such as consumer staples – food, clothing, etc. In terms of revenue generation, it is the more stable of the two business segments. We note that the payment processing business is less differentiated, less lucrative and, hence, much less valuable than the higher-growth, higher-margin multi-currency business.

The multi-currency business (~65% of revenue) provides merchants the ability to offer international cardholders the optional convenience of paying for purchases in their own currency, whereby Visa or MasterCard credit card purchases are made in the merchant’s local currency and converted after the card is presented (at the point of sale or online) into the cardholder’s home currency. It processes the cross-border transactions of travelers who, for example, may spend on hotels or at retail stores while overseas. Because these transactions are typically higher-ticket purchases, the multi-currency business is inherently more sensitive to changes in global economy; it is subject to macroeconomic sensitivity in the various end geographies it operates, by way of changes in travel and spending patterns.

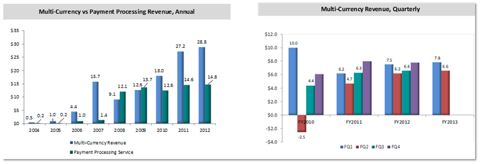

The multi-currency business has always exhibited an uneven growth trajectory. It has not demonstrated any sort of steady growth trajectory ever; it has been lumpy, in that it has grown in fits and starts. This is because when Planet introduces its services to a new geographic market, its resulting revenues will be either spectacular, or not. Additionally, when Planet enters a new geographic market and forms new partnerships, it isn’t in complete control of how quickly its partners (i.e. acquirers and processors) roll its services out to their customers (i.e. merchants); when there are delays, which is common, it can push Planet’s growth curve out. Although this has no impact on the company’s earnings power, owning the equity requires understanding that this is common and may again occur, and it mandates patience.

Investors Head-Faked by Q2’13 Guidance Reduction, Capitulated

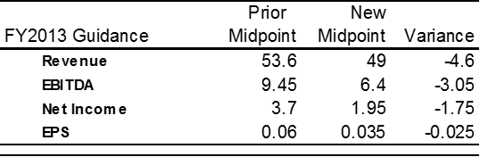

Planet reported Q2’13 earnings on August 13, 2013, also announcing a reduction to its 2013 guidance (refer to table below). The company also guided for 2014 revenue growth of 20%, a seemingly anemic target given the new, potentially game-changing markets they are on the verge of entering this year – specifically Brazil, Mexico, and Indonesia.

The reduction in guidance targets a revenue growth rate of 12% for 2013; this follows 2012’s 4% revenue growth rate, Planet’s weakest on record. To put this in context, these would be lowest growth rates Planet has on record, and may be the cause the stock price has stagnated for 2.5 years.

On the earnings conference call, management explanations for the reduction seemed to, on the surface, hint at persistent weakness in the business; investors reacted by panic liquidating their holdings, with the stock declining -34% to ~3 year lows.

However, an analysis of the company’s underlying operating metrics and a closer examination of the company’s explanation reveal that Planet is firing on all cylinders and setting up for a string of upside surprises after 2.5 years of stagnation in its stock price. We believe the company is more valuable today than it has ever been. Our view is that the panic liquidation by growth-oriented investors was fundamentally misdirected and has created opportunity to buy a dollar for $0.5.

On the earnings call, management attributed the miss and guidance reduction both to weakness in the multi-currency business emanating from the Asia Pacific market and delays in rolling out new business in the Americas:

"We have seen weakness in multi-currency results in the APAC region, which may impact growth in multi-currency revenue if these trends continue into back half of the year. Additionally some of our customers in the Americas have been slower than anticipated in completing technical implementations/rollouts to their customer portfolios."

The APAC market, from which ~56% of Planet’s multi-currency revenues are generated, has shrunk in every quarter since Q2’2012on the back of softness in travel to Hong Kong and Macau, Planet’s two primary APAC markets.

Planet initially announced 2013 guidance for $53.5m in revenue when itreleased its Q4’12 results; In Q4’2012, APAC multi-currency revenue declined by 11% YoY. On the Q4’12 call, it was twice emphasized that this guidance incorporated no leveling off of APAC revenue. In other words, the guidance had continued weakness in APAC baked into it. The below are exchanges from the Q4 call Q&A (emphasis added):

Chris Shutler - William Blair

I guess my first question would be, Philip and Bob, looking back at 2012, you guys increased the number of multi-currency merchants by -- I think about 35%, which is pretty impressive, but obviously the revenue growth was 4% and the gross markup was up 17%. So obviously, it's a little bit disconnect there, I know some of it was the economy, could you just dissect that a little bit closer, was there anything going on in terms of adoption rates or anything else that might have driven the delta there? Thanks.

Robert Cox - SVP and CFO

So Chris, I think one of the -- thank you for the question, one of the metrics or several of the metrics that we highlight, one is our total foreign multi-currency markup, as well as our active merchant numbers, and if you look at those, you would see a decline in the revenue per merchant that we were able to earn in 2012, versus that which we earned in 2011. Much of that is based upon the economic climate in the markets in which we do business, as well as the mix of the underlying merchant base. So we have talked about that a bit in the past in our releases, and so we have seen that.

Now what we have done, as far as our guidance goes frankly is we have kind of reset the bar, as far as our expectation of revenue for merchants, and we carry that forward. So that 20% to 26% top line growth that we have highlighted within our guidance, is driven off of the revenue per merchant number. So at the end of the day, we will continue to add merchants, and we are not expecting to see any rebound in that revenue per merchant number, but if we do see a rebound, I think we will all be pleasantly surprised. So, I think that's the direct answer to the question

Gary Prestopino - Barrington Research

That's fair. Maybe if you could talk about very briefly, not in depth, what you saw in each of your individual markets, as you track through 2012, meaning APAC, CEMEA and North America, and if you are seeing, what you are anticipating for 2013, do you see any strength, do you see stability, do you see just flatness? Is that something you can share with us?

Robert Cox - SVP and CFO

So we have highlighted what we saw top line wise in each region as it relates to our multi-currency business. Largely speaking, we saw a reduction in revenue per merchant, I think across the merchant phase in 2012, but as I mentioned, we are kind of carrying that forward with no expectation for an immediate rebound…

When the company announced Q1’13 results, APAC multi-currency revenue again contracted 11% YoY. At that time, management reiterated the guidance issued during the Q4 announcement (‘Prior Guidance’ in the table above). So again, persistent weakness and 11% YoY declines in APAC were baked into those higher numbers.

One quarter later, the company announced that in Q2’2013, APAC multi-currency revenues had only declined by 9% YoY; the decline improved, and this should have benefited the company toward hitting prior guidance, or at least not have affected it at all.

We believe weakness in APAC, which had been anticipated to continue and was factored into previous guidance, played no real role in management’s decision to reduce 2013 guidance. That weakness was hedged.

What were not hedged were delays in project roll-outs/implementations that were expected to have been revenue-generative by this time; Planet had banked on, by this time, already having had established its platform in Brazil with partner Cielo, having rolled out its services to Indonesia, and having begun processing Global Payments’ customer transactions. These were all partnerships/endeavors announced in 2012, and based on the earnings call, were likely accounted for in the initial 2013 guidance issued in Q4’12. The recent downward revision resulted from not being able to move forward as quickly as expected with these projects due to various reasons.

Delays are not unusual in breaking ground on new partnerships or geographies for any business; Planet is no exception. These implementations are now approaching completion.

We believe investors left the Q2’13 earnings call with a fundamental misperception of the health of this company. APAC is not drowning the company (as we discuss in the section below the APAC market is on the verge of re-emerging as an accelerant to revenue growth as Planet enters a new geography). There is no new competitive threat eating away at Planet’s business. Planet’s growth prospects are not impaired. Delays have pushed its previously anticipated and previously advertised growth curve out, by only a matter of months, with absolutely no effect on the company’s earnings power and intrinsic value.

We believe the stage for Planet is set to emerge from its two year lull.

Management Lowballs 2014 Guidance, Upside Surprises Imminent

Planet’s guidance for 20% revenue growth next year appears to be a lowball target, setting it up for a year of upside surprises. Planet is likely to win currently unplanned business, we believe it’s APAC market will soon strengthen, and it is entering Brazil at year end (an enormous market relative to those in which it currently operates), which is itself hosting the World Cup in 2014.

Per the Q2’13 press release, the 2014 guidance accounts only for planned multi-currency implementations; but, Planet is in constant negotiations for new business and working toward entry of new geographies. Landing ‘unplanned’ partners is a real likelihood.

We also believe that weakness in Planet’s APAC market will be short lived moving forward. Over the past two years, persistent weakness in the APAC market, Planet’s largest end market, has served as Planet’s Achilles heel, dragging growth to historical lows and keeping the company from delivering on its promise for immense earnings leverage. We were initially concerned that opt-in rates were in decline, but based on our sources they are not. We have also identified no real competitive threats that may be taking share. Management claims, and we have verified, that this has resulted from weakening travel and spending trends, a cyclical phenomenon. It will eventually bounce back and Planet will get positive boosts to its top and bottom lines. But Planet’s APAC market is likely turning around sooner than the cycle improves in Hong Kong and Macau. Planet is imminently entering the Indonesian market, likely to be a big driver of growth in APAC.

Most importantly, though, Planet is now setting up to enter another new, large market in Brazil. Brazil will bring meaningful volume that potentially dwarfs that from Planet’s current markets. We believe Cielo, which commands 60% of the Brazilian market, has placed a very high priority on getting up and running on Planet’s platform.

Additionally, Brazil is hosting the World Cup in 2014. Spending at World Cup events can amount to anywhere from $3-6 billion, and because of its relationship with Cielo, Planet is likely to capture a majority of the resultant cross-border spend.

In sum, after two years of lull, we believe that Planet presented investors with guidance it surely could not miss. In doing so, the company has almost guaranteed the prospect to surprise to the upside. We believe this is just another fit before a full on start for PLPM’s profitability and its equity price, which we believe is substantially undervalued at current levels.

Trading at a Large Discount to Intrinsic Value

We believe the panic liquidation by growth-oriented investors was fundamentally misguided and has resulted in the opportunity to buy a dollar for $0.50. The equity trades at 3 year lows and, yet, is by our assessment the most valuable it has ever been.

Planet Payment should have a clear runway to generate $100-120m in net revenue over the next 3-5 years. And, in an ideal world, 100% of each incremental $1 in net revenue should flow to the bottom line, as there is no incremental cost associated with it. In theory the platform should work like this, but in the real world maybe not. Accordingly, in our model we assume 75% incremental economics, such that if Planet generates $1 in incremental net revenue, $0.75 flows to EBITDA. Based on our DCF we believe the equity is worth $5-6.

Looking at Planet as an acquisition candidate, it’s safe to assume that if an institution were to buy it, it would not be doing so for the economics or the level of revenue Planet has managed to generate today. The institution would likely be purchasing Planet for its platform, to leverage it to a far greater degree than Planet is capable. Today, Planet generates $30m of net revenue on multi-currency; in the hands of an entity with a platform and a large marketing sales force, that would be almost pure profit. What's that worth? We believe 10x that number at least, because, ultimately, it is being bought on potential. $300 million takeout price results in a >$4 share price today, and that seems reasonable to us. The processing business also has value, although a far lesser value than the multi-currency business. It is a much lower margin business; it’s not operating in the richest space in payment processing. Absent management substantially scaling it pre-buyout, we take the view that it could be sold at perhaps 1x revenue because it is undifferentiated.

Even looking at Planet on a forward multiple basis (which we believe to be subpar given its growth potential), it is cheap at current levels even assuming the company only meets management’s 2014 guidance layup.Going into 2013 Planet was expecting far more revenue growth than it ended up generating, but the costs and investments to produce that anticipated revenue growth are already in place. The company is already prepped to flow additional dollars through its platform: On 1 incremental dollar of net revenue that comes through the platform (in the markets they’ve made these investments in),again, there should be no incremental cost associated with it; 100% of each incremental dollar should flow to the bottom line. Planet has guided for 20% revenue growth in 2014, which if met would result in an incremental ~$10m of revenue; we think it’s safe to assume that 75% of that will flow to EBITDA, which would indicate the equity is trading at a cheap 10x 2014 EBITDA at current levels – this for a high growth potential, high margin, recurring revenue business with a dominant competitive position.

We believe Planet equity has an intrinsic worth of $4-6 per share,indicating 75-160% upside from current levels.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.