June 8, 2015 1:16 PM | 3 min read |

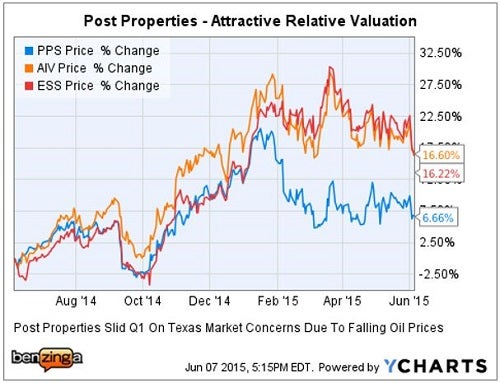

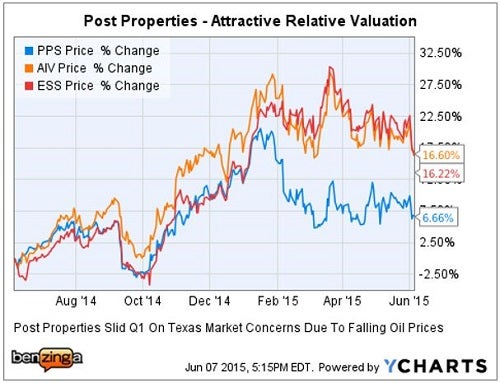

On June 5, Raymond James & Associates (RJA) analyst Buck Horne and his team published a report updating the multifamily REITs in its coverage universe prior to NAREIT's REITWeek presentations, including: Post Properties (NYSE: PPS) - $3 billion cap, 2.86 percent yield; Upgraded to Outperform, on Valuation. Apartment Investment & Management Co. (AIMCO) (NYSE: AIV) - $5.8 billion cap, 3.25 percent yield; Reiterate Outperform. Essex Property Trust (NYSE: ESS) - $14 billion cap, 2.9 percent yield; Maintain at Underperform, on Valuation.Tale Of The Tape - Past Year

27% profit every 20 days?

This is what Nic Chahine averages with his option buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.

Notably, no multifamily REIT received a Strong Buy rating from Raymond James.RJA - Apartment OutlookRJA remains "cautious" overall, with reservations based upon high stock valuations in the multifamily sector, citing: "… a mushrooming new supply pipeline, the sector's heightened NAV sensitivity to potentially rising interest rates, and the likelihood of decelerating NOI growth trends (from tough y/y comparisons) through year-end." On the other hand, RJA has "been pleasantly surprised by the durability of pent-up renter demand and new renter household formation…" noting that this is a theme that has been playing out for the past few years.RJA - Sector M&A Helps ValuationsHorne mentioned the Brookfield Asset Management $28.75 per share acquisition of Associated Estates Realty Corp. (NYSE: AEC), announced in April, at a 17.4 percent premium to priors day close; and noted "widespread speculation" of the potential acquisition of Home Properties (NYSE: HME).Notably, the Associated Estates purchase price is at a 22.4 percent premium to RJA's $23.49 per share NAV estimate, (vs. $25.14 consensus estimate at the time of the deal announcement).RJA points to deals like this one, as a reason "… multifamily cap rates have largely held firm in the face of recent increases in Treasury yields."RJA - Post Properties: Upgraded Market Perform To Outperform, Initiate $63 PT The new PPS $63 target price represents a potential 12.4 percent upside from Friday's close of $56.03 per share.The RJA $63PT is a 5% percent discount from its new NAV estimate of $66.15, (up from $59.01); and the PPS current share price represents a "sector-low"15 percent discount, based on the new NAV estimate.RJA increased PPS "2015 and 2016 FFO/share estimates to $2.91 (from $2.87) and $3.10 (from $3.07), respectively."Rationale: While RJA noted that the Washington D.C. market (19 percent of portfolio) is on the rebound with job growth, and Atlanta "continues to be a magnet for corporate relocation;" supply concerns were also discussed for: Dallas, Washington D.C., Atlanta and Austin markets. http://www.benzinga.com/analyst-ratings/analyst-color/15/03/5323679/jefferies-weighs-in-oil-prices-reits-apartment-supplydem RJA - AIMCO: Reiterate Outperform, Maintain $42 PTThe AIV $42 target price represents a potential 13.2 percent upside from Friday's close of $37.08 per share.The RJA $42 PT is roughly in-line with its new NAV estimate of $42.09 per share, which represents a 12 percent discount to current share prices, second largest in the sector according RJA estimates.Rationale: Horne noted double-digit AFFO growth and recent 15 percent Y/Y annual dividend increase, improving tenant credit profiles and high NOI growth potential. Additionally, the AIMCO portfolio does not have any exposure to "potential trouble spots in Texas," while benefiting from "red-hot market areas like coastal California (30.7% of NOI), Southeast Florida (8.4%), and Denver (4.4%)."RJA - Essex Property Trust: Maintain Underperform, Price Target Not MentionedBased upon Friday's close of $214.46, Essex shares are trading at a sector high 12 percent premium to RJA's revised NAV estimate of $191.50 per share, (vs. a 1.1 percent above NAV average for RJA covered apartment REITs).

RJA's "new 2015 and 2016 FFO/share estimates are $9.50 and $10.40, respectively, up from $9.34 and $10.29 previously," which implies ESS shares are currently trading at 20.6x 2016E FFO.Rationale: RJA believes that all of the good news about West Coast markets are already baked into the shares, including "condo optionality" for ~6,300 units.Horne noted supply concerns because new permits are up substantially in key Essex markets of San Jose, Los Angeles and Seattle; as well as a higher cost of capital impeding accretive acquisitions moving forward.

27% profit every 20 days?

This is what Nic Chahine averages with his option buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.