May 27, 2015 1:11 PM | 3 min read |

Crypto Whales Are Loading Up — Are You?

New research shows the biggest crypto buyers are back. And this time? They could hold for the possibility that Bitcoin will surpass $100,000 in 2024. You don’t want to miss the next massive crypto bull run like we saw in 2020 and 2021. To know exactly what’s going on and what to buy… Get Access To Benzinga’s Best Crypto Research and Investments For Only $1.

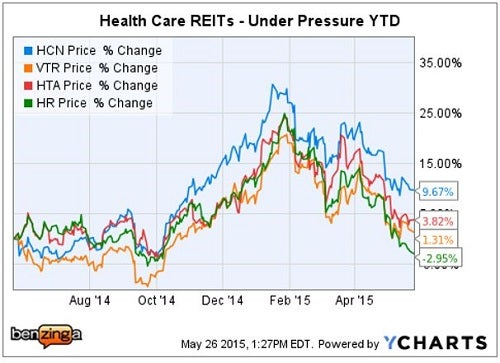

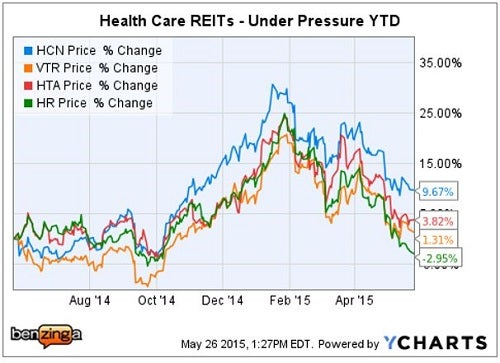

On May 26, Mizuho Securities USA released a note updating the U.S. REIT sector based upon macro views on the economy and interest rates by its Chief Economist Steve Ricchiuto.The Mizuho outlook is "for 'Fed Lift-Off' being pushed back to 2016," and the 10-Year Treasury to remain in a range of 1.75 to 2.25 percent -- a win/win for REITs in general.Extrapolating this to health care REITs, (one of the highest yielding and therefore particularly interest rate sensitive REIT sectors), resulted in Mizuho upgrading and raising price targets on two REITs, and reiterating its Buy rating on a third: Health Care REIT, Inc. (NYSE: HCN) - $24.9 billion cap, 4.66 percent yield. Ventas, Inc. (NYSE: VTR) - $22.6 billion cap, 3.4 percent yield. Healthcare Trust of America (NYSE: HTA) - $3.1 billion cap, 4.65 percent yield. Health Care Realty Trust, Inc. (NYSE: HR) - $2.4 billion cap, 4.96 percent yield.Tale Of The Tape - Past Year

Mizuho feels that health care REIT underperformance was mainly due to interest rate fears, and a 10-year Treasury at 2.25 percent or below, could represent a "buying opportunity."Mizuho - Historical Spreads

Mizuho noted that the ~150 bps spread between the 10-yr Note and broader REIT sector dividend yield (3.7 percent), remains close to historical averages.Mizuho - HCN: Upgrade Neutral To Buy; PT Increased $74 To $80The new Mizuho price target represents a potential 12.9 percent upside from HCN prior close of $70.86 per share. The Mizuho $80 PT "is based on a 2015 AFFO multiple range of 19x-21x." HCN has been the most accretive of its peers, with Q1 acquisition cap rates ranging from "the low-5's to mid-7's," mostly in senior housing and post-acute nursing assets. Mizuho noted that the HCN proprietary "Vantage" property management system was "the real deal" and sees it as a competitive advantage. The main PT risk noted by Mizuho was "if the company's significant exposure to the RIDEA structure results in declining same store prospects in the face of new supply growth, our price target may not be achieved." Mizuho - HR: Upgrade Neutral To Buy; PT Increased $26 To $28The new Mizuho price target represents a potential 15.8 percent upside from HR prior close of $24.18 per share.The Mizuho $28 PT "is based on a 2016 AFFO multiple range of 17x-20x." Mizuho sees HR being oversold YTD, down 11.5 percent, as compared with its MOB (medical office building) peer Healthcare Trust of America (Mizuho - Neutral), only down 7.4 percent during the same period, making HR the better pick currently. Mizuho also noted HR's "more granular/analytical approach" to the MOB business, and longer track-record as a public REIT, as compared with sector rival HTA. Mizuho sees positive fundamentals driving the MOB sector, including: increased utilization due to ACA (Obama-care); very high rent coverage ratios giving dividend protection; as well as consolidation of practices, and alignment of strong hospital groups/on-campus locations. The main PT risk noted by Mizuho was if "the company's same store growth fail[s] to maintain its historic pace of performance…"Mizuho - Ventas: Reiterate Buy; Maintain $85 PTThe Mizuho target price represents a potential 24.5 percent upside from VTR's previous close of $68.28 per share. The Mizuho $85 PT "is based on a 2015 AFFO multiple range of 19x-21x." Mizuho noted that similar to HCN, Ventas is a "blue-chip" health care REIT with a top management team. Mizuho sees Ventas achieving its FY 2015 growth goal of 3 to 5 percent, noting it was a wide range. Ventas' planned Care Capital Properties spin-out is "forward thinking" according to Mizuho; also noting that MOB "Doc-Fix" as a positive and post-acute nursing "pay-for" as appearing manageable. The post-acute nursing segment was noted as the biggest risk; however, Ventas 1.5x rent coverage with Kindred helps to mitigate that risk moving forward.Mizuho - Bottom LineThe health care REIT sector, based upon current lower valuations and an economic forecast of a relatively benign rate and macro environment, should represent an opportunity for investors during 2H 2015.Large caps Ventas and HCN, along with mid-cap Healthcare Realty Trust are the top three ways to play the sector for investors who agree with the Mizuho economic thesis.

Crypto Whales Are Loading Up — Are You?

New research shows the biggest crypto buyers are back. And this time? They could hold for the possibility that Bitcoin will surpass $100,000 in 2024. You don’t want to miss the next massive crypto bull run like we saw in 2020 and 2021. To know exactly what’s going on and what to buy… Get Access To Benzinga’s Best Crypto Research and Investments For Only $1.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.