April 1, 2015 9:48 AM | 2 min read |

Crypto Whales Are Loading Up — Are You?

New research shows the biggest crypto buyers are back. And this time? They could hold for the possibility that Bitcoin will surpass $100,000 in 2024. You don’t want to miss the next massive crypto bull run like we saw in 2020 and 2021. To know exactly what’s going on and what to buy… Get Access To Benzinga’s Best Crypto Research and Investments For Only $1.

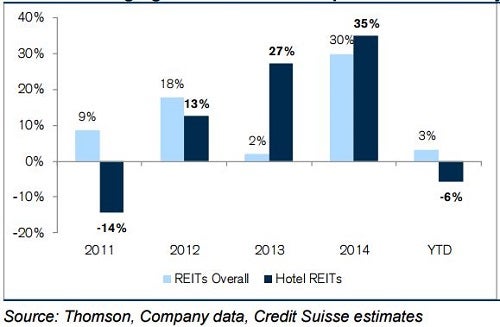

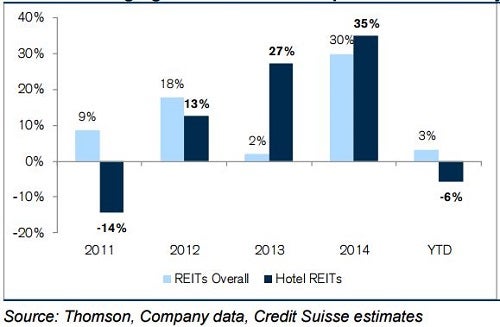

On March 30, Credit Suisse analysts published a report, "Hotels: Comparing Inflection in Fundamentals vs. Stocks." One notable investor takeaway was the apparent disconnect between key metrics remaining strong, while hotels have underperformed (down 6 percent) vs the broader REIT sector (up 3 percent) year-to-date.Credit Suisse observed that five years into this lodging recovery, driven in part by "limited new supply growth, improving macro and very solid RevPAR performance," hotel shares had still outperformed REITs over the last two years.

So, which trend should investors count on, given that "lodging stocks trade down well ahead of a turn in fundamentals?"Tale Of The Tape

Credit Suisse has three top picks in the lodging sector: Strategic Hotels & Resorts, Inc. (NYSE: BEE) - Neutral, no dividend. RLJ Lodging Trust (NYSE: RLJ) - Neutral, dividend yield 4.23 percent, (dividend recently hiked 10 percent). Sunstone Hotel Investors, Inc. (NYSE: SHO) - Neutral, dividend yield 1.2 percent.Here is why Credit Suisse remains bullish on lodging overall, despite potential headinds from an increasing supply of rooms in NYC and strong U.S. dollar negatively impacting tourism demand.Credit Suisse - Fundamental Drivers Healthy Supply: In the past 30 years, the tipping point comes when the supply pipeline of new hotel rooms reaches 3 to 4 percent of the existing stock of rooms. U.S. supply is expected to increase just 1.7 percent by the end of 2015, and 2 percent by the end of 2016. Healthy Demand: Even in the face of the slowdown in international travel to the U.S., "demand growth continues to materially outpace supply -- up 5% over the trailing 3-months, while posting a solid 4.3% gain in February." Positive U.S. Macro Trends: Notably, CS points out strong U.S. job growth as a key indicator. Specifically, when the unemployment rate trends below 5.5 percent, average daily room rate (ADR) growth has "historically accelerated to 5% to 6%, on average over extended periods of time."

CS - The Current Lodging Cycle Credit Suisse noted that "occupancy across the top 25 MSAs are trending 500bp+ above the '07 peak." Based on statistics from the 1991 hotel recovery, "lodging stocks could work for another 2+ years— assuming the sector is void of any unforeseen demand shocks."

Credit Suisse pointed out that unlike the last two recoveries in 1991 and 2002, "the industry has yet to witness a spike in rate, averaging just 3.5% to 4.5% the last 3+ years."CS - Key Bullish Signal To WatchAn acceleration in ADR growth would be a comfirmation of the thesis that the lodging recovery still has momentum to continue.

CS - Bottom LineIn the absence of an "unforeseen demand shock," Credit Suisse remains "fairly confident that ADR growth will accelerate, given: 1) the continued demand/supply imbalance; 2) well beyond peak occupancies; and 3) ADR growth accelerates (to 6%+) when the US unemployment rate falls below 5.5% (US unemployment rate is just 5.5% today)."

Crypto Whales Are Loading Up — Are You?

New research shows the biggest crypto buyers are back. And this time? They could hold for the possibility that Bitcoin will surpass $100,000 in 2024. You don’t want to miss the next massive crypto bull run like we saw in 2020 and 2021. To know exactly what’s going on and what to buy… Get Access To Benzinga’s Best Crypto Research and Investments For Only $1.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.