January 23, 2015 2:07 PM | 3 min read

20-Year Pro Trader Reveals His "MoneyLine"

Ditch your indicators and use the "MoneyLine". A simple line tells you when to buy and sell without the guesswork. It’s a line on a chart that’s helped Nic Chahine win 83% of his options buys. Here's how he does it.

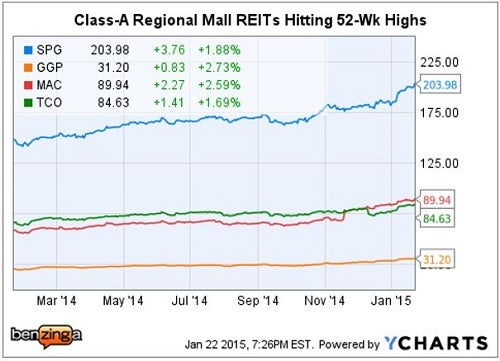

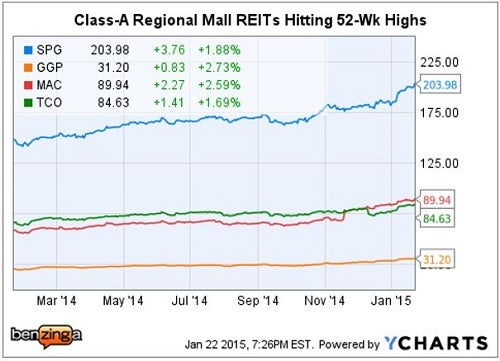

Well located Class-A malls with strong demographics are winning. One mall landlord hitting a 52-week high could mean it has a unique or "magic formula" for success; perhaps the sheer scale of $64 billion cap Simon Property Group (NYSE: SPG). Two more Class-A mall REITs hitting 52-Week highs, such as General Growth Properties (NYSE: GGP) and The Macerich Company (NYSE: MAC) might be a "coincidence" of some sort… However, it appears to be far more like an emerging trend when the smallest landlord by market cap, $5.3 billion Taubman Company (NYSE: TCO), hits a new high as well.Coincidence Or Not?

On the other hand, it just might be possible that consumers still like to shop at upscale malls, with a great merchandise mix, conveniently located near their affluent neighborhoods.Tale Of The Tape - Past 12 Months Amazon.com (NASDAQ: AMZN) clocked in with strong gains on January 22, too. Its shares were up over 13 points, or 4.43 percent. However, the next chart helps to put that into perspective.

A look back at the last year shows that pure-play Internet retailing giant Amazon has not been a "death ray" for Class-A malls, however, it has put a sizeable dent into shareholder's wallets.Amazon Is Building For The Future Amazon is spending billions of dollars to build a network of fulfillment centers near major U.S. metropolitan markets. This will help Amazon to provide same-day or next day service to a growing percentage of U.S. households. A great concept.Mall Retailers Already Have That OptionThe very nature of Class-A malls is that they are located near densely populated areas with high household incomes which are easily accessible by ground transportation and mass transit. In fact, urban planners often strive to locate mass transit stations and hubs at or near regional malls.Specialized same day delivery services such as Deliv are being nurtured by mall owners. There are also growing networks of for hire drivers such as Uber and Lyft that can provide that service.Another Big PlayerGoogle, Inc. (NASDAQ: GOOG) has a dog in this fight too. It is called Google Express. Customers can get same-day or overnight delivery from local stores and popular retailers in major metro areas. It ties in with Google Wallet. Current delivery areas include:• San Francisco• Peninsula & San Jose• West Los Angeles• Manhattan• Chicago• Boston• Washington, DCParticipation can vary by city, but includes: Costco, Walgreens, PetSmart, Staples, Whole Foods, Target, Ulta, Kohl's and a host of other national, regional and local retailers.Google also has a large investment in self-driving car technology, another perfect fit for same-day or overnight delivery in the future.Omnichannel RetailIdeally it is the seamless integration of a retail or store brand where the customer has a wide range of choices regarding how to research, purchase, pick-up, receive or return merchandise. This is where the future on retailing is headed according to Macy's, Inc. one of the most successful bricks and mortar retailers in the U.S. Macy's is closing stores in unsuccessful malls, while expanding its presence in successful malls where its ROIC is justified.Bottom LineThe foundation of omnichannel retail is the consumer having a bricks and mortar alternative. It appears that Mr. Market is betting that successful Class-A malls will continue to provide that alternative for the foreseeable future.

20-Year Pro Trader Reveals His "MoneyLine"

Ditch your indicators and use the "MoneyLine". A simple line tells you when to buy and sell without the guesswork. It’s a line on a chart that’s helped Nic Chahine win 83% of his options buys. Here's how he does it.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.