May 30, 2014 5:26 PM | 2 min read

27% profits every 20 days?

This is what Nic Chahine averages with his options buys. Not selling covered calls or spreads... BUYING options. Most traders don't even have a winning percentage of 27% buying options. He has an 83% win rate. Here's how he does it.

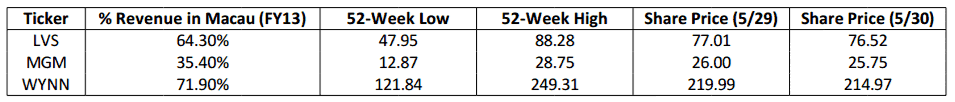

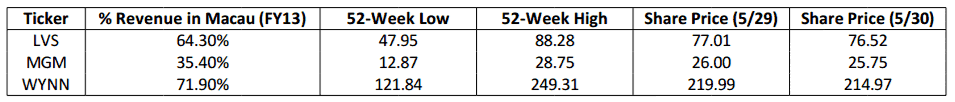

Casino stocks trade lower Friday surrounding Japanese legislation, Macau illegal money transfer crackdown, and tight VIP credit limit. With

Wynn Resorts (NASDAQ: WYNN) trading down as much as 2.82 percent, analyst Bryan Maher commented that the volatility in shares is not on “new news”.

Japan's Casino BillA few weeks ago, a conference focused on the future of the casino industry in Tokyo. According to CNN, Tokyo and Osaka are being “eyed as a key destination for so-called ‘Integrated Resorts' (IR), which would combine casinos with hotel, luxury retail and entertainment complexes.”Director of the Institute of Amusement Industry Studies at Osaka University of Commerce, Toru Mihara, said, “There is ample chance that the bill will be debated in parliament (this session) and will be passed by both houses.”On Friday, Reuters reported that Japanese Prime Minister Shinzo Abe “said casino resorts could become a pillar of his country's future economic growth as he toured Singapore's two lavish gaming venues on Friday. Abe, who until now has remained silent on the issue of casinos, gave a strong endorsement to legislation that would legalize casino gambling in Japan.”

”Macau Leads the News”In an exclusive phone interview with senior analyst Bryan Maher from Craig-Hallum Capital Group LLC, Maher remarked that Wynn Resorts shares may be a “little bit volatile” today. The analyst commented on the run-up of shares in the first quarter as a result from “good growth” in Macau, and expects to see shares “bounce around from $200.00 to $220.00 until Japan legislature is finalized.”Amidst continuous reports on illegal money transfer crackdown, the shutdown of the illegal use of UnionPay, and the tight VIP credit environment in Macau, Maher emphasized that Macau is the frontrunner on gaming news. “Macau lead the news,” the analyst said, “and Japan Trading follows the U.S.”

Defining a Frontrunner for Japan Licensing

Defining a Frontrunner for Japan LicensingBryan Maher continued to delve into the possibilities of casino stocks and opportunity in Japan. Craig-Hallum sees Las Vegas Sands (NYSE: LVS) as the “frontrunner for Japan licensing.” He continued, “LVS has seen a great run in shares.” With Las Vegas Sands puts outnumbering calls for the first time since March, the analyst emphasized that “significant gains in shares allows investors to benefit from Japan.

27% profits every 20 days?

This is what Nic Chahine averages with his options buys. Not selling covered calls or spreads... BUYING options. Most traders don't even have a winning percentage of 27% buying options. He has an 83% win rate. Here's how he does it.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.