27% profit every 20 days?

This is what Nic Chahine averages with his option buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.

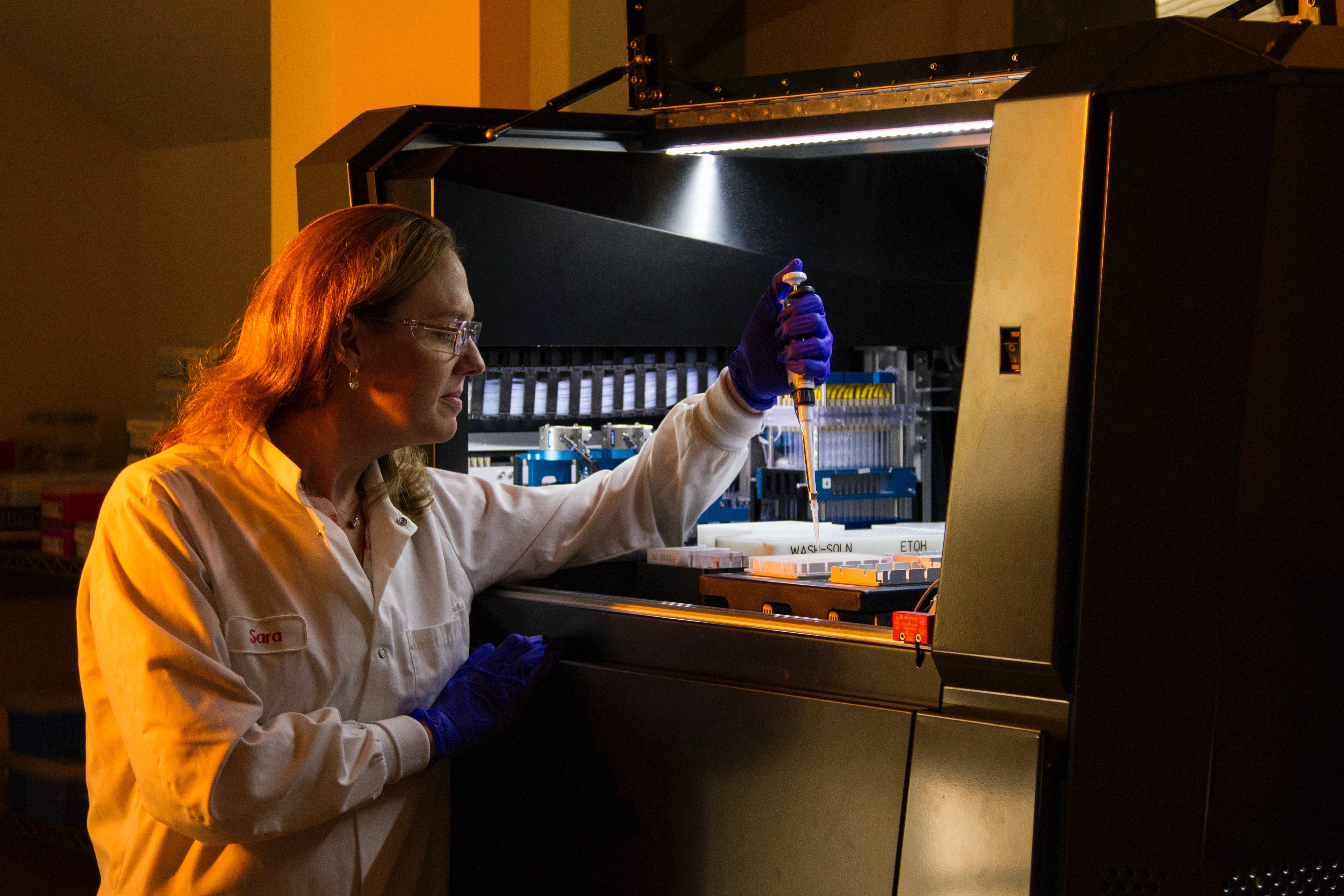

Picture credit: National Cancer Institute

The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

ENTER TO WIN $500 IN STOCK OR CRYPTO

Enter your email and you'll also get Benzinga's ultimate morning update AND a free $30 gift card and more!

The global genomics industry could be worth up to $27 billion by 2025, the global proteomics sector even more at $72 billion.

Massachusetts-based Pressure BioSciences Inc. (PBI) (OTCQB:PBIO) is aiming to take advantage of such growth by developing and commercializing patented technologies to aid drug manufacturers in the design, development, characterization and quality control of such therapeutics.

While genomics is the study of human genes and how they interact with each other as well as with the environment, proteomics studies the entire protein system in any one individual organism. Such research can give vital clues as to how to detect, treat, and cure disease.

PBI’s approach and contribution to this field is the use of two of its patented technology platforms: Pressure Cycling Technology (PCT) and the BaroFold Technology (BaroFold). These two platforms use hydrostatic pressure to safely control biomolecular interactions, even at ultra-high pressure levels.

PCT Platform: Current Focus on Next-Generation Products

FREE REPORT: How To Learn Options Trading Fast

In this special report, you will learn the four best strategies for trading options, how to stay safe as a complete beginner, a 411% trade case study, PLUS how to access two new potential winning options trades starting today.Claim Your Free Report Here.

The company has released its next-generation PCT-based Barocycler EXTREME instrument and has now started to market the system to biopharmaceutical drug manufacturers worldwide. Major drug manufacturers such as Merck & Co. Inc. (NYSE:MRK) and Pfizer Inc. (NYSE:PFE) have been users of the Barocycler system and others like AstraZeneca plc (NASDAQ:AZN) could be interested in such patented and powerful technology, especially in the application of biotherapeutics quality control.

The PCT platform is currently installed in more than 200 academic, governmental, pharmaceutical and biotech research and manufacturing laboratories worldwide, PBI says. In such locations, the platform is used to analyze proteins, lipids and nucleic acids from biological samples, a crucial tool in the discovery and development of biotherapeutic drugs by the pharmaceutical and biotech industries.

The company is also placing particular emphasis on research work with the Fairfax, Virginia-based Inova Schar Cancer Institute where its PCT platform is helping develop innovative cancer biopsy analysis.Other fields the PCT products can be used in include soil and plant biology, forensics and anti-bioterror, PBI says.

BaroFold Platform: Current Focus on Helping Protein-Based Drug Candidates Get to Market

The BaroFold Platform can be used to significantly improve the quality and decrease the production costs of protein biotherapeutics. It employs high pressure for the disaggregation and controlled refolding of proteins. This unique technology platform can help protein-based biopharmaceutical companies create and manufacture high quality, novel protein biotherapeutics and lower the cost of existing formulations. Major drug companies like GlaxoSmithKline Ltd (GSK: NYSE) and Sanofi S.A. (NASDAQ:SNY) could be interested in such unique and enabling proprietary technology.

PBI reported increased instrument sales in the first nine months of this year compared with the same period in 2020 with almost $1 million sector revenue in 2021 versus approximately $568,000 the previous year. Overall company revenue increased from about $1 million in the first nine months of last year to about $1.7 million in 2021.

The uptick in sales has led to an increased focus on ramping up the sales and marketing efforts of the company, including additions to PBI’s salesforce, which is currently a major company focus and is underway.

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

27% profit every 20 days?

This is what Nic Chahine averages with his option buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.