The markets were in risk-off mode during the Asian trading hours as respond to Crimea's votes results. If situation would get worse then be aware of even lower levels on S&P while Crude oil and Natural gas could find a support.

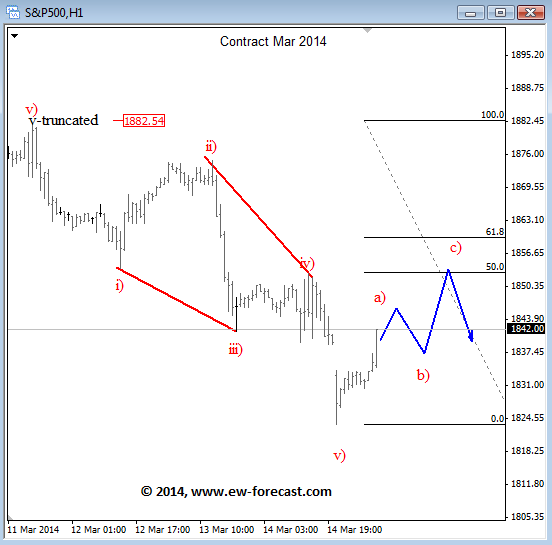

S&P Futures moved down and hit low at 1830 before reversing. This has been technically expected on Friday after we recognized a flat correction. At that time we have been tracking two counts, and so we are today. On the primary count we see five waves down as leading diagonal, so for a bearish case resistance around 1860 should hold after a three wave bounce.

S&P Futures (Mar 2014) 1h Count 1#

A second count is bullish, and will be confirmed if rally will extend up to 1875 in impulsive fashion.

S&P Futures (Mar 2014) 1h Count #2

27% profit every 20 days?

This is what Nic Chahine averages with his option buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.

ENTER TO WIN $500 IN STOCK OR CRYPTO

Enter your email and you'll also get Benzinga's ultimate morning update AND a free $30 gift card and more!

27% profit every 20 days?

This is what Nic Chahine averages with his option buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.

Written by www.ew-forecast.com

14 days trial just for 1€ >>http://www.ew-forecast.com/register