27% profits every 20 days?

This is what Nic Chahine averages with his options buys. Not selling covered calls or spreads... BUYING options. Most traders don't even have a winning percentage of 27% buying options. He has an 83% win rate. Here's how he does it.

CrowdStreet, the real estate investment platform, has unveiled an equity investment opportunity in a boutique Marriott-branded hotel located in Chattanooga, Tennessee.

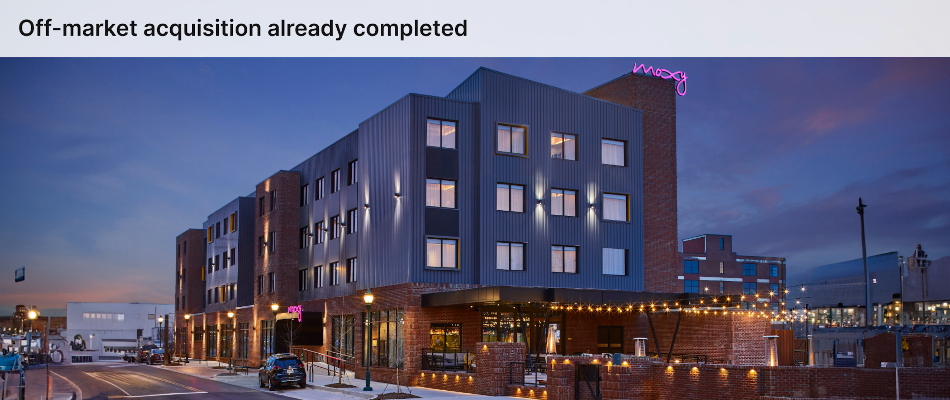

The Moxy Chattanooga Downtown, boasting 108 rooms, was secured through an off-market transaction. This acquisition allows investors an appealing entry at an approximate 9% discount to its estimated replacement cost. Since opening its doors in 2018, the hotel has consistently outperformed the market average in occupancy rates. The deal's sponsor is confident that with proactive management strategies, there is potential for even greater revenue growth.

Situated in the Southside Historic District of Chattanooga's downtown, the hotel is at the heart of the city's entertainment and nightlife scene, just a stone's throw from myriad restaurants and shopping centers. Every year, Chattanooga welcomes 15 million visitors who spend a collective $1.5 billion — a tourism figure that exceeds pre-pandemic levels. Given this rising demand for accommodations, Moxy Chattanooga stands in prime position to cater to tourists in search of a centrally-located downtown stay.

The offering's sponsor, DelMonte Hotel Group (DHG), aims to enhance net operating income through careful expense management and targeted revenue growth initiatives. DHG's strategies include minor in-room reconfigurations, increased on-site parking fees, options for advance room reservations, and tiered pricing for the hotel's premium rooms. These adjustments, among others, are projected to boost cash flows and enhance asset value over the proposed holding duration.

A stalwart in the hotel development and management arena, DelMonte Hotel Group has over five decades of industry experience. The company boasts long-standing affiliations with top-tier hospitality brands, holding the distinction of being Marriott’s longest-operating franchisee. Signaling its faith and dedication to the venture, DHG is investing 20% of the necessary equity for the project. Presently, the firm manages 17 hotels with a combined worth approaching $222 million.

Photo courtesy of CrowdStreet

27% profits every 20 days?

This is what Nic Chahine averages with his options buys. Not selling covered calls or spreads... BUYING options. Most traders don't even have a winning percentage of 27% buying options. He has an 83% win rate. Here's how he does it.

ENTER TO WIN $500 IN STOCK OR CRYPTO

Enter your email and you'll also get Benzinga's ultimate morning update AND a free $30 gift card and more!