REDWOOD CITY, Calif., June 11, 2019 /PRNewswire/ -- Today Personal Capital®, leading digital wealth manager, launched Personal Capital Cash, offering a new high-yield account with aggregated FDIC insurance that covers

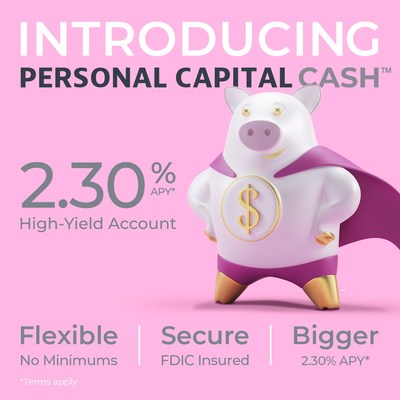

REDWOOD CITY, Calif., June 11, 2019 /PRNewswire/ -- Today Personal Capital®, leading digital wealth manager, launched Personal Capital Cash, offering a new high-yield account with aggregated FDIC insurance that covers balances up to $1.25 million, and Savings Planner, a savings tool to help people plan annual retirement savings, an emergency fund, and pay down debt.

Now anyone can open an account through Personal Capital Cash with no minimum balance, straight from their mobile device, and an annual percentage yield (APY) 23 times bigger than the national average you would get with a typical savings account, with the flexibility of an unlimited number of withdrawals and aggregated insurance protection up to five times more than what most banks offer.

"We have more than 2 million registered users who combined hold more than $41 billion in cash or money market accounts," explained Personal Capital CEO Jay Shah. "If those folks are earning the national rate on that cash, that amounts to more than $900 million in lost interest annually. We saw that and immediately knew we had to do something. So we built Personal Capital Cash to put that money back in the hands of American consumers."

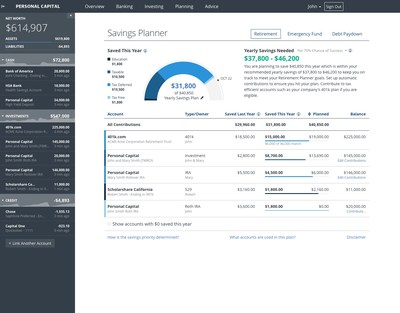

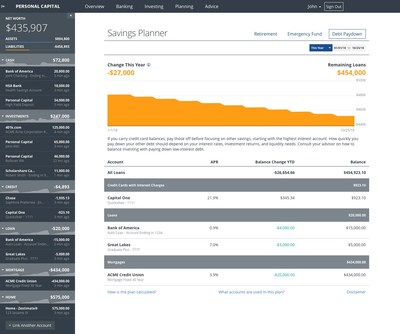

The latest Report on the Economic Well-being of U.S. Households, published by the Federal Reserve, found that 40% of Americans couldn't cover an unexpected $400 expense with cash, illustrating the need for savings support beyond retirement or vacation planning. With the company's holistic approach to financial planning, Personal Capital launched a new tool on its dashboard in addition to the new high-yield account: Savings Planner. Savings Planner calculates, breaks down, and tracks annual savings goals for retirement and an emergency fund by taking into account everything from monthly expenses to taxable versus tax-deferred accounts.

"Too many financial companies are trying to tell Americans that saving is simple - that they can just make coffee at home instead of buying that latte," continued Shah. "But we know better. Saving, whether it's for retirement, a short-term goal, or in case of an emergency, can cause anxiety. Personal Capital is creating complete, clear solutions to help people feel confident about their money decisions."

Today, Personal Capital Cash launched with 2.30% APY for non-clients and 2.35% APY for Personal Capital clients. Personal Capital Cash was launched by Personal Capital in partnership with Institutional Banking at UMB Bank. UMB's Institutional Banking team provides large scale banking services and insured deposit account solutions for broker-dealers, non-bank financial institutions, and fintech companies. To open an account visit www.personalcapital.com/cash or download our iOS or Android apps.

About Personal Capital

Personal Capital, a leading digital wealth manager, transforms financial lives through technology and people. Free online tools create total clarity with all your accounts in one place and advisors provide advice you can easily understand. The result is complete confidence in how you plan for and achieve your financial goals. Personal Capital is headquartered in Silicon Valley with hubs in San Francisco, Denver, Dallas, and Atlanta. Connect with us on Twitter, LinkedIn or Facebook. For more information and to open an account, visit https://www.personalcapital.com/ or download our iOS or Android apps.

About UMB

UMB Financial Corporation UMBF is a financial services company headquartered in Kansas City, Mo. UMB offers personal banking, commercial banking, healthcare services and institutional banking, which includes services to mutual funds and alternative-investment entities and investment advisory firms. UMB operates banking and wealth management centers throughout Missouri, Illinois, Colorado, Kansas, Oklahoma, Nebraska, Arizona, and Texas. For more information, visit UMB.com, UMB Blog or follow us on Twitter at @UMBBank, UMB Facebook, and UMB LinkedIn.

FOR MORE INFORMATION CONTACT

Personal Capital

Rebecca Neufeld, Head of PR

rebecca.neufeld@personalcapital.com

415.231.3055

UMB Bank

Stephanie Hague - SVP, Manager of External Communication and Content

Stephanie.Hague@umb.com

816.860.5088

Personal Capital Advisors Corporation, a wholly owned subsidiary of Personal Capital Corporation, is a registered investment advisor with the Securities Exchange Commission ("SEC"). Any reference to the advisory services refers to Personal Capital Advisors Corporation Personal Capital and the Personal Capital logo are trademarks of Personal Capital Corporation. All other trademarks, trade names or service marks used or mentioned herein belong to their respective owners.

Personal Capital Cash is offered through Personal Capital Services Corporation (Personal Capital), which is not a bank. To participate in the program, you must open an account at UMB Bank, n.a., Member FDIC, through which your funds will be placed in accounts at participating program banks. The advertised interest rates are paid by participating program banks, not by UMB. Your funds will be FDIC insured up to applicable limits while in transit through UMB Bank. Personal Capital receives a fee from each Program Bank in connection with the Program that is based on the aggregate daily closing balance of deposits held in Program Accounts by such Program Bank. The fee may vary from Program Bank to Program Bank and will generally increase as the aggregate amount of funds held in Program Accounts with the Program Bank increases.

The national rate is calculated by the FDIC as of June 11, 2019 based on a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Savings account rates are based on the $2,500 product tier. Account types included in the FDIC calculation are those most commonly offered by the banks and branches for which they have data – no fewer than 45,000 locations and as many as 81,000 locations reported. The deposit rates of credit unions are not included in the calculation. Visit www.FDIC.gov for details.

The Personal Capital Cash Annual Percentage Yield (APY) as of June 11, 2019 is 2.30% APY 2.274% interest rate. The calculation for APY is rounded to the nearest basis point. For Personal Capital advisory clients, the APY is 2.35% (2.323% interest rate). Both the interest rate and APY are variable and subject to change at our discretion at any time without notice.

There are no limits on the number of deposits or withdrawals you can make under the program. The maximum deposit limit per transaction is $250,000. The daily withdrawal limit is $100,000. For security reasons, there may be other limits on the amount, number, frequency, or destination of deposits or withdrawals you can make under the program. Transaction limits are subject to change at our discretion at any time.

SOURCE Personal Capital

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.