NEW YORK, Feb. 4, 2019 /PRNewswire/ -- Cohen & Steers CNS has released its latest whitepaper, A New Era for Midstream Energy: The Case for Allocation. The paper examines a unique way for investors to potentially participate in North America's path to energy independence—in a market offering a prospective 7% distribution yield1, with limited overlap to broad equities and low correlations to other asset classes.

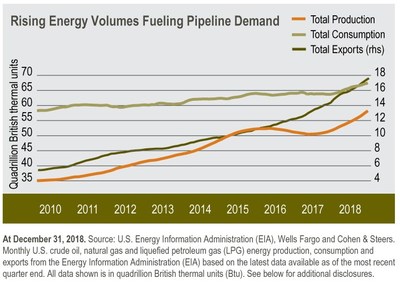

Midstream energy stocks are off to a strong start following a difficult 2018. Industry fundamentals appear to be steadily improving amid firmer energy prices and rising throughput volumes. At the same time, efforts by many companies to evolve their business model tends to lead to better alignment with shareholder interests, simpler corporate structures, stronger balance sheets and a focus on long-term shareholder returns.

"The combination of poor stock and unit price performance in recent years with dramatically improving fundamentals and cash flow trends has left valuation multiples near crisis levels," said Tyler Rosenlicht, Portfolio Manager and Head of Midstream Energy & MLPs at Cohen & Steers. "We believe the relatively predictable, inflation-linked cash flows of midstream businesses can provide a valuable defense against economic uncertainty, in addition to offering substantial upside potential," Rosenlicht added.

The paper also explores:

- The four primary factors contributing to improving industry fundamentals

- Why commodity prices may affect certain businesses more than others based on contract types

- How regional price differentials for commodities highlight potential investment opportunities

- How investments in midstream businesses can potentially generate high income and attractive returns

- How low correlations to other assets offer the potential to enhance a portfolio's risk-adjusted returns

A New Era for Midstream Energy is available to U.S.-based investors for free download on Cohen & Steers' website. Additional information on the asset class can be found at the Cohen & Steers' Midstream Energy & MLP Knowledge Center.

Important Disclosures

Data quoted represents past performance, which is no guarantee of future results. The preceding views and opinions are as of the date of publication and are subject to change without notice. There is no guarantee that investors will experience the type of performance reflected in this material. There is no guarantee that any historical trend illustrated will be repeated in the future, and there is no way to predict precisely when such a trend will begin.

This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, is not intended to predict or depict performance of any investment and does not constitute a recommendation or an offer for a particular security. We consider the information in this material to be accurate, but we do not represent that it is complete or should be relied upon as the sole source of suitability for investment. Please consult with your investment, tax or legal adviser regarding your individual circumstance before investing.

Please consider the investment objectives, risks, charges and expenses of any Cohen & Steers fund carefully before investing. A summary prospectus and prospectus containing this and other information may be obtained by visiting cohenandsteers.com or by calling 800 330 7348. Please read the summary prospectus and prospectus carefully before investing.

Risks of Investing in MLP Securities

An investment in MLPs involves risks that differ from a similar investment in equity securities, such as common stock, of a corporation. Holders of equity securities issued by MLPs have the rights typically afforded to limited partners in a limited partnership. As compared to common shareholders of a corporation, holders of such equity securities have more limited control and limited rights to vote on matters affecting the partnership. There are certain tax risks associated with an investment in equity MLP units. Additionally, conflicts of interest may exist among common unit holders, subordinated unit holders and the general partner or managing member of an MLP; for example, a conflict may arise as a result of incentive distribution payments. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment, including the risk that an MLP could lose its tax status as a partnership. MLPs may trade less frequently than larger companies due to their smaller capitalizations, which may result in erratic price movement or difficulty in buying or selling. MLPs may have additional expenses, as some MLPs pay incentive distribution fees to their general partners. The value of MLPs depends largely on the MLPs being treated as partnerships for U.S. federal income tax purposes. If MLPs were subject to U.S. federal income taxation, distributions generally would be taxed as dividend income. As a result, after-tax returns could be reduced, which could cause a decline in the value of MLPs. If MLPs are unable to maintain partnership status because of tax law changes, the MLPs would be taxed as corporations and there could be a decrease in the value of the MLP securities.

Cohen & Steers Capital Management, Inc. (Cohen & Steers) is a registered investment advisory firm that provides investment management services to corporate retirement, public and union retirement plans, endowments, foundations and mutual funds.

Website: http://www.cohenandsteers.com

Symbol: CNS

About Cohen & Steers. Cohen & Steers is a global investment manager specializing in liquid real assets, including real estate securities, listed infrastructure, commodities and natural resource equities, as well as preferred securities and other income solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Hong Kong, Tokyo and Seattle.

1 Alerian Midstream Energy Index dividend yield of 6.9%, as of December 31, 2018.

SOURCE Cohen & Steers

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.