Chris Capre’s Trading Waves

Turn Market Volatility Into Profit Opportunities

✓ Average Return of 22.6% In 2025 ✓ 6+ Trade Alerts Monthly ✓ Former Hedge Fund Trader ✓ See Trade Opportunities Before Others ✓ Trades Can Close In As Little As 24 Hours

Chris Capre

Proven Wall Street Experience

- Former Wall Street Broker

- Former Hedge Fund Trader

- Founder & CEO of 2nd Skies Trading

Start Your 7-Day Free Trial!

Test-Drive Chris Capre’s Trading Waves With Zero Risk

Join Chris Capre's Trading Waves FREE for 7 days. You'll get real-time trade alerts, live market analysis, and direct access to Chris’s years of Wall Street expertise.

- Mobile Trade Alerts: Get specific notifications when Chris identifies high-probability short-term options setups that can typically close within days

- Weekly Live Trading Sessions: Join Chris every Monday at 9:45am EST where he breaks down current market conditions and and discusses general trading concepts in an educational Q&A format

- Exclusive Options Flow Cheat Sheet: Access Chris's weekly breakdown of institutional money movements that could signal potential price moves before they happen

- Former Hedge Fund Strategy: Follow the same professional analysis techniques Chris used at JNF Fund, simplified for retail traders

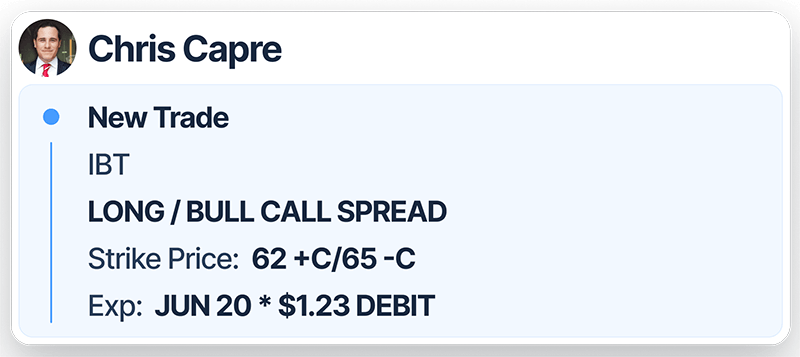

- Complete Position Guidance: Every alert includes exact strike prices, entry points, exit targets, and recommended position sizing

- Minimum 6 Trade Opportunities Monthly: Consistent flow of actionable trades with individual trade returns up to 195%

HEDGE FUND EXPERIENCE

Wall Street Trader, Now Working for You

After years as a Wall Street broker at FXCM and professional trader at JNF Fund, Chris Capre developed a specialized system for capturing short-term price movements. His approach focuses on 0-5 day options trades—giving retail traders access to professional-grade analysis previously reserved for institutions.

PROVEN TRACK RECORD

Consistent Short-Term Profit Potential

Trading Waves' 0-5 day strategy is designed to capitalize on short-term market moves that traditional traders often miss. Members receive detailed performance updates showing both successful trades and teaching moments, allowing you to learn from every recommendation. This approach has helped members develop consistent trading habits regardless of market conditions.

MOBILE TRADE ALERTS

6+ Monthly Trade Alerts with Complete Professional Guidance

Members receive a minimum of 6 actionable trade alerts each month, with clear strike prices, expiration dates (typically within 5 days), entry points, exit targets, and position sizing guidance. Each alert is delivered instantly via push notification and email, allowing immediate action on time-sensitive opportunities.

ON-DEMAND TRAINING

Access the Full Archive of Previous Trading Sessions

All Monday strategy sessions are recorded and stored in a searchable library, allowing members to review past market analysis and trading lessons at their convenience. This growing resource contains Chris's commentary on various market conditions and detailed explanations of his trading methodology.

OPTIONS CHEAT SHEET

Weekly Institutional Money Tracker

Every week, Chris publishes his proprietary Options Flow Cheat Sheet showing which options are being heavily bought or sold by institutions. This concrete data includes ticker symbols, buy/sell indicators, strike prices, call/put volume, and gamma readings that often precede major price movements.

24/7 TRADING COMMUNITY

Get Real-Time Support from Chris and Seasoned Members

Questions about a trade? Chris’s messages guide members through every market move. Plus, you're surrounded by experienced traders sharing insights around the clock - while Chris and our team can't give individual advice, you're never trading alone.

Chris’s #1 Trading Strategy Made Simple

Trading Waves focuses primarily on Bull Call Spreads and Bear Put Spreads—straightforward strategies any broker will approve for basic options accounts. No complex strategies or margin requirements. Chris's alerts spell out exactly which options to buy and sell, with specific entry and exit targets.

Your Money Freed Up Every 1-5 Days

While most services keep capital locked in positions for weeks, Chris's 0-5 day approach means your money typically becomes available for the next opportunity. This rapid capital recycling lets you potentially compound gains faster and reduce exposure to prolonged market downturns.

Reliable Trades for Turbulent Markets

Trading Waves specializes in short-term options strategies specifically designed for today's volatile markets. Chris uses technical triggers and options flow data to identify setups that typically resolve within days—turning market uncertainty into an advantage rather than a threat.

Track Record

RECENT WINNING TRADES

*Past performance does not guarantee future results

Trading Waves members have recently capitalized on various market conditions with Chris’s 0-5 day approach:

UVXY Bull Call Spread: 195% Return in Just 2 Days (April 2025)

When market volatility spiked in early April, Chris spotted unusual options activity in UVXY (a volatility ETF).

The Trade Alert: Buy UVXY $25 Call / Sell $30 Call for $0.81 debit

The Result: Members sold the position just 48 hours later for $2.39

The Return: 195% gain in 2 days

What Made It Work?

Quick identification of institutional money flow at the exact moment volatility was surging

GLD Bull Call Spread: 67% Return in 13 Days (March 2025)

Chris’s analysis identified a potential continuation move in gold after a period of consolidation.

The Trade Alert: Buy GLD $280 Call / Sell $290 Call for $3.63 debit

The Result: First half closed for 57.5% profit, second half for 77%

The Return: 67% total gain

What Made It Work?

Strategic half-position exit approach to secure profits while letting winners run

NVDA Bull Call Spread: 81.5% Return (February 2025)

Technical analysis showed a potential bullish setup in this semiconductor leader.

The Trade Alert: Buy NVDA $135 Call / Sell $140 Call for $1.76 debit

The Result: First half closed for 62% profit, second half for 101%

The Return: 81.5% total gain

What Made It Work?

Precise timing before a major market catalyst combined with strategic exit planning

LLY Bull Call Spread: 77% Return in 2 Days (January 2025)

After identifying bullish options activity, Chris alerted members to a potential upside opportunity.

The Trade Alert: Buy LLY $780 Call / Sell $800 Call for $6.45 debit

The Result: First half closed for 53% profit, second half for 101%

The Return: 77% total gain

What Made It Work?

Timing the entry point before a significant move and managing risk with partial exits

PLTR Bull Call Spread: 90% Return in 14 Days (Nov-Dec 2024)

When Palantir Technologies (PLTR) showed technical strength amid a sector rotation, Chris’s options flow data revealed smart money accumulationing calls.

The Trade Alert: Buy PLTR $60 Call / Sell $65 Call for $1.90 debit

The Result: First half closed for 68% profit after 6 days, second half for 112% after 14 days

The Return: 90% total gain

What Made It Work?

Chris’s half-position exit strategy maximized gains while securing profits early

GLD Bull Call Spread: 91.5% Return in 7 Days (Oct 2024)

As economic uncertainty increased, Chris identified unusual options flow in gold, indicating smart money positioning for a quick move higher.

The Trade Alert: Buy GLD $242 Call / Sell $245 Call for $1.16 debit

The Result: First half closed for 57% profit after 2 days, second half for 126% after 7 days

The Return: 91.5% total gain

What Made It Work?

Chris’s technical triggers combined with options flow data caught the move before mainstream financial media reported on it

How Chris Handles Losses

Not every trade is a winner—that’s simply the reality of trading – and past performance is not an assurance of future results. What matters is having a system that produces more winners than losers over time:

Chris recommends specific position sizes (typically 1-5% of trading capital) to protect your account on any single trade

Trading Waves focuses on quick exits on losing positions to preserve capital

Strict risk management through defined-risk spreads limits maximum potential loss

Ready to test-drive Trading Waves?

Why Chris’s 0-5 Day Trading Strategy Beats Other Approaches In 2025

MORE CHANCES TO PROFT

Traditional services might give you 1-2 trades per month that tie up your capital for weeks. Trading Waves' 0-5 day approach means your money is quickly available for the next opportunity. This rapid capital recycling gives you more chances to profit each month without requiring a larger account size.

LESS TIME AT RISK

The longer your money sits in a position, the more exposed you are to unexpected market drops, negative news, or economic shifts. Chris's short-term approach minimizes this exposure by completing most trades within days—not leaving you vulnerable to the unpredictable events that can destroy longer-term positions.

VOLATILITY BECOMES YOUR ALLY

While most traders fear market volatility, Trading Waves members specifically capitalize on it. In choppy, uncertain markets, Chris's 0-5 day options strategies identify short-term price disconnections that typically resolve within days. This means you can potentially profit regardless of whether the broader market is up, down, or sideways.

MEMBER SUCCESS STORIES

“I have been following Benzinga for 3 years now and have to say this is the most consistent platform hands down. I have tried numerous discord groups as well as other chart analysis websites and always find that everything i need is right here for much cheaper than all these other sites. Teachers like Chris Capre and Mark Putrino are so invaluable and essential that you’d be doing yourself a disservice going anywhere else.”

— Felix Concepcion, Verified TrustPilot Review

“I can’t say enough about Rod, Chris and Matt. If you want to learn or even if you are a pro. They can lead you to great trades and are great people.”

— Charles Phillips, Verified TrustPilot Review

“I have taken the Trading Options Class with Chris Capri, Let me just Say! Nobody should attempt Trading Options before taking this class. I have learned more in three weeks then many years of trading. Can not even express the gratitude for his service.”

— Don Antol, Verified TrustPilot Review

“OMG, without the trade classes with Mark and the options classes with Chris, I wouldn’t be anywhere near where I am now as far as trading. Mark and Chris have changed my life!”

—Matthew Brandt, Verified TrustPilot Review

START YOUR 7-DAY

FREE TRIAL TODAY

Your Trading Waves Membership Includes:

- Instant trade alerts delivered to your phone

- Live Monday market analysis sessions with Chris

- 24/7 access to our active trading community

- Complete trade guidance with entries and exits

- Chris’s institutional-level technical analysis

Try Trading Waves FREE for 7 Days

Then just $150/month if you decide to stay!

No Long-Term Commitment

Cancel Anytime During Trial Period

100% Satisfaction Guaranteed

Q How is Trading Waves different from other options services?

Q Do I need a lot of trading experience to follow Chris's alerts?

No. Chris focuses primarily on straightforward options strategies like Bull Call Spreads and Bear Put Spreads that most basic options accounts can trade. Each alert includes exact strike prices, expiration dates, entry points, exit targets, and position sizing guidance. Many Trading Waves members started with limited options experience and quickly learned Chris’s approach through the Monday strategy sessions.

Q How many trades can I expect each month?

Trading Waves guarantees a minimum of 6 trade alerts each month, though the actual number may be higher depending on market conditions. Chris prioritizes quality setups over quantity, focusing only on high-probability trades rather than forcing alerts when conditions aren’t favorable.

Q How quickly will I receive trade alerts?

Trade alerts are delivered instantaneously via push notification and email the moment Chris executes a trade. Because most Trading Waves opportunities are in 0-5 day options, timing is critical—and the notification system ensures you never miss a potential trade. Each alert contains all the information needed to take action immediately.

Q What happens after my 7-day free trial ends?

If you enjoy Trading Waves and want to continue, you’ll be automatically enrolled at the standard rate of $150/month. There’s no long-term commitment, and you can cancel anytime. If you decide Trading Waves isn’t for you, simply cancel before your trial ends, and you won’t be charged. We’re confident you’ll find value in the service, which is why we offer the risk-free trial. RetryClaude can make mistakes. Please double-check responses.