Announcement to the Australian Securities Exchange and Toronto Stock Exchange

SUBIACO, WESTERN AUSTRALIA / ACCESSWIRE / September 5, 2019 / RTG Mining Inc. (ASX:RTG)RTGRTGGF ("RTG" or "the Company") is pleased to announce that it has entered into a Sale and Purchase Agreement ("SPA") with White Cliff Minerals Limited ("WCN") to acquire its majority (90%) stake in the high grade Chanach Gold and Copper Project ("Chanach Project") in the Kyrgyz Republic ("Transaction").

View source version on accesswire.com:

https://www.accesswire.com/558574/RTG-to-Acquire-90-Stake-in-the-High-Grade-Chanach-Gold-Project-in-the-Kyrgyz-Republic

Highlights of the Transaction include:

- Strategic addition to RTG's portfolio with an existing high grade JORC compliant Inferred Mineral Resource of 2.95 Mt @ 5.11 g/t Au for 484,000 ounces of Au and 17.23 Mt @ 0.37% Cu for 64,000t of Cu1 (141.1 Mlbs Cu) from only limited drilling to date.

- Acquisition cost of US$3.65 / ounce of Gold and US$0.0063 / pound of Copper.

- Consideration of US$2.15 million cash and US$0.5m in RTG shares (escrowed for 12 months).

- Transaction subject to WCN shareholder approval with a target completion date of mid to late October 2019.

- Unanimous WCN board recommendation and shareholder support statements from 20% of WCN's shareholders to vote in favour of the Transaction (both in the absence of a superior proposal).

- Experienced technical expert, advising RTG, believes the exploration potential at the Chanach Project is excellent.

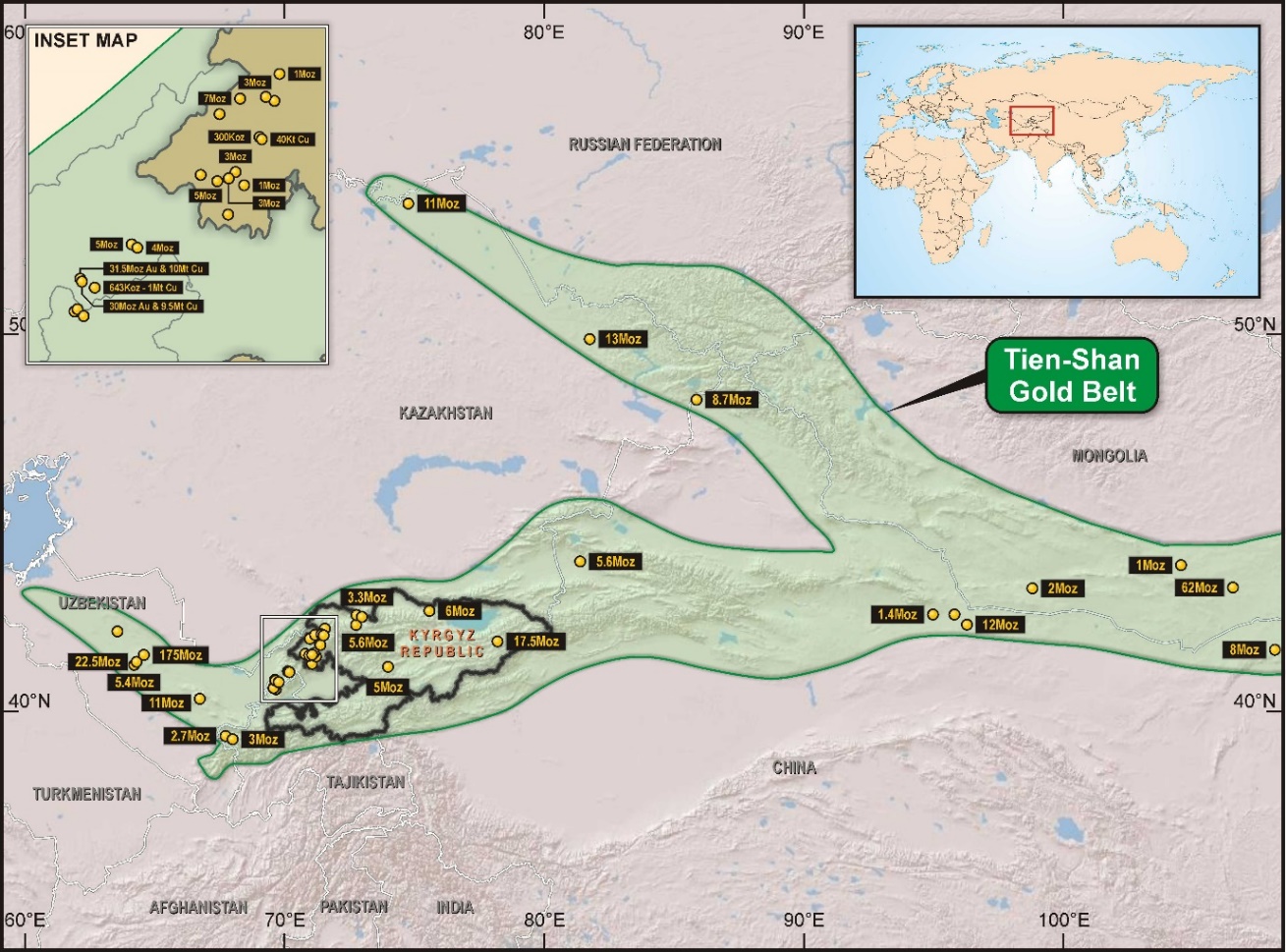

The Chanach Project is located in the prolific southern Tien Shan metallogenic belt, which runs more than 1,500 km from Uzbekistan through to China and hosts one of the world's largest open pit gold mines, Murantau (175 Moz2) with production believed to be in the order of 2 million ounces per annum2. RTG have appointed Mr. Greg Hall of Phoenix Gold International and former Chief Geologist for Placer Dome, as a consultant given his knowledge of the Chanach Project and other projects in similar geological settings.

The Chanach Project has extensive outcropping mineralised geology with high grade gold veins from surface and significant gold and copper Inferred Mineral Resources. With only 5% of the identified strike length tested to date, RTG believes the Chanach Project has substantial upside. The Chanach Project area is considered to be highly prospective for world class epithermal gold, porphyry copper-gold and polymetallic skarn deposits with numerous targets already identified.

To date the limited exploration activities have defined an Inferred Mineral Resource of 2.95 Mt @ 5.11 g/t Au for 484,000 ounces of Au and 17.23 Mt @ 0.37% Cu for 64,000t of Cu1.

Figure 1: Chanach Project Location

DEAL TERMS

RTG has agreed to acquire a 90% interest in the high grade Chanach Project in the Kyrgyz Republic (License AP590) through the acquisition of 100% of PB Partners (Malaysia) Pte Ltd, a wholly owned subsidiary of WCN. The Transaction is subject to the approval of WCN shareholders under Chapter 11.2 of the ASX Listing Rules. The purchase price consists of: (i) cash consideration of US$2.15 million: and (ii) US$0.5 million in new RTG shares to be issued at a price equal to the 5-day VWAP of the RTG shares on the ASX for the 5 trading days leading up to completion of the Transaction.

The purchase price, together with the planned initial drill program have been fully funded by a new unsecured loan of US$2.5 million, obtained by RTG from an external financier, on arm's length terms and conditions.

This represents a highly attractive and value accretive deal for RTG with an acquisition cost of only US$3.65 per gold ounce and US$0.0063 per pound copper (metal contained in Inferred Mineral Resources).

On completion, RTG will be manager and operator of the Chanach Project Joint Venture company (Chanach LLC) and will solely fund operating expenditures until completion of a Bankable Feasibility Study at which time, funding will then be contributed on a pro-rata basis in accordance with Chanach Project interests.

The 10% joint venture partner is represented by two local brothers, both geologists, who have a strong understanding of the region, orebodies and new targets for extension, with good local support and strong relationships with the mining authorities. They have been very supportive of the RTG acquisition, waiving their pre-emptive rights.

WCN has provided customary exclusivity undertakings to RTG in connection with the Transaction, including no shop and no talk restrictions, and provided RTG with a notification right in respect of any competing proposal.

In addition to WCN shareholder approval, the Transaction and the transactions contemplated in the SPA are subject to any applicable regulatory approvals and no material adverse change/breach of warranties.

COUNTRY BACKGROUND

The Kyrgyz Republic is a stable, democratic and mining-friendly jurisdiction in Central Asia bordering China and Kazakhstan. With four new mines approved since 2014 and with another mine under construction by Chaarat Gold Holdings Limited CGH, there is strong government support for new mining projects and a growing awareness and recognition of both; the significant economic contribution made by the country's biggest industry and the potential for this contribution to grow rapidly, with the gold industry already contributing half of the country's industrial output and 60% of export earnings.

Chaarat has two new projects planned, with the Tulkubash Mine under construction (target production of 94,000 to 110,000 ounces per annum2) to be followed by the Kyzyltash mine which has measured and indicated resources of 4.5 million ounces @ an average grade of 3.7 g/t2, with target production in the order of 200,000 to 300,000 ounces per annum3.

The Kumtor mine operated by TSX listed Centerra Gold Inc. CG has produced over 12 million ounces during its 22 years of uninterrupted profitable production since inception in 1997, with current production in excess of 500,000 ounces per annum4. It has recently finalised negotiations with the Kyrgyz Government which has resulted in a significant re-rating of the company on the Toronto Stock Exchange, trading now with a market capitalisation of approximately C$3.5 billion. In addition to Centerra, there are other major players including Zijin Mining Group Co. Ltd who are operating, exploring and expanding their investment in the country.

The Kyrgyz Republic has a simple revenue-based tax system, strong rule of law, secure licensing processes and does not have local project ownership requirements. Mining infrastructure is well established, with a readily available and skilled mining labour force.

GEOLOGICAL SETTING

The Chanach Project (prospecting license AP590) is located in the North Western part of the Kyrgyz Republic in the Jalal-Abad province and covers an area of 57.25 km2 of the Chatkal Ranges inside the south-western Tien Shan metallogenic belt.

Regionally, the world class Tien Shan system spans from Uzbekistan in the west across the Kyrgyz Republic and into Mongolia and China and is one the best-endowed gold provinces in the world. It hosts multiple styles of mineralisation due to its complex tectonic history. The juxtaposition of multiple crustal sections within the Tien Shan, including volcanic arcs, continental margins, accretionary and fore-arc complexes, and continental collisional zones, has resulted in a complex mix of overlapping mineralised systems which developed in different crustal environments. These mineralising systems are prolific producers of base and precious metals. The geology of the south-western Tien Shan is generally regarded as being highly fertile ground for sedimentary hosted gold deposits, copper-gold porphyry deposits and their associated epithermal and polymetallic skarn deposits.

The underexplored system plays host to some significant discoveries and operations including very large sediment hosted gold deposits such as Kumtor in Kyrgyzstan (19 million ounces5) and Muruntau in Uzbekistan (175 million ounces6), which is recognised as one of the world's largest gold deposits. It also hosts large porphyry copper deposits like Almakyr in Uzbekistan. Major deposits located within 100km of Chanach contain inventories of up to 93 million ounces of gold and 25 million tonnes of copper (Figure 1 and Figure 2).

Figure 2: The Gold Endowment of the Tien Shan Metallogenic Belt7

DISCOVERY & DRILL RESULTS

The Chanach Project area was discovered around 1963 with geological mapping and surface sampling intermittently up to 2010. The geology of the Chanach Project area is prospective for epithermal gold deposits, porphyry copper deposits and polymetallic skarn deposits. The project area has outcropping mineralised geology seen as multiple high grade outcropping epithermal veins and skarns, which have indicated several porphyry targets.

From 2010 more modern exploration has taken place with approximately US$8.0 million spent by WCN on exploration, of which US$5.7 million is attributable to the Chanach Gold Project, with the balance spent on Chanach Copper Project exploration and resource development.

Targeting has been enhanced by various structural and geophysical surveys including a structural geology study completed by Orefind in 2017, a ground magnetics study by Southern Geoscience in 2016 and a geophysical study completed by Baoding Geological Engineering Institute in 2011.

The Chanach Project is a target-rich environment with 2019 planned exploration focussing on multiple gold targets designed to extend the current Inferred Mineral Resource.

Total exploration drilling includes 142 reverse circulation and diamond holes totalling approximately 19,500 metres, of which 111 drill holes (87 RC and 24 diamond) for a total length of 14.1km can be attributed to the Chanach Gold Project and the balance to copper exploration and the development of the Chanach Copper Project.

To date, the Chanach Project has generated an Inferred Gold Mineral Resource of 484,000 ounces Au at a grade of 5.1 g/t at an extremely cost-effective rate of US$11.80 / ounce and this metric is expected to improve with the ongoing enhancement and refinement of geological understanding and targeting.

Exploration drilling at the Chanach Gold Project commenced in 2014 and to date there have been spectacular intersections of gold mineralisation spanning across the project area, as previously reported by WCN.

Significant intervals from the Quartz Gold Zone include:

- UGZ-15-35 - 8m @ 57.08 g/t Au from 75m including 1m @ 85.53 g/t Au from 76m, 1m @ 89.34 g/t Au from 80m followed by 1m @ 73.28 g/t Au from 81m.

- ERC16-035 - 7m @ 23.52 g/t Au from 45m including 1m @ 149.41 g/t Au from 45m.

- ERC16-036 - 12m @ 15.65 g/t Au including 1m @ 63.24 g/t Au from 82m followed by 1m @ 95.12 g/t Au from 83m.

Significant intervals from the Sandstone Gold Zone include:

- UGZ-15-33 - 4m @ 99.15 g/t Au from 65m including 1m @ 348.48 g/t Au from 67m.

- UGZ-15-32A - 3m @ 41.45 g/t Au including 1m @ 71.58 g/t Au from 53m.

Significant intervals from the Lower & Upper Gold Zone include:

- LGZ-15-29A - 6m @ 38.40 g/t Au from 26m with 4m @ 56.46 g/t Au from 26m including 1m @ 49.79 g/t Au from 26m, 1m @ 23.55 g/t Au from 27m, 1m @ 95.22 g/t Au from 28m and 1m @ 57.29 g/t Au from 29m.

- CH14-18 - 4m @ 23.83 g/t Au from 85m including 1m @ 30.19 g/t Au from 86m.

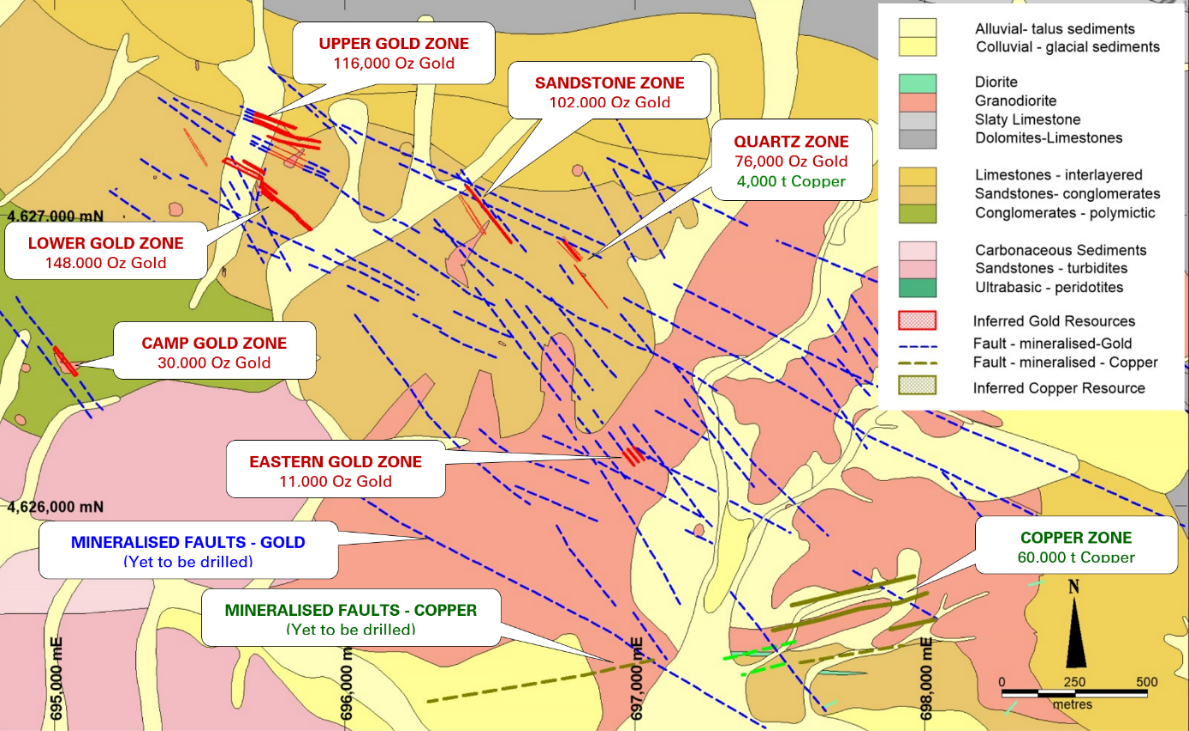

Readers are advised that these assay intervals have not been top-cut prior to reporting and true mineralisation widths are not reported. Mineralisation is expected to be sub-vertical. Intervals selected have used a lower cut-off of 0.50 g/t Au. Locations of significant drill intercepts with respect to the mapped mineralised zones are shown in Figure 3.

Figure 3: Locations of Significant Drill Intercepts at Chanach Gold Project

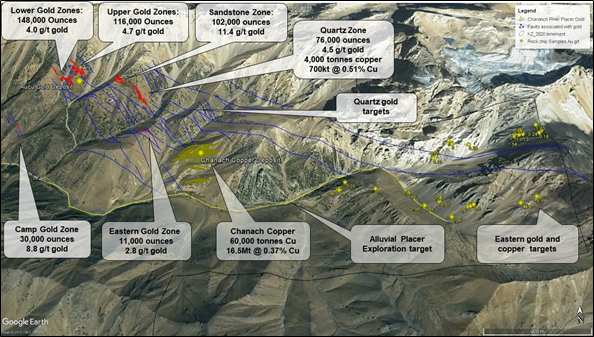

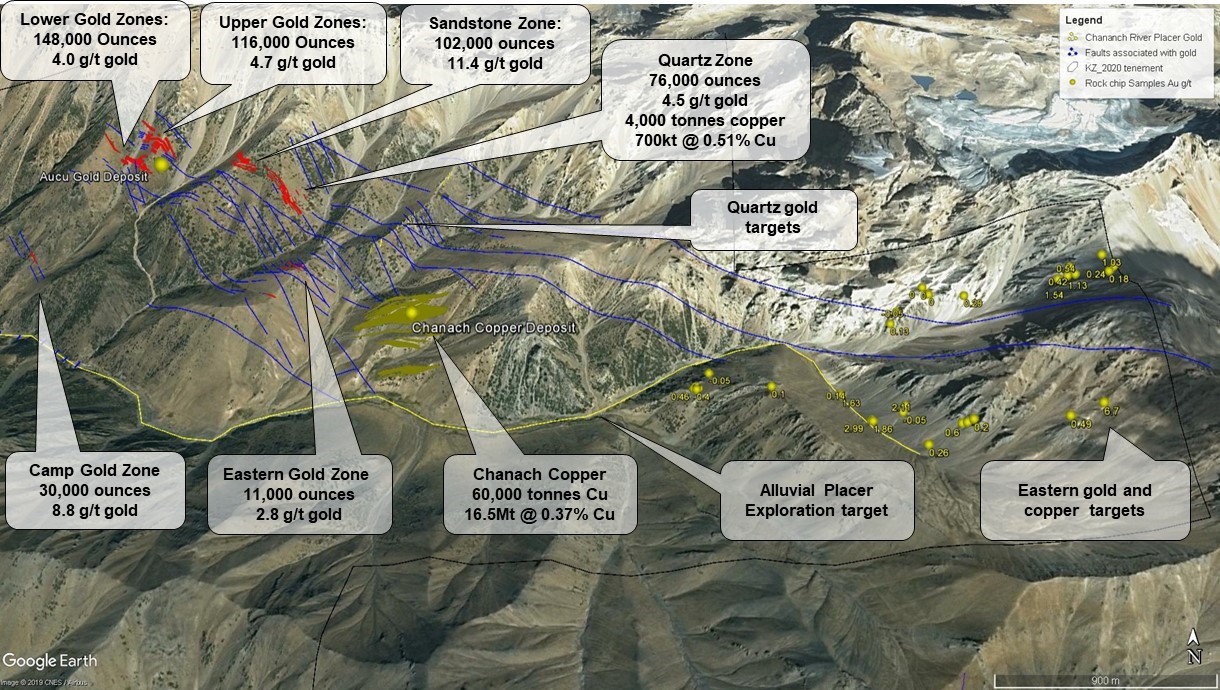

RESOURCE GROWTH POTENTIAL

The current gold resources at Chanach are open at depth and along strike. RTG Consultant and Chartered Professional Geologist, Greg Hall of Phoenix Gold International and former Chief Geologist for Placer Dome, has visited the Chanach Project area and notes: "the extensive red hematite staining in the project area is an indication of the size of the system, which along with other geological factors and anomalies would indicate an exploration target materially greater than the current Inferred Gold Mineral Resource with further upside in several porphyry and skarn targets that remain untested"

The mineralised faults (vein groups), that are currently defined by field mapping at the Chanach Gold Project, span over a 3km strike length with drilling along only 5% of the strike length identified and mapped to date and with drilling to an average depth of only 120m. Given the existing resource is open at depth, with 95% of veins as yet untested by drilling over the existing 3km strike length and recent mapping programs likely to extend the mineralised strike length by a further 4km, the potential for resource growth is thought to be significant. Additionally; the Chanach Copper Inferred Mineral Resource is open at depth and along strike, with multiple additional porphyry targets identified for testing including several outcropping copper zones 4km to the east of the current resource. Copper skarn mineralisation has also been identified along porphyry-limestone contacts over a 2km trend within the Chanach Project area.

Figure 4: Mineralised Faults (Blue) Relative to Inferred Gold Resources (Red)

Anomalous antimony, which is used as a proxy to estimate the distribution of ore stage pyrite that accompanies gold mineralisation (defined by antimony assays in soil sample), extends more than 3km in an east-west direction and 2km in a north-south direction. The anomaly is coincident and thought to define the Chanach low sulphidation epithermal gold vein system (Figure 4).

Three of the gold vein zones have an expression along the western contact of the antimony anomaly. The eastern extent of the antimony anomaly is defined by outcropping porphyry copper mineralisation and its causative intrusion. Ground magnetic data supports the interpretation that the mineralised intrusion (and its precursor variably magnetic intrusion) underlie the full extent of the antimony anomaly.

Fluid flow has been vertical from this underlying intrusion into the limestone where the mineralising fluid has intersected a groundwater aquifer within the limestone, resulting in oxidation of the iron within the mineralised fluid and extensive deposition of red hematite (Figure 5). This hematite staining is another indicator of the size of the system and extends the full length of the antimony anomaly (3km in an east-west direction). The sequence is tilted 15-20 degrees north, so the veins now dip 70-75 degrees to the south.

It is believed that the drilling of the gold vein systems to date, using relatively shallow holes to an average of 120m, is representative of the overall strike and dip length of veins over the three-kilometre strike length (mapped and coincident with the antimony anomaly). Given that only 5% of the mineralised veins have been drilled and the veins are likely to extend vertically at least to the limestone contact, or the base of the valley (approximately 400 vertical meters), then it is believed by RTG consultant, Greg Hall, that there is an exploration target materially greater than the current Inferred Gold Mineral Resource.

Figure 5: Highly Visible Geology Showing Extensive Hematitic Red Staining at the Chanach Project Area

Figure 6: Mineral Resources & Targets at the Chanach Project

DEVELOPMENT POTENTIAL

Although currently in the exploration stage, the Chanach Project has a number of factors that would favour the development of a new mining operation. The RTG team is experienced in international mine development and operations and experienced in unlocking resource project value in emerging markets. With previous experience in Kyrgyzstan and Central Asia and excellent in-country capability, RTG believes the coupling of the potential for rapid resource growth and scalability at Chanach, strong government support and good infrastructure will be highly conducive to a project development opportunity. Access to the Chanach Project area is straight forward, there is a proximal grid power line and the Chanach Project area resides in an uninhabited valley void of any artisanal mining activity. From a technical standpoint, preliminary metallurgical test work performed for the Chanach Gold Project indicates that the sandstone hosted gold mineralisation will be free milling with a high gravity gold component and is likely to be amenable to standard gold processing methods.

MINERAL RESOURCE

In May 2018, WCN reported an Inferred Mineral Resource of 2.95 Mt at 5.1 g/t gold for 484,000 ounces and 17.23 Mt at 0.37% copper for 64,000 copper tonnes.

The most recent mineral resource estimates for the Chanach Gold Project are summarised in Table 1 for gold and Table 2 for copper. These Mineral Resources are reported in accordance with JORC Code, 2012 and were first publicly reported 30 May 2018 by WCN. Refer to the cautionary statement below.

Resource | Zone | Tonnes | Au | Ounces |

Inferred | Lower Gold Zone | 1,155 | 4.00 | 148 |

Inferred | Upper Gold Zone | 772 | 4.67 | 116 |

Inferred | Sandstone Zone | 279 | 11.41 | 102 |

Inferred | Quartz Main | 325 | 6.22 | 65 |

Inferred | Quartz Min | 185 | 1.87 | 11 |

Inferred | Eastern Gold Zone | 123 | 2.79 | 11 |

Inferred | Camp Gold Zone | 106 | 8.77 | 30 |

Inferred | Total | 2,945 | 5.11 | 484 |

Table 1: Chanach May 2018 Gold Mineral Resource (cut-off grade 1.0g/t Au)*

Resource | Zone | Tonnes | Au | Ounces |

Inferred | Quartz Cu | 700 | 0.51 | 4 |

Inferred | Chanach | 16,534 | 0.36 | 60 |

Inferred | Total | 17,234 | 0.37 | 64 |

Table 2: Chanach May 2018 Copper Mineral Resource (cut-off grade 0.25% Cu)*

* The Mineral Resource estimates were originally compiled and announced by WCN on 30 May 2018, in accordance with the JORC Code, 2012 and was last disclosed in WCN's March, 2019 quarterly report on 30 April, 2019.

https://www.asx.com.au/asxpdf/20190430/pdf/444pg6f8t5ln5t.pdf

RTG believes that this information has not materially changed since it was last reported. The Mineral Resources have been reviewed by RTG's Competent Person.

However, it is important to note that:

- an 'Inferred Mineral Resource' is that part of a Mineral Resource for which quantity and grade are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to an Ore Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- that nothing has come to the attention of RTG's Competent Person that causes it to question the accuracy or reliability of the former owner's estimates.

Refer to Appendix 1 for further details on the Mineral Resource.

Technical Summary - Mineral Resource Estimation Methodology and Data

WCN Mineral Resource Estimates (MRE) were compiled by Optiro and has been reviewed by the Competent Person.

Geology and Geological Interpretation

The reported Chanach Inferred Gold Mineral Resource occurs in quartz veining and faults 1-10 metres wide within sandstone and porphyries. The sandstones dip at -20 degrees to the NNE and the porphyry intrusions are sub-vertical in several orientations. The quartz veins and fault zones are orientated NW to NNW are sub-vertical and cross all lithologies indicating that they formed after the sandstone deposition and after the main porphyry intrusion. The mineralised faults and veins cover an extensive area of over 5km2 and less than 5% of the identified faults have been drilled. The reported Chanach Inferred Copper Resource occurs entirely within a main porphyry intrusion as several ENE to easterly trending shear zones that are sub-vertical.

Drilling Techniques

The Inferred Mineral Resource drilling has been conducted with a Korean Hanjin tracked reverse circulation rig drilling 130mm diameter holes using a pneumatic hammer and face sampling bit. This technique shatters the rock into small sub 10mm chips which flow into the centre of the drill rod and are transported to surface using high pressure air. The sample is collected in a cyclone before passing into a sample bag. Diamond Drilling has also been conducted using the same drill rig configured for collection of NQ (50mm) rock core. Drilling has been conducted on approximately 50m spaced lines with approximately 20 to 25m spaced drill holes at the Chanach gold deposit. Drilling has been conducted on approximately 100m spaced lines with approximately 50m spaced drill holes at the Chanach copper deposit.

Sampling

Sampling of 1m drill chip intervals takes place by splitting the 30kg sample using a three-tier riffle splitter that reduces the sample to 3kg for laboratory analysis. The remnant sample is stored for metallurgical test work if required. At the laboratory the 3kg drill sample is dried, crushed to 90% passing a 1mm screen then subsampled via Jones riffle splitter to 300 grams. The 300-gram sample is milled to 90% passing 75 microns (0.075mm). A 30-gram subsample is weighed and analysed for gold via either an acid digest (aqua regia) with Atomic Absorption Spectroscopy (AAS) or via Fire Assay and an AAS analysis. Copper and base metals are assayed using a 2-10 gram sample four acid digest followed by ICP-MS.

Estimation Methodology

Mineralisation envelopes were constructed by WCN using a minimum grade of 0.3 g/t for gold and 0.25% for copper. Up to 2 metres of internal dilution has been allowed for at zero grade. Mining industry consultants Optiro Pty Ltd were engaged to estimate the gold and copper Mineral Resource. Samples were selected with each mineralisation envelope and composited to 1 metre. Where required top-cuts were applied before estimation of grade using ordinary kriging within the mineralisation envelopes. There are no assumptions in any of the estimates relating to by-products, deleterious elements, selective mining units or correlations between estimation variables. The model estimates are validated by comparing model inputs (composites) to model outputs (panel or block estimates) on a global and moving window (trend-plot) basis for each estimation domain. The models and composites are also inspected on-screen to confirm that the trends in the input data are reproduced as expected in the block estimate.

Cut-off Grade

The Chanach Mineral Resource has been classified as Inferred and reported in accordance with the JORC Code, 2012 using a cut-off of 1 g/t gold and 0.25% copper. The cut-offs were chosen based on assumed economic mining scenarios.

Resource Classification Criteria

The resource classification of Inferred is based on the quality of information for the geological domaining, as well as the drill spacing and geostatistical measures to provide confidence in the tonnage and grade estimates. The Mineral Resource estimate appropriately reflects the Competent Person's view of the deposit.

About RTG Mining Inc.

RTG Mining Inc. is a mining and exploration company listed on the main board of the Toronto Stock Exchange, Australian Securities Exchange Limited and the OTCQB Venture Market. RTG is focused on a proposal with a landowner lead consortium to secure an exploration licence at the high tonnage copper-gold Panguna Project in Bougainville PNG and the high grade copper/gold/magnetite Mabilo Project in the Philippines, while also identifying major new projects which will allow the Company to move quickly and safely to production, such as the Chanach Gold and Copper Project.

RTG has an experienced management team which has to date developed seven mines in five different countries, including being responsible for the development of the Masbate Gold Mine in the Philippines through CGA Mining Limited, RTG has some of the most respected and international institutional investors as shareholders including Franklin Templeton, Sun Valley, Sprott and Equinox.

Enquiries

Australian Contact

President & CEO - Justine Magee

Tel: +61 8 6489 2900

Fax: +61 8 6489 2920

Email: jmagee@rtgmining.com

US Contact

Investor Relations - Jaime Wells

Tel: +1 970 640 0611

Email: jwells@rtgmining.com

Cautionary Note Regarding Forward Looking Statements

This announcement includes certain "forward-looking statements" within the meaning of Canadian and applicable securities legislation. Statements regarding the anticipated benefits of the Transaction to RTG, WCN and their respective shareholders; the timing and receipt of required shareholder, stock exchange regulatory approvals for the Transaction; the ability of RTG and WCN to satisfy the other conditions to, and to complete the Transaction; the closing of the Transaction; future growth potential for RTG, WCN and their respective businesses; future mine development plans at the Chanach Project, including anticipated drill programs and feasibility studies; interpretation of exploration results, exploration targets, plans for further exploration and accuracy of mineral resource and mineral reserve estimates and related assumptions and inherent operating risks, are forward-looking statements. Forward-looking statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from RTG's expectations include uncertainties related to fluctuations in gold and other commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; the need for cooperation of government agencies in the development of RTG's mineral projects; the need to obtain additional financing to develop RTG's mineral projects; the possibility of delay in development programs or in construction projects and uncertainty of meeting anticipated program milestones for RTG's mineral projects and other risks and uncertainties disclosed under the heading "Risk Factors" in RTG's Annual Information Form for the year ended 31 December 2017 filed with the Canadian securities regulatory authorities on the SEDAR website at sedar.com. The forward‐looking statements made in this announcement relate only to events as of the date on which the statements are made. RTG will not release publicly any revisions or updates to these forward‐looking statements to reflect events, circumstances or unanticipated events occurring after the date of this announcement except as required by law or by any appropriate regulatory authority.

Qualified Person and Competent Person Statement

The information in this release that relates to Exploration Results and Mineral Resource Estimates is based upon information compiled, reviewed and approved by Elizabeth Haren who is a Qualified Person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' who is a Member and Chartered Professional of the Australian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed by Haren Consulting Pty Ltd and is a consultant to RTG. Elizabeth Haren has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person and a Qualified Person for the purposes of NI 43-101. Elizabeth Haren consents to the inclusion in the release of the matters based on her information in the form and the context in which it appears.

The information in this release that relates to Exploration Targets is based upon information compiled, reviewed and approved by Greg Hall who is a Qualified Person under NI 43-101 and a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' who is a Member and Chartered Professional of the Australian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Greg Hall is employed by Golden Phoenix International Pty Ltd and is a consultant to RTG. Greg Hall has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person and a Qualified Person for the purposes of NI 43-101. Greg Hall consents to the inclusion in the release of the matters based on his information in the form and the context in which it appears.

JORC Code, 2012 Edition - Appendix 1

Section 1 Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections.)

Criteria | JORC Code Explanation | Commentary |

Sampling Techniques |

|

|

Drilling Techniques |

|

|

Drill sample recovery |

|

|

Logging |

|

|

Sub-sampling techniques and sample preparation |

|

|

Quality of assay data and laboratory tests |

|

|

Verification of sampling and assaying |

|

|

Location of data points |

|

|

Data spacing and distribution |

|

|

Orientation of data in relation to geological structure |

|

|

Sample security |

|

|

Audits or reviews |

|

|

Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section.)

Criteria | JORC Code Explanation | Commentary |

Mineral tenement and land tenure status |

|

|

Exploration done by other parties |

|

|

Geology |

|

|

Drill Hole Information |

|

|

Data Aggregation methods |

|

|

Relationship between mineralisation widths and intercept lengths |

|

|

Diagrams |

|

|

Balanced Reporting |

|

|

Other substantive exploration data |

|

|

Further Work |

|

|

Section 3 Estimation and Reporting of Mineral Resources

(Criteria listed in the preceding section also apply to this section.)

Criteria | JORC Code Explanation | Commentary |

Database integrity |

|

|

Site visits |

|

|

Geological Interpretation |

|

|

Dimensions |

|

|

Estimation and modelling techniques |

|

|

Moisture |

|

|

Mining factors or assumptions |

|

|

Metallurgical factors or assumptions |

|

|

Environmental factors or assumptions |

|

|

Bulk density |

|

|

Classification |

|

|

Audits or reviews |

|

|

Discussion of relative accuracy/ confidence |

|

|

1 The Mineral Resource estimates were originally compiled and announced by WCN on 30 May 2018, in accordance with the JORC Code, 2012 and was last disclosed in WCN's March, 2019 quarterly report on 30 April, 2019. https://www.asx.com.au/asxpdf/20190430/pdf/444pg6f8t5ln5t.pdf

2 Wilde, A. and Gilbert, D. 2000. Setting of the giant Muruntau Gold Deposit: Implications for ore genesis. In: (Ed.) Gordon Lister, Geological research for the exploration industry, Journal of the Virtual Explorer, Electronic Edition, ISSN 1441-8142, volume 1, paper 1, doi:10.3809/jvirtex.2000.00004

3 Chaarat CGH investor presentation June 2019 www.chaarat.com/wp-content/uploads/2019/06/Chaarat-Investor-presentation-June-2019.pdf

4 Centerra CG Kumtor Production and Reserves www.centerragold.com/operations/kumtor/production-and-reserves

5 Centerra CG Kumtor Production and Reserves www.centerragold.com/operations/kumtor/production-and-reserves

6 Wilde, A. and Gilbert, D. 2000. Setting of the giant Muruntau Gold Deposit: Implications for ore genesis. In: (Ed.) Gordon Lister, Geological research for the exploration industry, Journal of the Virtual Explorer, Electronic Edition, ISSN 1441-8142, volume 1, paper 1, doi:10.3809/jvirtex.2000.00004

7 Indicative gold endowment shown as aggregation of historical production and mineral inventory

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.