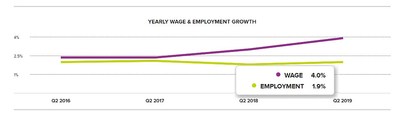

ROSELAND, N.J., July 24, 2019 /PRNewswire/ -- Wages for U.S. workers grew 4.0 percent over the last year, increasing the average wage level by $1.09 to $28.54 an hour, according to the ADP Research Institute® Workforce Vitality Report (WVR) released today. The growth, accelerating from 3.8 percent to 4.0 percent annual as of June 2019, was driven by strong wage gains for workers in the manufacturing (4.4 percent wage growth, $29.83 hourly wage) and construction (4.4 percent wage growth, $28.65 hourly wage) industries. From the service sector, information (4.2 percent wage growth, $41.56 hourly wage), trade (4.3 percent wage growth, $25.27 hourly wage), which represents 22 percent of the workforce, and professional and business services (4.1 percent wage growth, $36.45 hourly wage) were the major contributing industries.

"The tight labor market is pushing companies to pay more," said Ahu Yildirmaz, co-head of the ADP Research Institute. "As labor shortages are apparent in most of the sectors, the businesses are holding on to their skilled workers by increasing their wages. Female job holders are capturing larger wage gains than their male counterparts. Since January 2019, female job holders received average wage gains of 5 percent, while men averaged wage gains of 4.6 percent."

Job switchers in the information industry continued to lead the way with a wage level of $41.08 and growth of 9.7 percent. Job switchers in professional and business services and construction also realized high wage growth of 8.3 and 8.7 percent, respectively. In trade, the largest sector, job holders experienced stronger growth in wages than the workers who switched to the industry, 5.2 percent versus 3.8 percent, but lagged in employment growth with only a mere 0.6 percent annually.

Table 1: Wage and Employment Growth by Industry – June 2019

Industry | Wages | YOY Wage Growth | Yearly Growth | ||||

All | Holders | Entrants | Switchers | Employment | Switching | ||

-ALL- | $28.54 | 4.0% | 5.0% | 5.3% | 5.3% | 1.9% | 20.9% |

Goods | |||||||

Construction | $28.65 | 4.4% | 5.3% | 3.0% | 8.7% | 4.6% | 15.3% |

Manufacturing | $29.83 | 4.4% | 5.0% | 3.0% | 5.4% | 1.2% | 18.8% |

Resources and | $34.74 | 2.4% | 4.4% | 4.9% | 3.0% | 3.1% | 12.4% |

Services | |||||||

Information | $41.56 | 4.2% | 5.4% | -4.3% | 9.7% | 1.4% | 19.2% |

Finance and | $33.48 | 3.8% | 5.1% | 8.9% | 5.8% | 1.3% | 17.9% |

Professional | $36.45 | 4.1% | 4.7% | 5.3% | 8.3% | 2.5% | 23.8% |

Education and | $27.16 | 3.7% | 4.5% | 4.8% | 3.3% | 2.4% | 19.7% |

Leisure and | $17.42 | 4.2% | 5.9% | 5.9% | -2.4% | 2.4% | 25.0% |

Trade, | $25.27 | 4.3% | 5.2% | 6.1% | 3.8% | 0.6% | 21.8% |

Workers in the Midwest outpaced other regions with 4.5 percent wage growth though the hourly wage rate was the lowest at $26.57 and lowest employment growth at 1.0 percent. Job switchers fared best in the West experiencing a wage growth of 7.3 percent. The workers in the South and Northeast had the lowest wage growth at 3.6 percent. By firm size, workers at large firms had the highest wage growth rate at 5.1 percent, with employment growth at 3.1 percent.

Table 2: Wage and Employment Growth by Region and Firm Size – June 2019

Region | Wages | YOY Wage Growth | Yearly Growth | ||||

All | Holders | Entrants | Switchers | Employment | Switching | ||

-USA- | $28.54 | 4.0% | 5.0% | 5.3% | 5.3% | 1.9% | 20.9% |

MIDWEST | $26.57 | 4.5% | 4.8% | 4.5% | 4.0% | 1.0% | 19.8% |

NORTHEAST | $31.99 | 3.6% | 4.9% | 5.8% | 5.7% | 1.6% | 22.1% |

SOUTH | $26.72 | 3.6% | 4.9% | 4.4% | 4.5% | 2.1% | 20.7% |

WEST | $30.69 | 4.2% | 5.2% | 6.8% | 7.3% | 2.6% | 21.1% |

Company | |||||||

-ALL- | $28.54 | 4.0% | 5.0% | 5.3% | 5.3% | 1.9% | 20.9% |

49 or less | $26.05 | 2.9% | 4.3% | 3.9% | 3.4% | 0.7% | 14.9% |

50 to 499 | $28.49 | 3.2% | 5.0% | 5.6% | 5.3% | 0.8% | 22.9% |

500 to 999 | $29.56 | 3.0% | 5.7% | 4.5% | 5.6% | 3.1% | 21.4% |

1000 or more | $29.91 | 5.1% | 5.1% | 6.1% | 5.7% | 3.1% | 23.5% |

To see detailed results from the ADP Workforce Vitality Report for the second quarter of 2019, including data broken down by region, firm size, industry, gender, and age, visit http://workforcereport.adp.com/. The third quarter 2019 ADP Workforce Vitality Report will be released on Wednesday, October 23, 2019.

About the ADP Workforce Vitality Report

The ADP Workforce Vitality Report (WVR) was developed by the ADP Research Institute. It is an unprecedented, in-depth monthly analysis (published quarterly) of the vitality of the U.S. labor market based on actual data that identifies labor market trends and dynamics across multiple dimensions. These dimensions include employment growth, job switching, wage growth and hours worked. In addition to the macro data presented in the report, there are also segment-specific findings by industry, state, gender, age, experience, and pay level. Established in October 2014, the report methodology was updated in April 2018 utilizing monthly data to include additional data points and deeper insights. For more information about the report, please visit http://workforcereport.adp.com/.

About ADP (NASDAQ-ADP)

Designing better ways to work through cutting-edge products, premium services and exceptional experiences that enable people to reach their full potential. HR, Talent, Time Management, Benefits and Payroll. Informed by data and designed for people. Learn more at ADP.com.

ADP, the ADP logo, Always Designing for People and ADP Research Institute are registered trademarks of ADP, LLC. All other marks are the property of their respective owners.

Copyright © 2019 ADP, LLC.

ADP - Media

SOURCE ADP, LLC

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Your update on what’s going on in the Fintech space. Keep up-to-date with news, valuations, mergers, funding, and events. Sign up today!