Everybody who is into crypto, and probably even those who aren't, are aware Bitcoin is king. Its dominance may change in the future, but it is undeniable for the time being. This is not to say, however, that Bitcoin is perfect. It does have a few issues.

One of the most significant issues is scalability. Scalability is the ability of a blockchain to cope with a large influx of transactions without creating a heavy backlog of transactions and increasing transaction costs. Bitcoin is limited to about 7 transactions per second; beyond that, transactions are placed into a queue.

Anyone who has been using Bitcoin long enough has experienced periods of heavy use where it seemed like it took hours for transactions to be confirmed. Generally, along with the extended wait times came increased transaction costs.

With the Bitcoin Lightning Network launch, Bitcoin developers hope to scale from about 7 transactions per second to possibly millions and drastically reduce transaction costs.

The Lightning Network in and of itself is not a blockchain. It is a second-layer protocol built on top of the Bitcoin blockchain. This second layer protocol allows for off-chain transactions between parties. All these transactions occurring off-chain help to reduce congestion on the Bitcoin network.

History of the Lightning Network

The Lightning Network whitepaper was written in early 2015 by Thaddeus Dryja and Joseph Poon. The whitepaper titled “The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments” was first released in February 2015.

The inspiration for the white paper was conversations between Satoshi Nakamoto and fellow developer Mike Hearn; in these discussions, Nakamoto described payment channels. Mike Hearn published the talks in 2013. The whitepaper details an off-chain protocol made up of payment channels.

In 2016, Dryja, Poon and a few other contributors founded Lightning Labs, a company dedicated to making the Lightning Network a reality. One main stumbling block was to make it compatible with the core Bitcoin network. A breakthrough came in 2017 after the Segwit soft fork that freed up space in each block for more data. It also removed a longstanding Bitcoin bug called transaction malleability, enabling users to fake transactions.

The Lightning Network was launched in January of 2018. Because of the pre-launch testing, developers were immediately able to build apps on the Lightning Network. Their apps included simple use cases such as gambling platforms and wallets that took advantage of the lightning networks microtransactions.

It was also in 2018 when Twitter CEO Jack Dorsey became involved with the project. He hired a team of developers to focus exclusively on Lightning Network development and paid them in Bitcoin. He also discussed plans to implement the Lightning Network into Twitter.

How Does the Lightning Network Work?

The Lightning Network protocol allows users to create bi-directional payment channels between themselves and a second party. The two parties create the payment channel, each creating a multi-signature wallet (Lightning wallet) and adding funds. Once this channel is created, they can send unlimited transactions nearly instantaneously and at a low cost. The channel acts as its own ledger used for making micro-transactions without affecting the Bitcoin network.

When a payment channel is created, the payer must lock up a certain amount of Bitcoin into the network. After the Bitcoin is locked up, the recipient can invoice amounts against the balance as needed. Once the balance is used up, the payer can deposit more Bitcoin to keep the channel open or close it. If they choose, the two parties can transfer Bitcoin back and forth between them indefinitely without telling the main blockchain.

Because not all transactions on the blockchain need to be approved by all nodes, the Lightning Network strategy drastically reduces congestion. The reduction in congestion speeds up transaction times and lowers transaction costs. The combination of individual payment channels forms the Lightning Network nodes capable of routing transactions. The Lightning Network itself is the sum of many payment channels that are linked together.

Once two parties decide their transactions are completed, they can choose to close the channel. Once the channel is closed, all transactions are bundled into a single transaction. That single transaction is then broadcast to the Bitcoin mainnet for recording. By consolidating all of the transactions into a single transaction, it eliminates the spamming of the Bitcoin network by a multitude of smaller transactions.

Who Uses The Bitcoin Lightning Network?

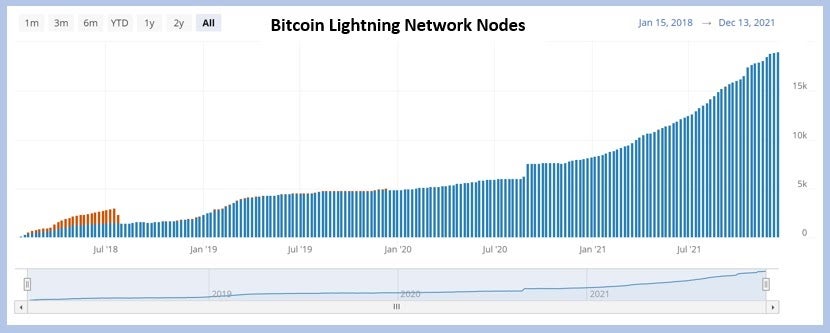

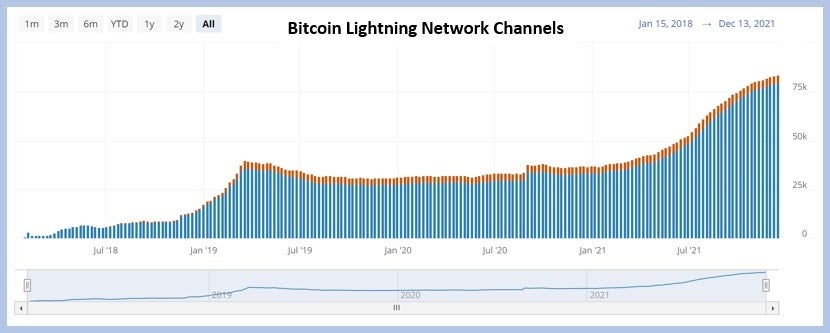

Anyone can use the Bitcoin Lightning Network, but you must have a Lightning Network wallet. There are several wallets available, both custodial and non-custodial. Adoption of the Lightning Network continues to surge. The number of nodes has more than doubled from a little over 8,000 a year ago to over 19,000 today. Payment channels have also surged from around 37,000 a year ago to over 83,500 today.

© Image credit: Bitcoin Visuals

In June 2021, the El Salvador legislative assembly voted to make Bitcoin legal tender. This adoption has played a big part in the surge of Lightning Network users. The El Salvador government also officially sponsored the Chivo Bitcoin wallet, through which they have distributed $30 worth of Bitcoin to every Salvadoran citizen to jumpstart the Bitcoin economy. But citizens are free to use any Lightning Network wallet they want. The government has also built a network of 200 Bitcoin ATMs.

© Image credit: Bitcoin Visuals

Crypto payment firms are rushing into El Salvador to capitalize on Bitcoin becoming legal tender. One such firm is Flexa who has launched Lightning Network payments with select partners and merchants. Flexa is the global leader in pure-digital payments. Flexa is not alone; OpenNode is another payment provider quickly moving into El Salvador. OpenNode has teamed up with McDonald’s to enable Bitcoin Lightning Network payments at every McDonald’s in the country.

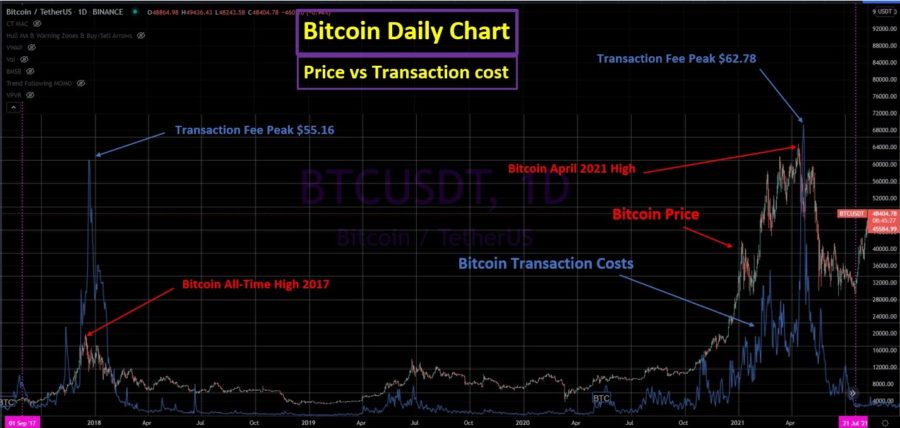

Lightning Network Fees vs. Bitcoin Layer 1 Fees

When it comes to Bitcoin fees historically, they have varied wildly at times of high network congestion. To date, two periods have seen the highest fees. The first was just after the December 2017 peak at almost $20,000 when the transaction fee peaked at over $55. This year, the other was after the April price peaked at nearly $65,000 when the cost peaked at almost $63.

Most of the rest of the time, the transaction fees range somewhere between $1 and $10. Currently, the median transaction fee is about $2. In contrast, currently, the median base fee for the Lightning Network is 1 Satoshi which is $0.000481373 (data from 1ML.com).

Does the Bitcoin Lightning Network Have Smart Contracts?

Bitcoin’s Lightning Network has some smart contract functionality, but it’s not the same as smart contracts on other blockchains. This smart contract is a multisig transaction called Hashed Time-Locked Contract (HTLC). A time-locked contract is a Bitcoin transaction that includes a time-lock. The transaction is then hashed to form the Hashed Time-Locked Contract.

When used on the Lightning Network, these smart contracts allow payments to be routed across multiple nodes. HTLCs allow Bitcoin payments to be routed between two parties in a trustless manner. They also guarantee that any user that assists in routing the transaction receives a small fee.

Pros and Cons of Using the Lightning Network

Although the Bitcoin Lightning Network appears to be a significant step in improving the scalability of Bitcoin, it is not without problems. Here are some of the pros and cons.

The Pros:

- Faster transactions

- Incredible scalability

- Near instantaneous settlement

- Micropayments

- Small transaction costs

The Cons:

- Lack of decentralization

- Possible complexity of payment channels

- Not suited for large transactions

- HTLC issues (how many a channel can forward at once; the minimum value of an HTLC)

Where To Invest in Bitcoin

Every cryptocurrency exchange offers Bitcoin, so finding somewhere to purchase Bitcoin is easy no matter where you live in the world. Probably one of the most accessible places to buy Bitcoin is from PayPal Holdings Inc. (NASDAQ: PYPL). There are drawbacks though –– the selection of other cryptocurrencies is minimal. Another issue is you can’t transfer the crypto you purchase. It has to remain in your PayPal account.

You can also purchase Bitcoin from Coinbase Global Inc. (NASDAQ: COIN), Webull and eToro. Webull and eToro are very reputable brokerage firms and would be well suited for someone who wants to buy both crypto and stocks. Coinbase is one of the top crypto exchanges with excellent security and a user-friendly trading platform. It is great for first-time users.

Sum of median estimated savings and rewards earned, per user in 2021 across multiple Coinbase programs (excluding sweepstakes). This amount includes fee waivers from Coinbase One (excluding the subscription cost), rewards from Coinbase Card, and staking rewards. ³Crypto rewards is an optional Coinbase offer. Upon purchase of USDC, you will be automatically opted in to rewards. If you’d like to opt out or learn more about rewards, you can click here. The rewards rate is subject to change and can vary by region. Customers will be able to see the latest applicable rates directly within their accounts.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Is the Lightning Network the Future of Bitcoin?

The short answer is, well, it might be. The Lightning Network does substantially improve Bitcoin's scalability and also reduces transaction costs. But, the Lightning Network does have some issues of its own. Time will tell if these issues can be resolved or if they turn into an insurmountable stumbling block. At this time, it is still too early to categorically state that the Lightning Network is the cure-all for Bitcoin’s issues. It does however show a lot of promise, and over time any issues it does have may be resolved. For now, all that can be done is to watch how it plays out.

- Exclusive Crypto Airdrops

- Altcoin of the Week

- Insider Interviews

- News & Show Highlights

- Completely FREE

About Donald Hancock

Donald’s expertise lies in the technical analysis of both stocks and crypto.