Bookkeeping: Weekly Changes to Fund Positions Year 3, Week 8

Year 3, Week 8 Major Position Changes

To see historic weekly fund changes click here OR the label at the bottom of this entry entitled 'fund positions'.

Cash: 67.4% (v 73.9% last week)

24 long bias: 20.5% (v 16.5% last week)

7 short bias: 12.1% (v 9.6% last week)

31 positions (vs 30 last week)

Weekly thoughts

Some drama finally returned to the markets, as we've encountered rough waters since Fed decision afternoon. Apparently, even the slightest of hints that the punch bowl of liquidity will be taken away on some far away day was enough to make speculators worry. Considering many are only buying because "everyone else is" (pure momentum trading based on nothing but charts) [Larry Levin - Fundamentals? Pshaw] - it is not too surprising. Further, despite once in a lifetime handouts in the housing markets, seasonality still has begun to strike its head as the age old reality that home activity spikes in late spring and summer, happened yet again. Both existing home sales (the far more important number at >90% of sales) Thursday and new home sales on Friday were below expectation. We've warned seasonality would end (as it does EVERY year) and those relying on month over month growth, rather than analyzing year over year results, were blinded by green shoots.

What is remarkable from this seat is with so much government / central bank assistance to the housing market that it the data is STILL so poor year over year. Even the so called celebrated green shoot data the past 4-5 months, when analyzed with an overlay of the trillion+ dollars stolen from future generations - can be labeled nothing more than disappointing. There are only so many ways to squeeze blood from stone, and lest you think the politicians won't try try again - you will be wrong. As predicted LONG ago, this first time home buyer program won't be the end of it. Lobbyists and misguided politicians are working in hand to hand (nothing good can come of that) to recreate the success of the current program (and even bigger "success" of cash for car clunkers). I eagerly await another round of housing stimulus along with paying for the unemployed workers mortgage [Mortgage Assistance for Unemployed Gains Steam]; when you can't create jobs for your people you have to pay for the full nanny state. Like a junkie the US and its people have borrowed themselves into a corner, and to keep the mirage of prosperity going will require bigger and bigger hits of the cocaine to keep the high going. Where will the first time home buyers come from in 2010 when we drew them all in 2009? No problemo - we will do a handout to all buyers. I can only assume renters must be furious but they appear to be 2nd class citizens in United States of Handout. Without anyone in leadership willing to lead an intervention, we'll keep going until we hit the wall at 180 mph. (2008? That was hitting the wall at 120 mph - you ain't seen nothing yet kiddo)

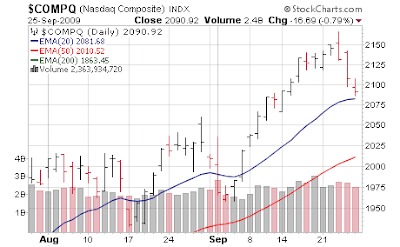

As for markets we've come to a similar point we've hit many times in this 7 month rally - a pullback to a key support. As we mentioned in a post just over a week ago we were at a historically high 20% over the 200 day moving average which has been a near term "peak" over the course of the past 25 years. We also had posted a chart at that time of a trending channel, and we had hit the top of that channel. It took a few more days than anticipated but we've since sold off. Now it gets interesting...

As you can see even in the past few months we've pulled back to the 20 day moving average a few times; and indeed even broke through it. Each time the bears salivate believing the trend is broken and finally a more sustainable pullback is in store. But we don't even make it back to the 50 day moving average before a 180 degree reversal swoops in, and these have not been the type of reversals you can catch a few days late... they are swift and sudden.

As I've noted I want to see a move below S&P 1040, and I'll be making a short term foray into some index instruments to help offset losses in our core long positions, to try to press to 1020. I use 1020 because in early September we had a gap in the SPY ETF at 102. And at that point we'll be at the exact same spot we've been multiple times in this epic rally - broken below the first support level but no real change in character... the bulls will be sweating a bit, the bears will feel emboldened and then we see if the exact same "miracle" buying out of the blue happens where a flood of buy orders come from the heavens to rescue the bulls and signal American prosperity (cue the music Larry Summers)

I won't even bother with analyzing the NASDAQ because the entire stock (and commodity) market has simply become 1 simplistic 2nd grade level trade. If the dollar rallies, stocks / commodities go sideways or drop. If the dollar falls, buy anything - hurry!! It is pathetic it has come to this, but it is what it is.

So in summary nothing has really happened (YET) other than some extreme overbought conditions have been a tad relieved. A big dollar rally from here, and the entire game changes. Otherwise... business as usual.

I won't pretend to know if this will just be another hand slap to the face of the bears once their hopes are raised, or "the inflection point" but let's raise 2 important points. Unlike all other portions of this multi quarter rally, where bears have constantly tried to guess when the reversal comes only to have their teeth handed to them (aside from one -7% drop 3 months ago), short interest is at an extreme low. Put another way, bears have thrown in the towel with their money even if some try to fight the good fight with their words. Second, after sitting out this entire rally - mostly rolling into bonds [Sep 16, 2009: Mutual Fund Investors Cling to Safety of Bonds, Missing Stock Rally] the retail mutual fund investor has finally decided to join the stock chase the past few weeks. [Sep 22, 2009: Retail Investors Continue to Wade Deeper Into the Deeper Risk End] This was the exact same condition that had me bearish on the Chinese market with a week left in July. (a huge surge in retail brokerage accounts being opened) Shanghai proceeded to lose almost a quarter of its value in the following month. That said, Larry Summer was not (allegedly) using taxpayer money to support the Shanghai stock market so we'll see if the free market can act like it normally does when almost everyone is "in" the market (shorts eviscerated, and retail mutual fund investor finally ready to join the rally after a 55%+ move). I'd be a lot more confidant in a sell off if not for the fact our government and friends in the central bank seem to be supporting every asset market on Earth. Now we'll have to see at what point human emotion overcomes Larry's (alleged) buying power if and when some technical levels are allowed to be broken.

This is a tough place for an investor and I expect to be whipsawed a lot, as a lot of stocks I am watching have pulled back to a secondary support area (where I sometime buy) and some could soon fall back to a primary support area (where I love to buy). However, if a real sell off appears many of those purchases at primary support areas will be stopped out quickly, so I could be selling things I bought days or indeed hours earlier. I have my neck brace ready after Friday's session. For the portfolio, I punted my long term put exposure late this week, so it certainly would be ironic for some sort of selloff to begin immediately thereafter - especially after getting raked over the coals holding that insurance for 3+ months. Other than that I restarted a position in Myriad Genetics (MYGN) late in the week after it "filled a gap", and began a starter stake in Las Vegas Sands (LVS) - the latter I'd like to build a position significantly lower and as a high beta name it could be down (or up) 30% in a blink of an eye. Both these positions I am looking toward 2010 with. I also began a position in silver (with an eye to 2020!), but again if the dollar rallies precious metals will get smoked - unless the dollar rallies SO much that fear returns, in which case precious metals will rally as well. Confused yet? Good - that's why you send the money to me. I closed a laggard position in Excel Maritime Carriers (EXM) as there are better performing sectors each time the Kool Aid of recovery permeates the air; good trading stock - bad investing stock for now. Doesn't fit my time lines, more of a daytrading vehicle. My top line strategy is to buy solid names on pullbacks, hedged off with short exposure of a shorter tern nature until (unless) we see our first lower low in a long time - this would be sub S&P 990. In that scenario our longer term goal of S&P 906 would be dusted off and a change in mood would certainly be about.

Economic data is weighted to later in the week... Tuesday we have Case Shiller (not important to me but the market reacts to it). As far as I'm concerned if we are ever willing to remove the Fed's involvement in manipulating mortgage rates down, and concurrently take away "cash for clunker" homes handouts - home prices would drop another 10-15% immediately. But we have a subsidized economy (and market) - so green shootists will cling to subsidized data. Thursday is loaded with data and Friday is the monthly (un)employment report. Speaking of subsidized, after a huge boost to auto sales last month due to Cash for Clunkers, we now will see the hangover (Thursday). What is so pathetic is estimates are for an annual run rate of 8M cars sold for the month; the previous month was in excess of 13M... if you average the two you get just north of 11M. Which (lo and behold) was the run rate we were near before the wasteful cash for clunkers program. So all we did was handout $4 billion to get 750,000 cars sold and didn't change the trajectory of sales at all. Just put it on the IOU bill...

ISM manufacturing, a report that is increasingly meaning less to America also comes out that day - market participants still cling to it as if its 1967 or even 1989... hey everyone, news flash - manufacturing is roughly 12% of the US economy and falling quickly. It's just not that important anymore to the "financial innovation and services we cannot afford" economy. Pending home sales, construction spending, and the normal weekly unemployment claims round out a very busy Thursday. Volatility should be immense as we act like lemmings to each data point, and then await Friday's employment report. All I can say about that, is if enough Americans believe the green shoots to go and look for jobs our unemployment rate (while massively understated) should shoot up even if the actual number of job losses is 100 to 200K. Remember, if you are discouraged and have not looked for a job for 4 weeks in America you are no longer unemployed. So as more people read about green shoots and go looking for jobs - well the unemployment rate rises. And with our participation rate (# of people in the workforce as a % of all eligible) at multi decade lows, there are countless discouraged just waiting for hope to go back looking. Unfortunately, for most I see nothing more than pianos dropped from the 12th story level ala Wylie Coyote.

To end the weekly summary I thought I'd showcase a few of the headlines I posted last week - as you read these, and you think about the health of the US economy and what we are doing to ourselves ... well, it speaks for itself.

- Mortgage Assistance for Unemployed Gains Steam

- More of World's Talented Workers Opt to Leave USA

- The Real Problem is the Economy Does not Need you Anymore

- FDIC to be Bailed out by Banks?... The Surreal Life Continues

- US Agriculture Department Hands out $0 Down, 100% Financed Mortgages

- Julian Robertson - US May Face Armageddon if China, Japan Don't Buy Debt

- Scariest Headline of the Week - China Set to Swing from Trade Surplus to Deficit

I can only think of one thing when I read these things....

Uhh, no not really, more like this:

Let the circus continue, and the peasants be entertained while we tax and pillage them into oblivion.

Blanche DuBois: I don't want realism. I want magic! Yes, yes, magic. I try to give that to people. I do misrepresent things. I don't tell truths. I tell what ought to be truth.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.