ECB Predicts 16 Years Until Eurozone Sovereign Debt Recedes to Treaty Level of 60%

Sit down before you read this and don't faint. Bury any optimism that hopes for a speedy recovery from the world's biggest financial and economic crises ever. Well hidden on page 89 of the European

Central Bank's (ECB) Monthly Bulletin for March the ECB's economic staff predicts it will take 16 years until Eurozone government debt levels return to the Lisbon Treaty level of 60 %.

Mind you, this is the best case scenario of the ECB based on the theory that the Eurozone governments will enact stringent - and hurting - fiscal discipline, coupled with the hope of an economic recovery sometime.

The ECB explains chart A to the left:

"Fiscal developments as of 2011 are determined by three alternative scenarios shown in Chart A. Scenario 1 assumes a rather rapid fiscal consolidation process, with the primary balance improving by 1.0 percentage point of GDP per year until an overall balanced budget is reached (in 2018). Thereafter, the primary surplus is assumed to decline slightly in order to maintain the budget in balance until the end of the simulation period (i.e. 2030). Scenario 2 assumes a less ambitious consolidation path, with the primary balance improving by only 0.5 percentage point of GDP per year until an overall balanced budget is reached (in 2025). Primary surpluses compatible with a balanced budget are then assumed until 2030. Finally, Scenario 3 assumes that no consolidation efforts are made. The primary balance remains at -3.7% of GDP, i.e. constant at the forecast value for 2010, over the whole simulation period."

Scenario B and C: Eurozone Will Remain Highly Indebted for Decades

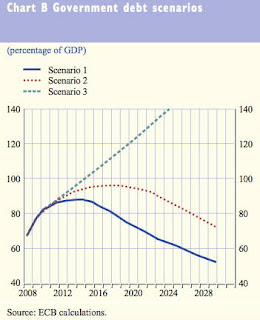

The developments of debts under these 3 scenarios reach from bad to horrific as chart B reveals. If nothing is done, debt:GDP ratios may climb to an unmanageable 150%.

In the ECB's own words:

The results of these scenarios for euro area debt are shown in Chart B. The government debt ratio in Scenario 1 peaks at 89.3% of GDP in 2013 and in Scenario 2 at 97.2% of GDP in 2017. Subsequently both these scenarios lead to a gradual decline in the government debt-to-GDP ratio. The 60% of GDP reference value is reached within the next two decades (i.e. in 2026) only in Scenario 1. Scenario 3 would lead to a steady rise in the government debt ratio to over 100% of GDP in 2015, 120% in 2020 and 150% in 2026.

GRAPH: Once the ECB gets so pessimistic/realistic in its ultra long term outlook it is time to get prepared for the toughest of all times since WW2.

The ECB economists add more warnings

when explaining their underlying assumptions:

The results of these scenarios are sensitive to the underlying assumptions on economic growth and (implicit) interest rates. They are based on pre-crisis calculations, and their actual values may differ substantially in the aftermath of the crisis. However, they may well serve to illustrate the increased risks to fiscal sustainability in the euro area stemming from a rapidly rising euro area government debt-to-GDP ratio. Unchanged fiscal policies (i.e. Scenario 3) would pose a clear threat to the longer-term sustainability of public finances. These risks may be compounded by negative feedback effects if rising government debt ratios were to trigger higher real interest rates and/or reduce economic growth. The true risks to fiscal sustainability are even more pronounced, as the three debt scenarios take into account neither the projected rise in ageing-related costs, nor the risks associated with contingent liabilities stemming from the guarantees provided to the financial and non-financial sectors in the context of the crisis. However, banks may still be faced with further write-downs3 and, after 2020 in particular, strong pressures on public finances are to be expected on account of ageing populations.

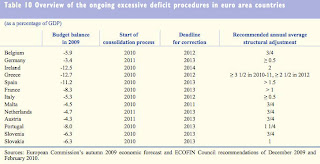

The table of excessive deficits below shows the gargantuan tasks the Eurozone faces and has to overcome. Remembering that International Monetary Fund recently pledged for higher inflation targets, recommending that the Federal Reserve and the ECB should consider doubling their inflation targets from 2% to 4% I am of the strong opinion that it will be economically easier to inflate away these debts, but this comes at the risk of Eurozone wide social tensions as unemployment is unlikely to come down in such an environment.(Click to enlarge)

While I recommend parsing the whole bulletin which sounds a bit more aggressive and realistic than past issues let me finally chip in this table that summarizes GDP growth forecasts for 2010 and 2011. The ECB staff takes a convenient approach. Its forecast range catches the predictions of all other institutions. (Click to enlarge)

It should be clear by now that Eurozone governments have no other option than to enter into a competition for new debts. It will come at the price of dramatically rising sovereign yields.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.