Citigroup (C): How You Might Trade a Low-Dollar Stock

Citigroup may seem like a complicated stock to trade at its current low price, but trading 1,000 shares of Citigroup at $4.88 is like trading 100 shares of a stock worth $48.80. Investments, after all, should be viewed in terms of percentage returns. The same general concept is true for options traders, who can simply buy (or sell) more contracts to increase their exposure to C or any other low-dollar stock.

Citigroup may seem like a complicated stock to trade at its current low price, but trading 1,000 shares of Citigroup at $4.88 is like trading 100 shares of a stock worth $48.80. Investments, after all, should be viewed in terms of percentage returns. The same general concept is true for options traders, who can simply buy (or sell) more contracts to increase their exposure to C or any other low-dollar stock.

Jim Cramer expressed some fairly lofty estimates on Citigroup (NYSE: C). “I think it goes much higher,” Cramer said in a recent episode of CNBC’s Mad Money. In fact, he says he thinks the stock could reach $12 by the end of 2012 (that’s a jump of 145% over the next 31 months).

Whether you agree with Cramer’s bullish prognosis or oppose it, there may be ways to trade Citigroup using options. Below are just two potential options strategies. These are not buy-sell-hold recommendations, just examples of bullish and neutral options strategies.

*Prices given as of Wednesday afternoon

Bullish Option Strategy: Long Call

The long call is arguably one of the most simple bullish options strategies, and one way committed Citigroup optimists can trade the shares. Investors, like Cramer, who think Citigroup is poised for a rally, could buy the September 5 call for 48 cents. If Citigroup is trading above breakeven ($5.48) when these options expire in five months, call buyers can enjoy unlimited profits. The maximum loss, meanwhile, is capped at 48 cents (the entire premium paid).

Neutral Option Strategy: Iron Condor

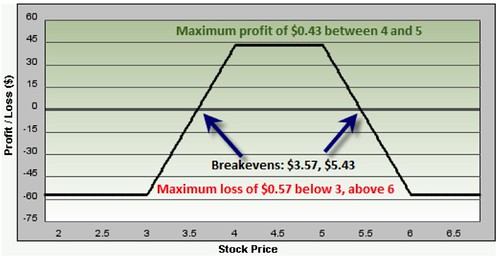

On the flip side, investors who think Citi may have found an intermediate-term range between 4 and 5 could consider the iron condor strategy. This is a four-legged spread, constructed by selling the September 4/3 bull put spread (selling the 4 put and buying the 3 put) and selling the September 5/6 bear call spread (selling the 5 call and buying the 6 call). The overall net credit for this trade is 43 cents. The iron condor trader will keep 100% of this credit as profit if C is trading between the short strikes (4 and 5) at September expiration. Breakevens are $3.57 to the downside and $5.43 to the upside. Below or above these respective levels, the iron condor will lose money. Losses are capped at 57 cents per condor (at the 3 and 6 strikes).

Your Citigroup Prognosis?

Do you think Citigroup could rally all the way to $12 – or higher over the long term? Or are you more skeptical? What’s your favorite way to trade single-digit stocks? Let us know what you think with a quick comment below.

Compare OptionsHouse rates for stock options with other brokers. For investors who are new to options and want to try out their trades without committing real money, practice using a free virtual trading account.

Share and Enjoy:

Related posts:

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.