|

Daily Market Comment

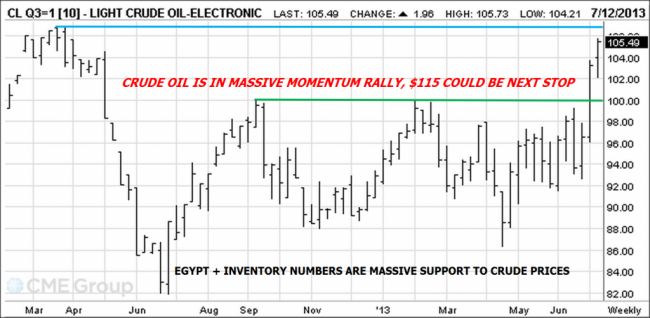

PERFECT STORM BREWING FOR OIL RALLY

|

|

Are You An Investor? Then Get Lido Isle Advisors "Favorite 3" Alternative Money Managers Emailed to You by Clicking Here. Don't Miss It!

In China, a report from the General Administration of Customs in Beijing showed that exports fell 3.1 percent in June from a year earlier. The median estimate in a Bloomberg survey had called for a 3.7 percent gain. Inventories at U.S. wholesalers unexpectedly declined in May, pointing to a pick-up in sales.

Equities: The SEP13 emini SP 500 is down slightly today, trading down 1.75 points to 1644. The market awaits two key pieces of data today, the FOMC minutes and a Bernanke speech. We would not be surprised to see this market pull back after the minutes, which will likely echo the sentiment of Bernanke’s June 19th Q&A which pointed towards end-of-year stimulus tapering. We believe the 1650 level is a key level for this market and can serve as important resistance. The economic #’s have been very positive, which overall seems to be lending support to the market. We would not be surprised to see a short term pullback after the minutes are released, but perhaps might even rally after Bernanke talks, as he might emphasize the growing US economy looking better and better.

Bonds: The SEP13 US 30yr bonds are down 11 ticks today in front of a potentially bearish news day (for bonds) with the FOMC minutes + Bernanke speech. We do not believe the downtrend in bonds is over, but don’t expect a huge move down today as a lot of what could be presented today was likely presented last month. So if there is a big down move today in bonds, we look for buyers to be bargain hunting.

Currencies: The USD index is interestingly pulling back this morning, trading down 43 ticks to 84.36. We believe this index will be supported by buying if it dips below 84, or even if it gets close to 84. We believe this could be the dip before another leg higher, possibly today upon digestion of Bernanke and the FOMC. The Euro and the Pound are retracing some recent losses, mainly due to USD strength. We believe in the Pound downtrend and would not be surprised to see the Pound head lower over the next several months.

Commodities: The real story today and this week is crude oil. AUG13 crude oil has broken out from a key technical level of $100, and is now up over $2 to $105.67. We have a new short term target of $106.60. Really, with this ‘perfect storm’ of technicals, fundamentals, and global events aligning, we believe this rally could be far from over. We would not be surprised to see $110 hit, possibly $115. On a safe haven bid, plus likely more technical short-covering, we are seeing gold rally to $1256, up $10 on the day. It is above our key pivot level of $1230, and we would not be surprised to see a run towards $1275 or perhaps $1282, two key resistance levels.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. TRADING COMMODITY FUTURES AND OPTIONS IS SPECULATIVE, INVOLVES RISK OF LOSS, AND IS NOT SUITABLE FOR ALL INVESTORS.

Are You An Investor? Instantly Receive Full Summaries of Our "Favorite 3" Managed Futures & Options Programs by Clicking Here. Don't Miss It!

Lido Isle Advisors is an elite provider of futures and options brokerage. The leadership of Lido Isle Advisors has been featured on CNBC, Bloomberg TV, and referenced in leading publications such as Financial Times, Wall Street Journal, Reuters, Benzinga, Futuresmag, & Marketwatch for expertise on the futures and commodities markets. |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.