McKinsey Says Deleveraging Will Exert Drag on GDP Growth

International consulter Mc Kinsey is another mainstream thinking business that takes a seat in the orchestra of doom, fearing years of gloom:

The specter of deleveraging has been haunting the global economy since the credit crunch reached crisis proportions in 2008. The fear: an unwinding of unsustainable debt burdens will drag down growth rates for years to come. So far, reality has been more benign, with economic growth recovering sooner than expected in some countries, even though the financial sector is still cleaning up its balance sheets and consumer demand remains weak.

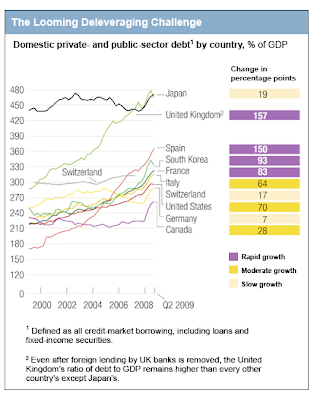

New research from the McKinsey Global Institute (MGI), though, suggests that the deleveraging process may just be getting under way and is likely to exert a significant drag on GDP growth.1 Our study of debt and leverage2 in ten mature and four emerging economies3 indicates that some sectors of the economies of five countries—Canada, South Korea, Spain, the United Kingdom, and the United States—will very probably experience deleveraging.

What’s more, our analysis of deleveraging episodes since 1930 shows that virtually every major financial crisis after World War II was followed by a prolonged period in which the ratio of total debt to GDP declined significantly. The one exception was Japan, whose bursting asset bubbles in the early 1990s touched off a financial crisis followed by many years... (register to read the rest)

GRAPH: Sovereign debt growth explodes on a worldwide scale. Save money, get out of government bonds as yields will rise in a process of countries competing against each other. (Click to enlarge)

Still betting on a swift recovery? I am taking bets.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.